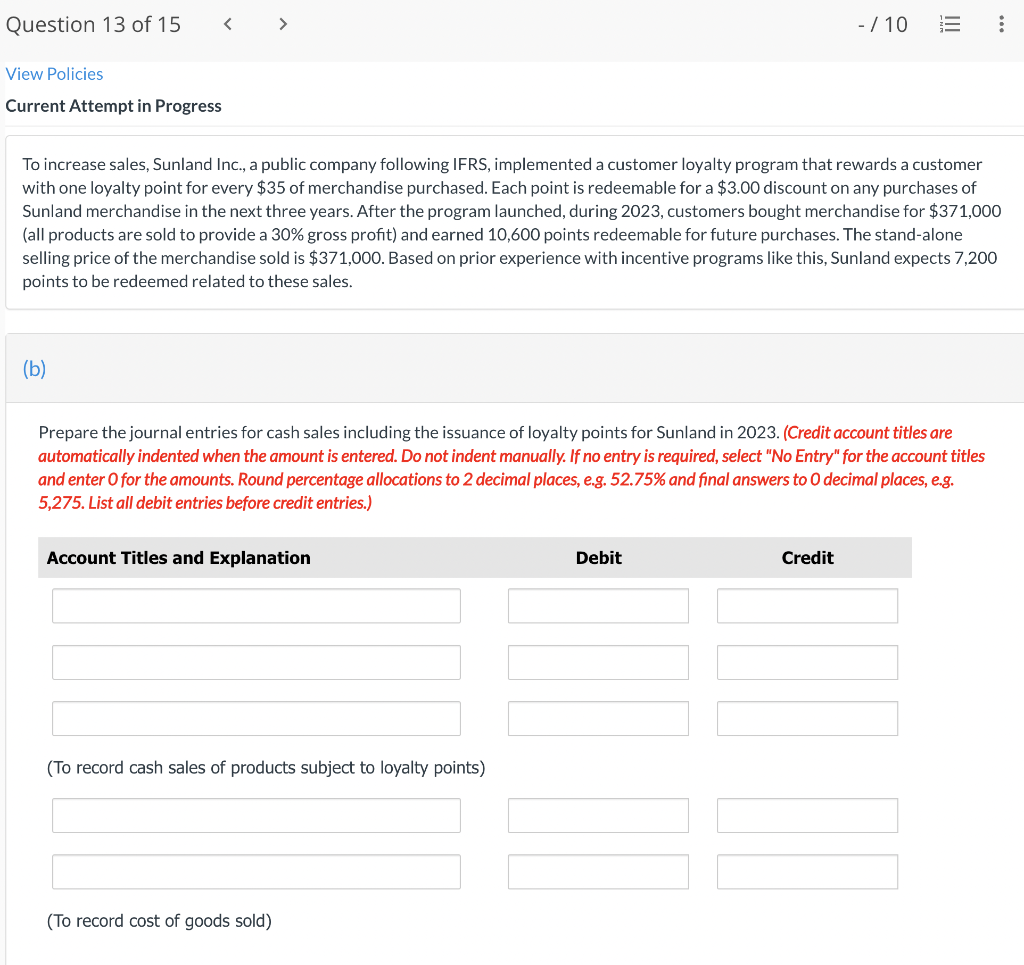

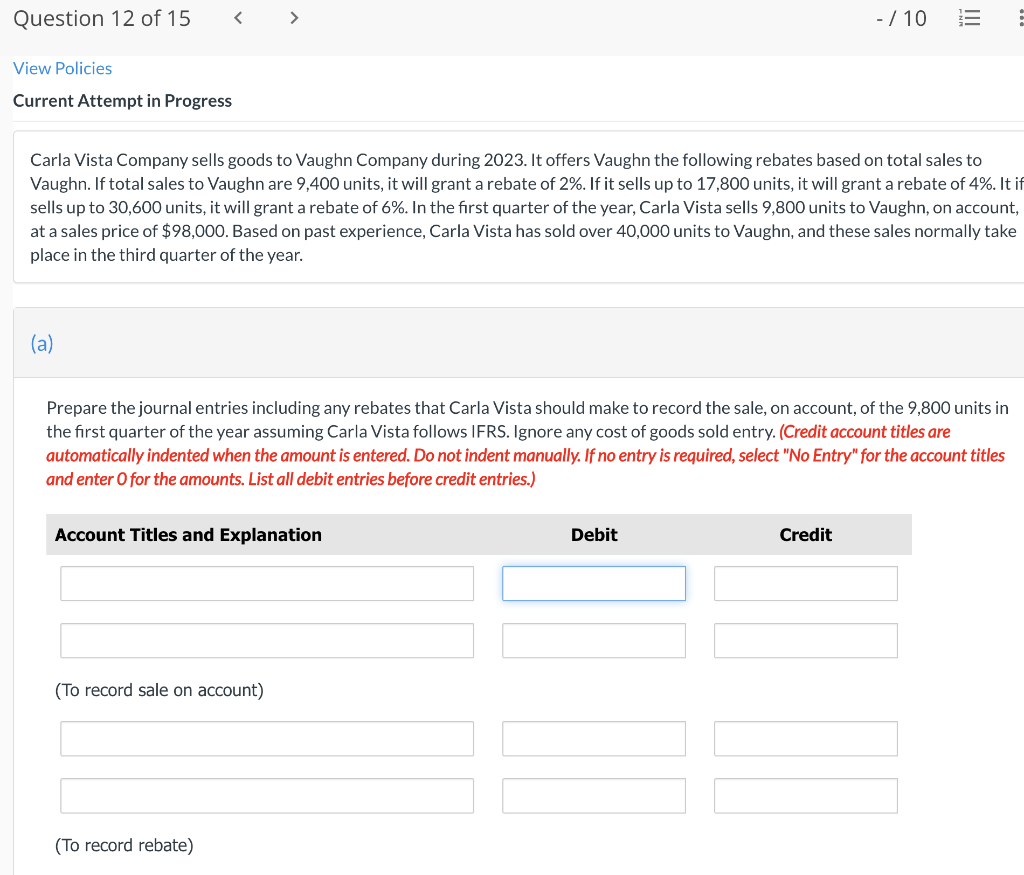

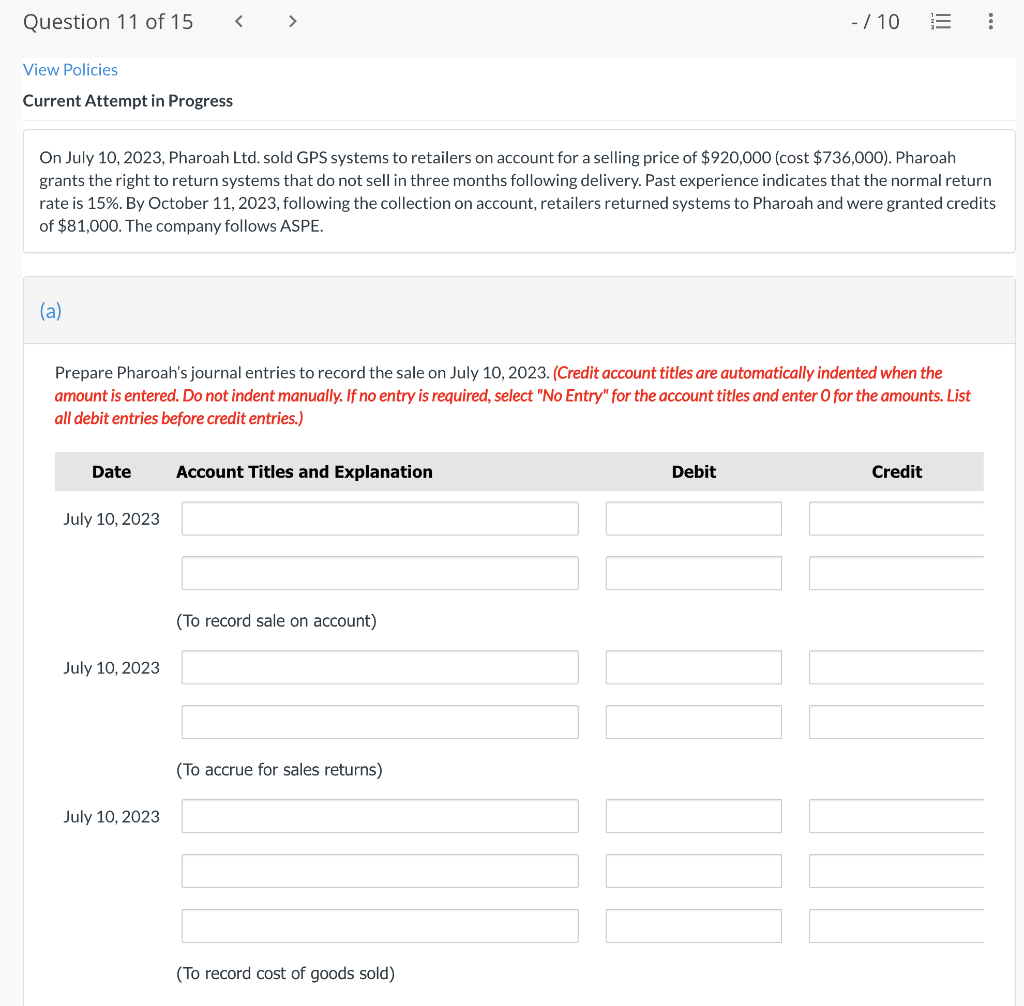

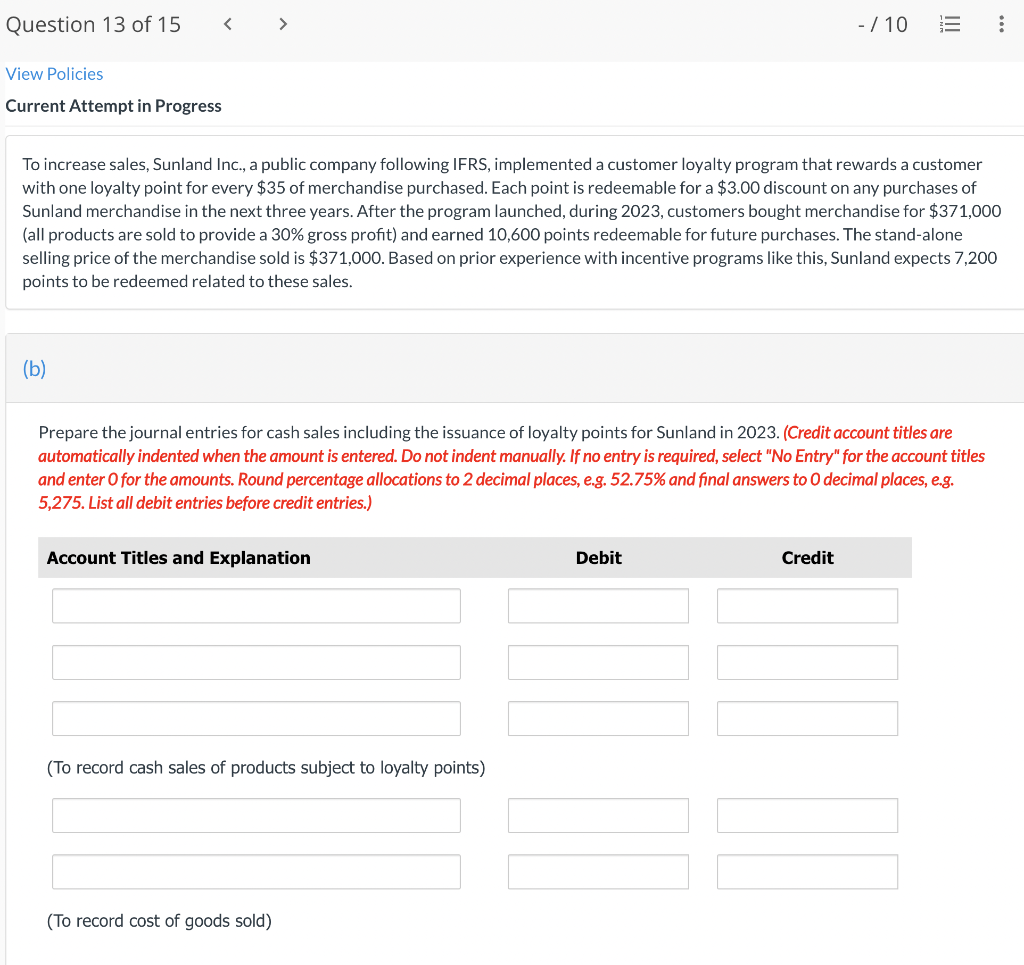

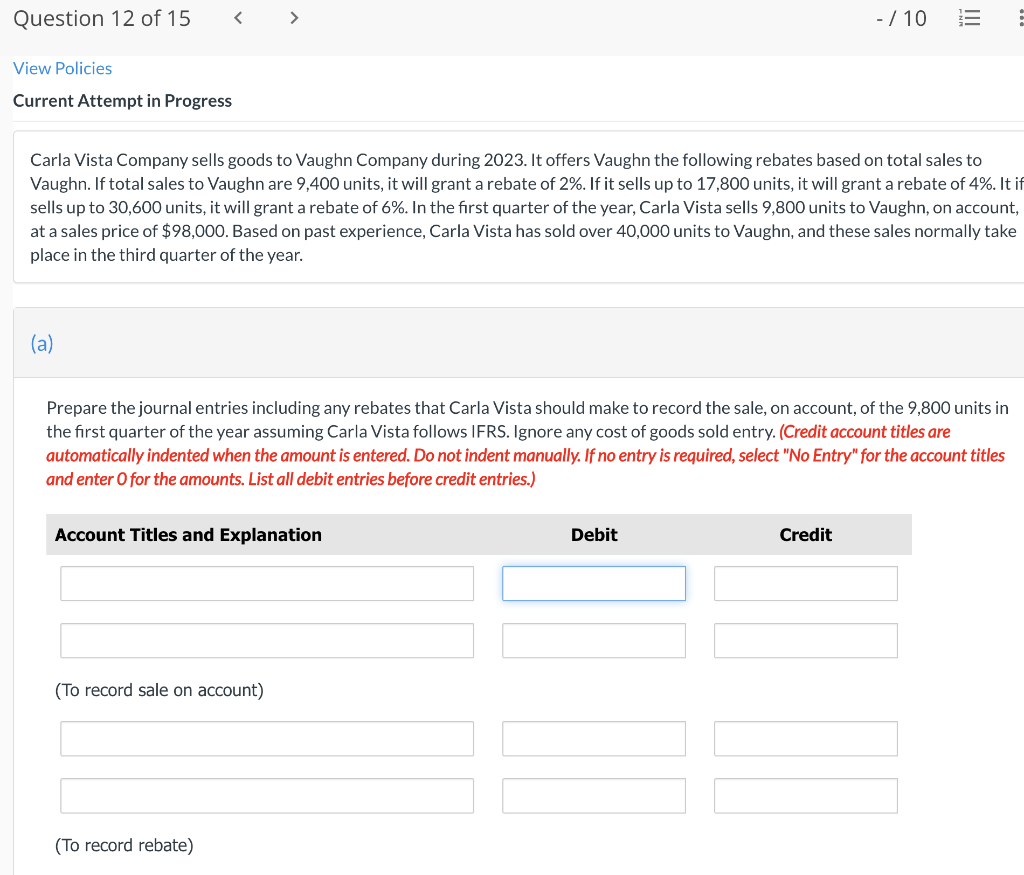

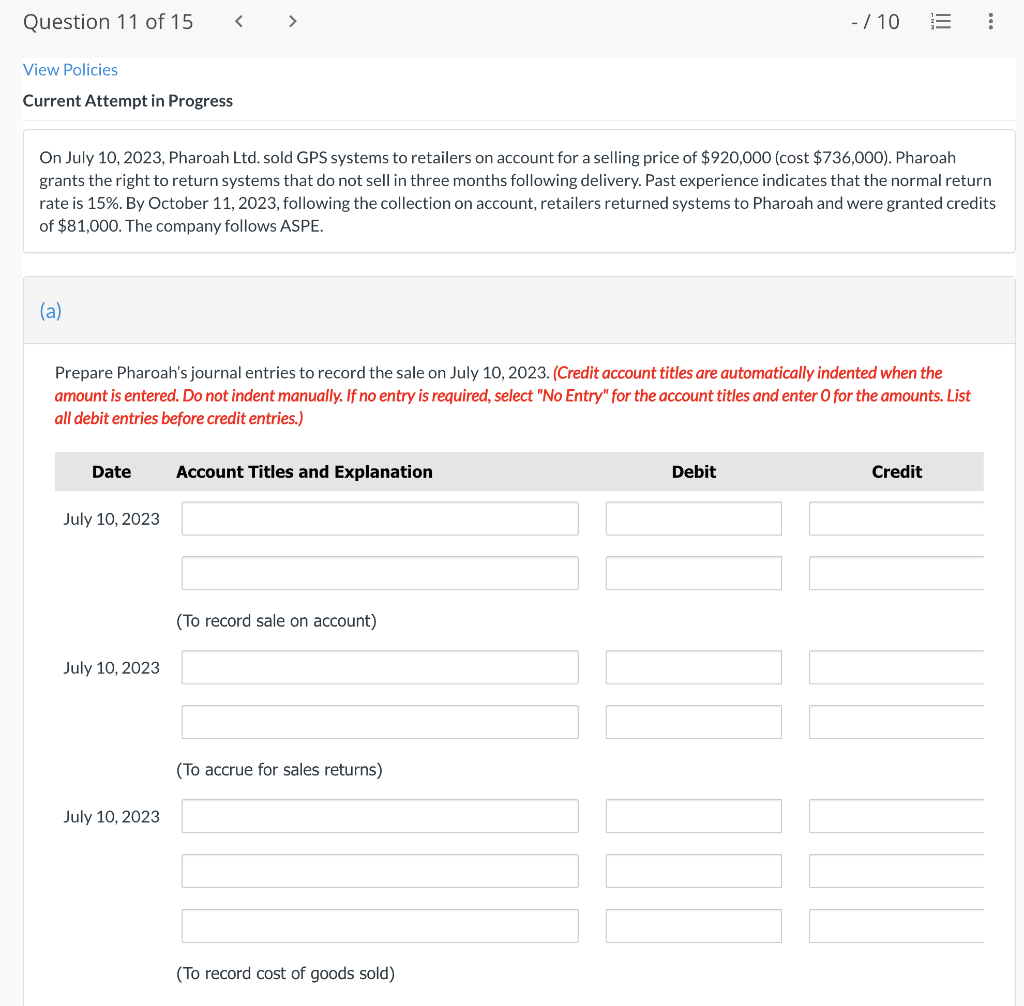

To increase sales, Sunland Inc., a public company following IFRS, implemented a customer loyalty program that rewards a customer Sunland merchandise in the next three years. After the program launched, during 2023 , customers bought merchandise for $371,000 (all products are sold to provide a 30% gross profit) and earned 10,600 points redeemable for future purchases. The stand-alone selling price of the merchandise sold is $371,000. Based on prior experience with incentive programs like this, Sunland expects 7,200 points to be redeemed related to these sales. (b) Prepare the journal entries for cash sales including the issuance of loyalty points for Sunland in 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Round percentage allocations to 2 decimal places, e.g. 52.75% and final answers to 0 decimal places, e.g. 5,275. List all debit entries before credit entries.) Carla Vista Company sells goods to Vaughn Company during 2023. It offers Vaughn the following rebates based on total sales to Vaughn. If total sales to Vaughn are 9,400 units, it will grant a rebate of 2%. If it sells up to 17,800 units, it will grant a rebate of 4%. It i sells up to 30,600 units, it will grant a rebate of 6%. In the first quarter of the year, Carla Vista sells 9,800 units to Vaughn, on account, at a sales price of $98,000. Based on past experience, Carla Vista has sold over 40,000 units to Vaughn, and these sales normally take place in the third quarter of the year. (a) Prepare the journal entries including any rebates that Carla Vista should make to record the sale, on account, of the 9,800 units in the first quarter of the year assuming Carla Vista follows IFRS. Ignore any cost of goods sold entry. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) On July 10, 2023, Pharoah Ltd. sold GPS systems to retailers on account for a selling price of $920,000 (cost $736,000 ). Pharoah grants the right to return systems that do not sell in three months following delivery. Past experience indicates that the normal return rate is 15%. By October 11, 2023, following the collection on account, retailers returned systems to Pharoah and were granted credits of $81,000. The company follows ASPE. (a) Prepare Pharoah's journal entries to record the sale on July 10, 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)