Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To model the future performance of an investment fund in the next 10 years, you assume that in each of the first 5 years,

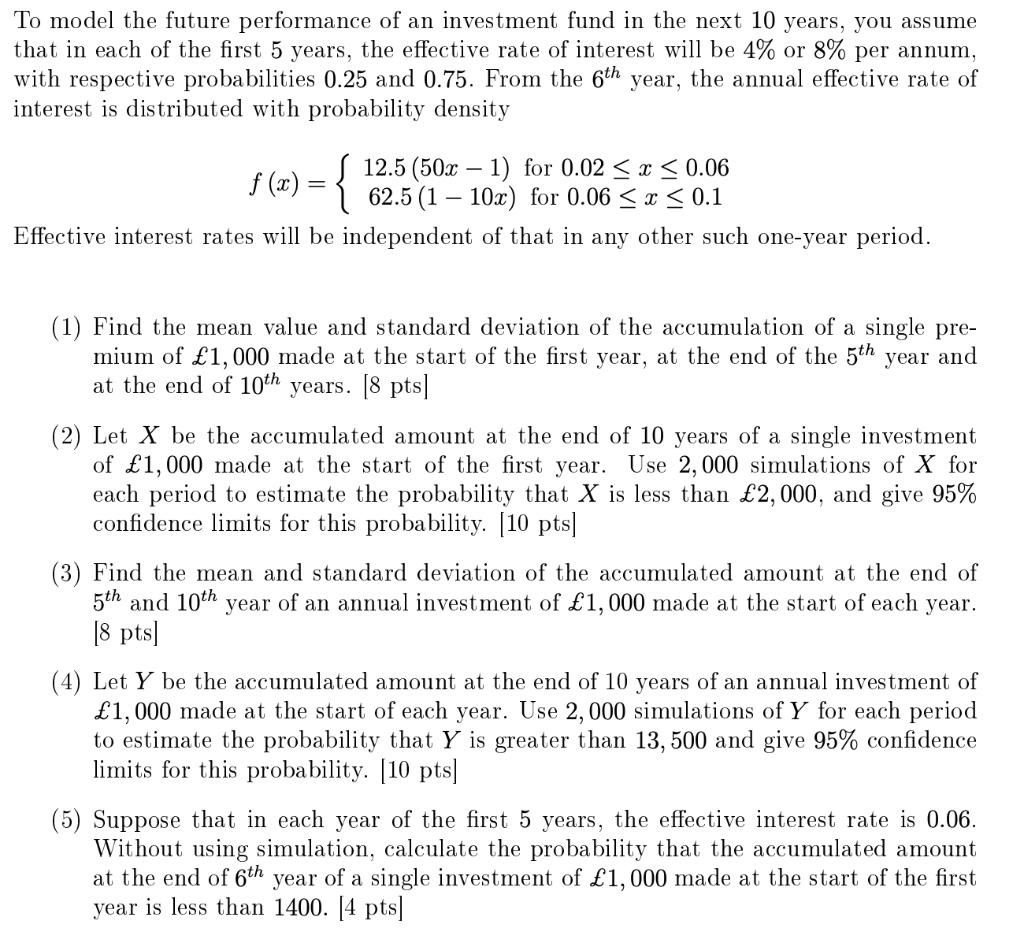

To model the future performance of an investment fund in the next 10 years, you assume that in each of the first 5 years, the effective rate of interest will be 4% or 8% per annum, with respective probabilities 0.25 and 0.75. From the 6th year, the annual effective rate of interest is distributed with probability density f) = 12.5 (50x1) for 0.02 x 0.06 62.5 (110x) for 0.06 x 0.1 Effective interest rates will be independent of that in any other such one-year period. (1) Find the mean value and standard deviation of the accumulation of a single pre- mium of 1,000 made at the start of the first year, at the end of the 5th year and at the end of 10th years. [8 pts] (2) Let X be the accumulated amount at the end of 10 years of a single investment of 1,000 made at the start of the first year. Use 2,000 simulations of X for each period to estimate the probability that X is less than 2,000, and give 95% confidence limits for this probability. [10 pts] (3) Find the mean and standard deviation of the accumulated amount at the end of 5th and 10th year of an annual investment of 1,000 made at the start of each year. [8 pts] (4) Let Y be the accumulated amount at the end of 10 years of an annual investment of 1,000 made at the start of each year. Use 2, 000 simulations of Y for each period to estimate the probability that Y is greater than 13, 500 and give 95% confidence limits for this probability. [10 pts] (5) Suppose that in each year of the first 5 years, the effective interest rate is 0.06. Without using simulation, calculate the probability that the accumulated amount at the end of 6th year of a single investment of 1,000 made at the start of the first year is less than 1400. [4 pts] To model the future performance of an investment fund in the next 10 years, you assume that in each of the first 5 years, the effective rate of interest will be 4% or 8% per annum, with respective probabilities 0.25 and 0.75. From the 6th year, the annual effective rate of interest is distributed with probability density f) = 12.5 (50x1) for 0.02 x 0.06 62.5 (110x) for 0.06 x 0.1 Effective interest rates will be independent of that in any other such one-year period. (1) Find the mean value and standard deviation of the accumulation of a single pre- mium of 1,000 made at the start of the first year, at the end of the 5th year and at the end of 10th years. [8 pts] (2) Let X be the accumulated amount at the end of 10 years of a single investment of 1,000 made at the start of the first year. Use 2,000 simulations of X for each period to estimate the probability that X is less than 2,000, and give 95% confidence limits for this probability. [10 pts] (3) Find the mean and standard deviation of the accumulated amount at the end of 5th and 10th year of an annual investment of 1,000 made at the start of each year. [8 pts] (4) Let Y be the accumulated amount at the end of 10 years of an annual investment of 1,000 made at the start of each year. Use 2, 000 simulations of Y for each period to estimate the probability that Y is greater than 13, 500 and give 95% confidence limits for this probability. [10 pts] (5) Suppose that in each year of the first 5 years, the effective interest rate is 0.06. Without using simulation, calculate the probability that the accumulated amount at the end of 6th year of a single investment of 1,000 made at the start of the first year is less than 1400. [4 pts] To model the future performance of an investment fund in the next 10 years, you assume that in each of the first 5 years, the effective rate of interest will be 4% or 8% per annum, with respective probabilities 0.25 and 0.75. From the 6th year, the annual effective rate of interest is distributed with probability density f) = 12.5 (50x1) for 0.02 x 0.06 62.5 (110x) for 0.06 x 0.1 Effective interest rates will be independent of that in any other such one-year period. (1) Find the mean value and standard deviation of the accumulation of a single pre- mium of 1,000 made at the start of the first year, at the end of the 5th year and at the end of 10th years. [8 pts] (2) Let X be the accumulated amount at the end of 10 years of a single investment of 1,000 made at the start of the first year. Use 2,000 simulations of X for each period to estimate the probability that X is less than 2,000, and give 95% confidence limits for this probability. [10 pts] (3) Find the mean and standard deviation of the accumulated amount at the end of 5th and 10th year of an annual investment of 1,000 made at the start of each year. [8 pts] (4) Let Y be the accumulated amount at the end of 10 years of an annual investment of 1,000 made at the start of each year. Use 2, 000 simulations of Y for each period to estimate the probability that Y is greater than 13, 500 and give 95% confidence limits for this probability. [10 pts] (5) Suppose that in each year of the first 5 years, the effective interest rate is 0.06. Without using simulation, calculate the probability that the accumulated amount at the end of 6th year of a single investment of 1,000 made at the start of the first year is less than 1400. [4 pts]

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

1The mean value is 10001045108511251165125512768 The standard deviation is 10001045112521085112521125112521165112521251125255024 2 The answer is There ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started