Answered step by step

Verified Expert Solution

Question

1 Approved Answer

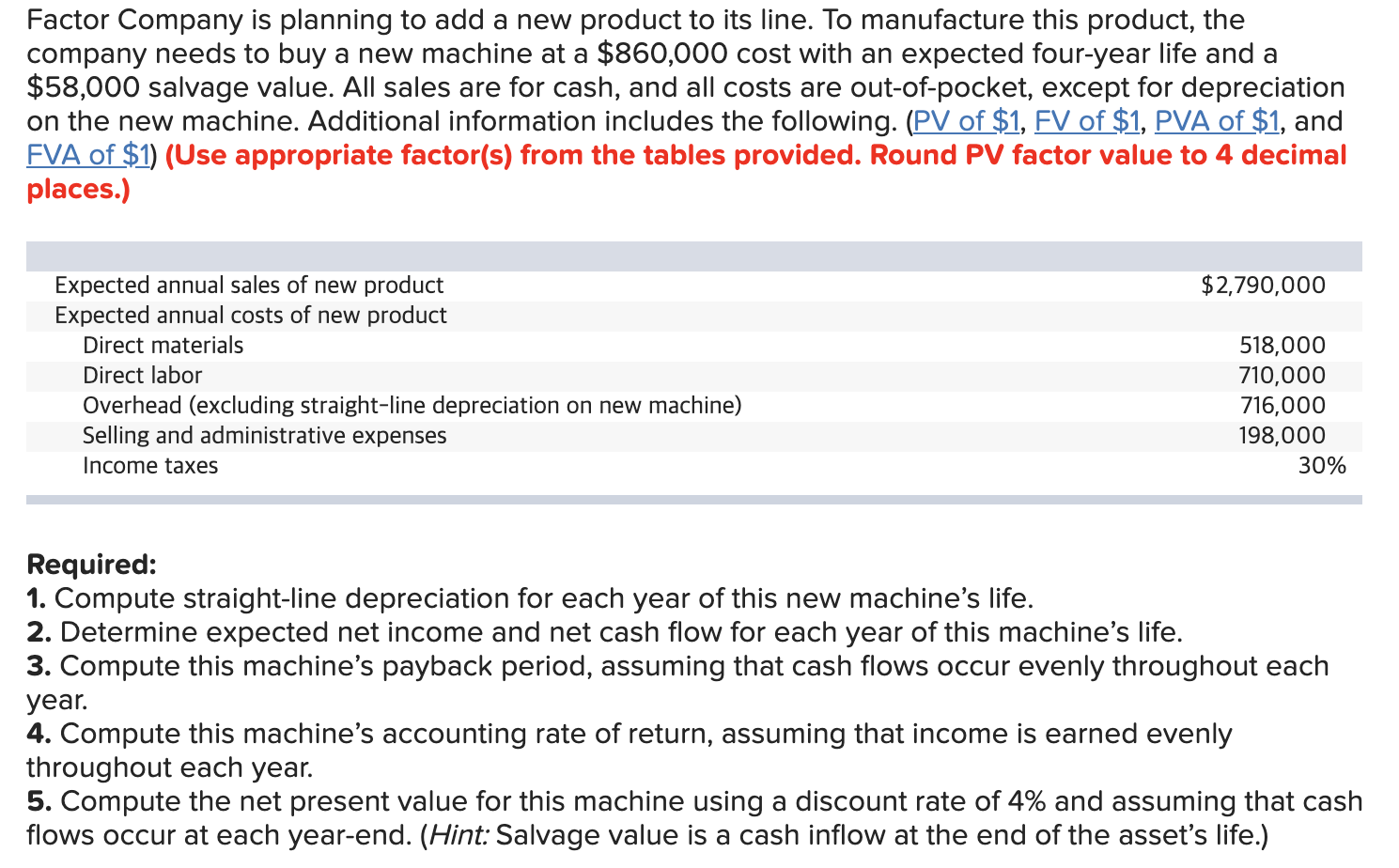

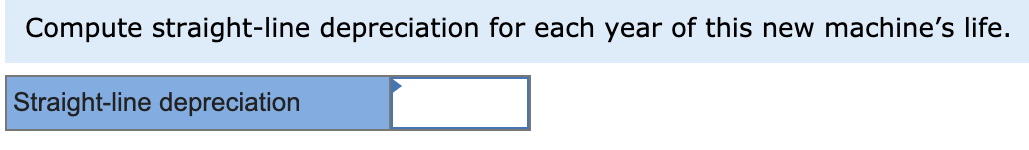

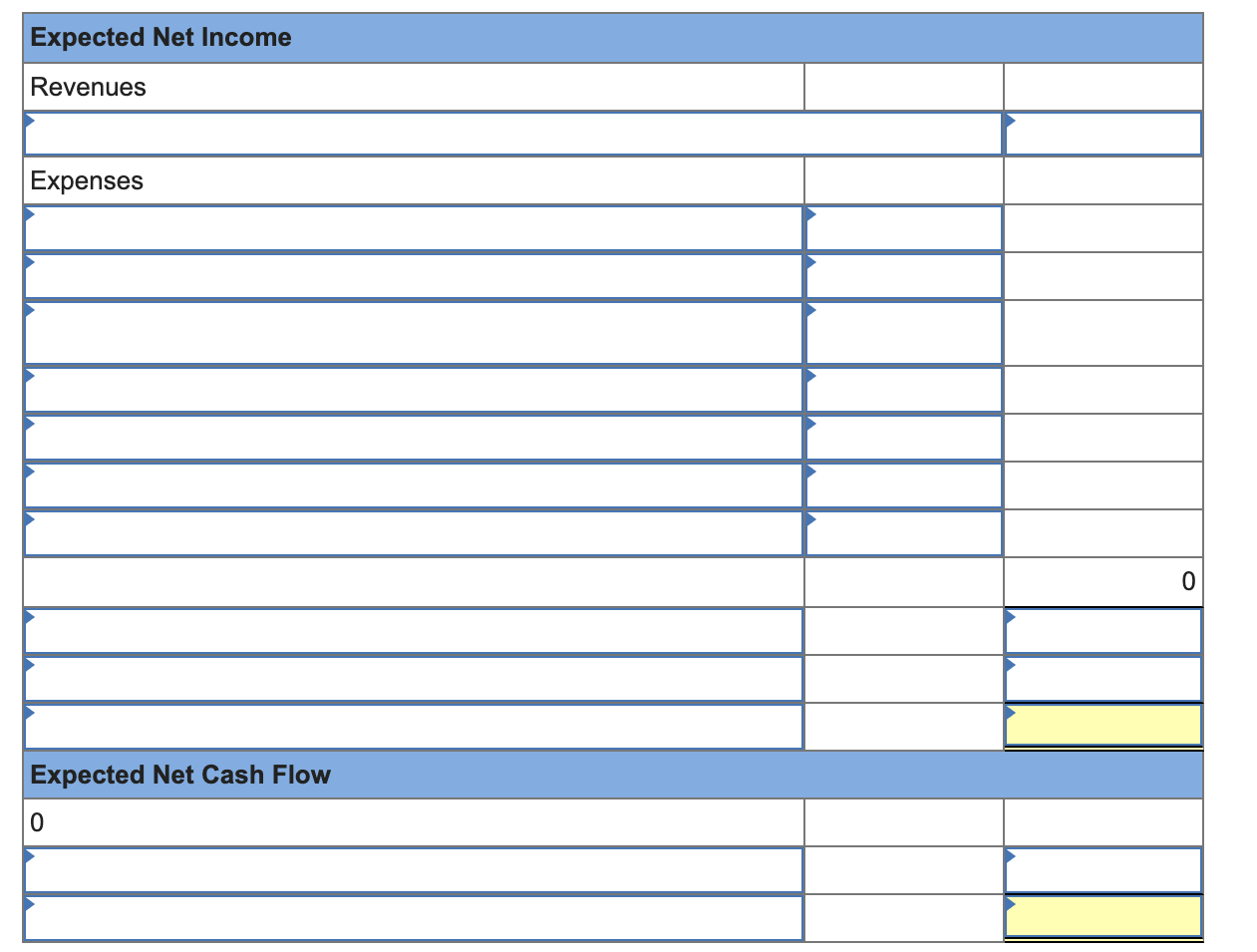

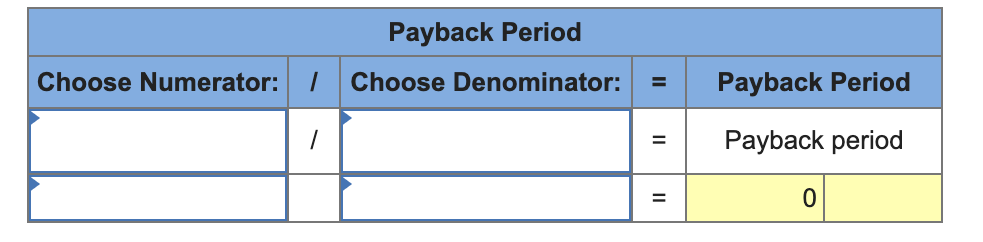

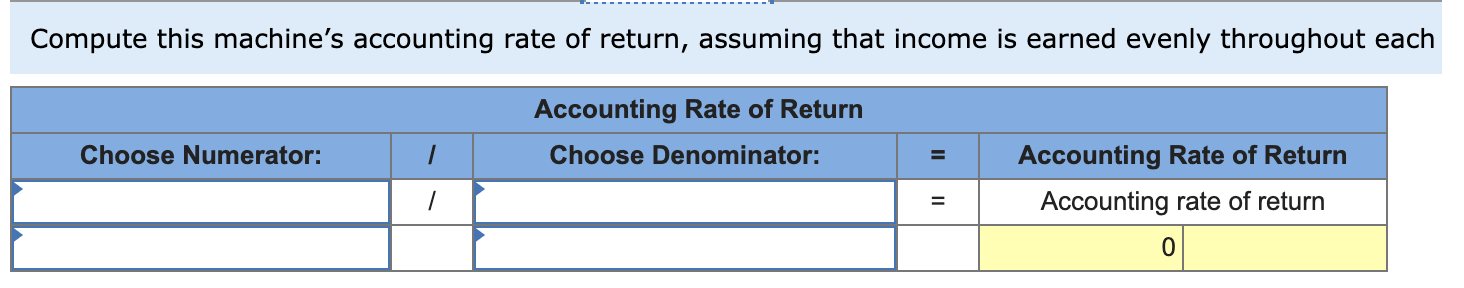

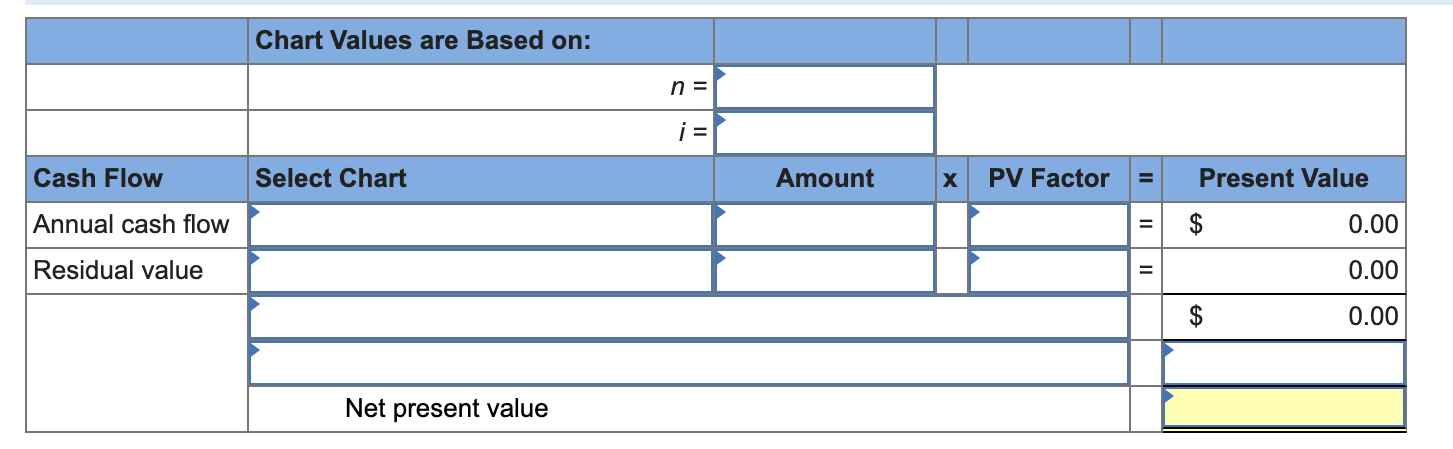

To manufacture this product, the company needs to buy a new machine at a $860,000 cost with an expected four-year life and a $58,000 salvage

To manufacture this product, the company needs to buy a new machine at a $860,000 cost with an expected four-year life and a $58,000 salvage value. All sales are for cash, and all costs are out-of-pocket, except for depreciation on the new machine. Additional information includes the following. (PV of $1, FV of $1, PVA of $1, and FVA of $1)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started