Answered step by step

Verified Expert Solution

Question

1 Approved Answer

to investors in this tranche. a 2 . If the interest rate demanded by investors on this investment is also 8 percent, what would be

to investors in this tranche.

a If the interest rate demanded by investors on this investment is also percent, what would be the prices of the IO and PO strips?

b If interest rates increased to percent and prepayments remained at a zero rate, how would the price of the IO and PO strips

change? What is the percentage price change of each security?

c Investor interest rates now decline to percent. What is the price of the IO PO Prepayments now increase to a rate of percent

per year because mortgage borrowers in the pool begin to refinance at lower interest rates. What would prices for the IO and PO be

now? Assume that the prepayment received at the end of each year is based on the outstanding loan balances at the end of the

preceding year. What is the percentage price change of each security?

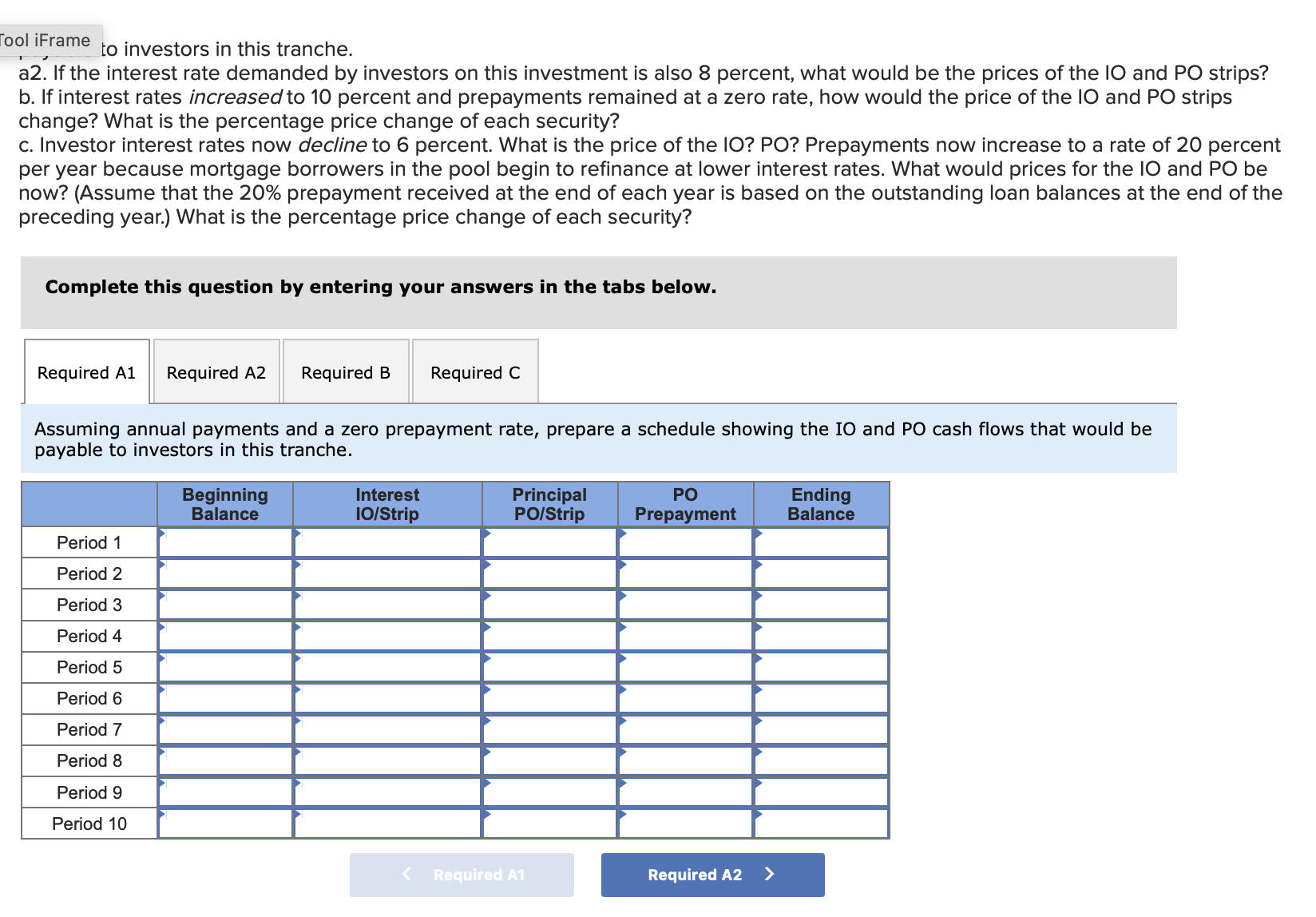

Complete this question by entering your answers in the tabs below.

Assuming annual payments and a zero prepayment rate, prepare a schedule showing the IO and PO cash flows that would be

payable to investors in this tranche.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started