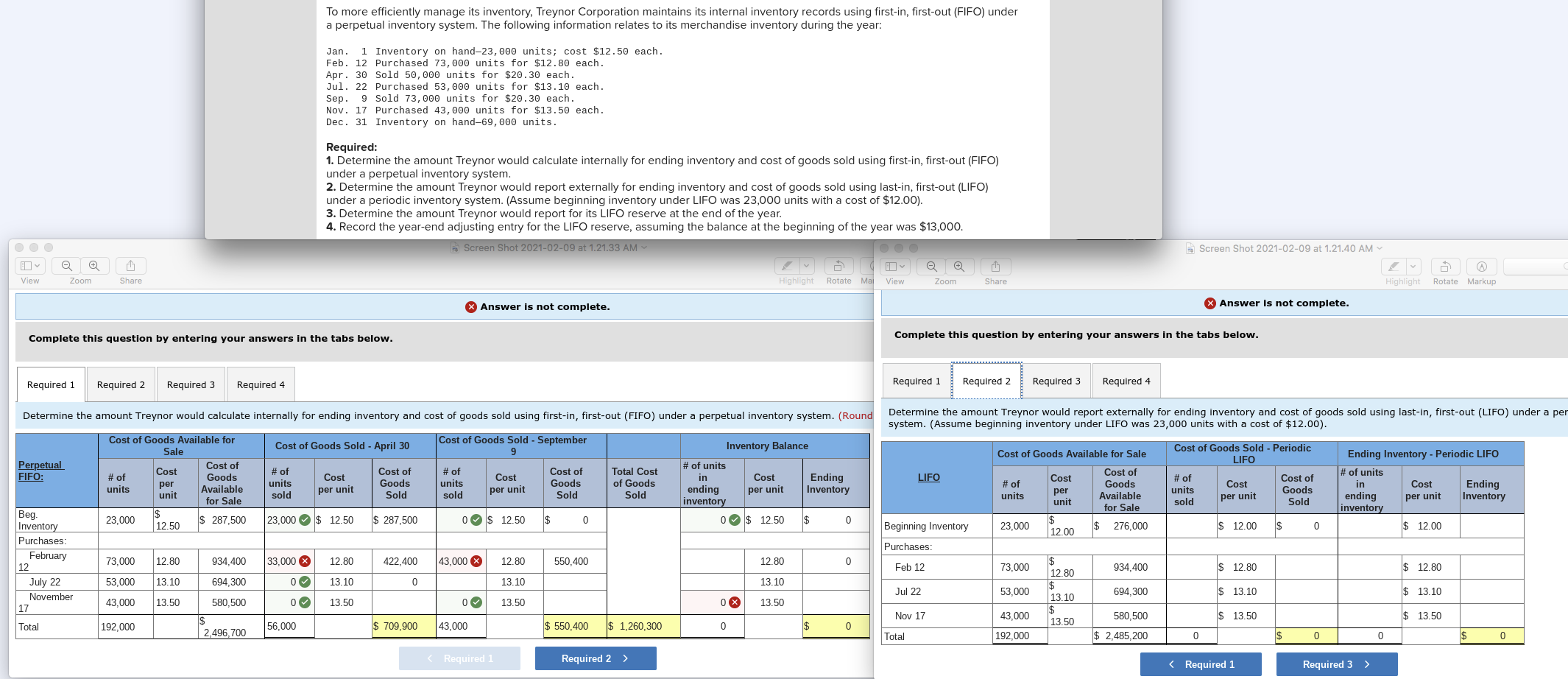

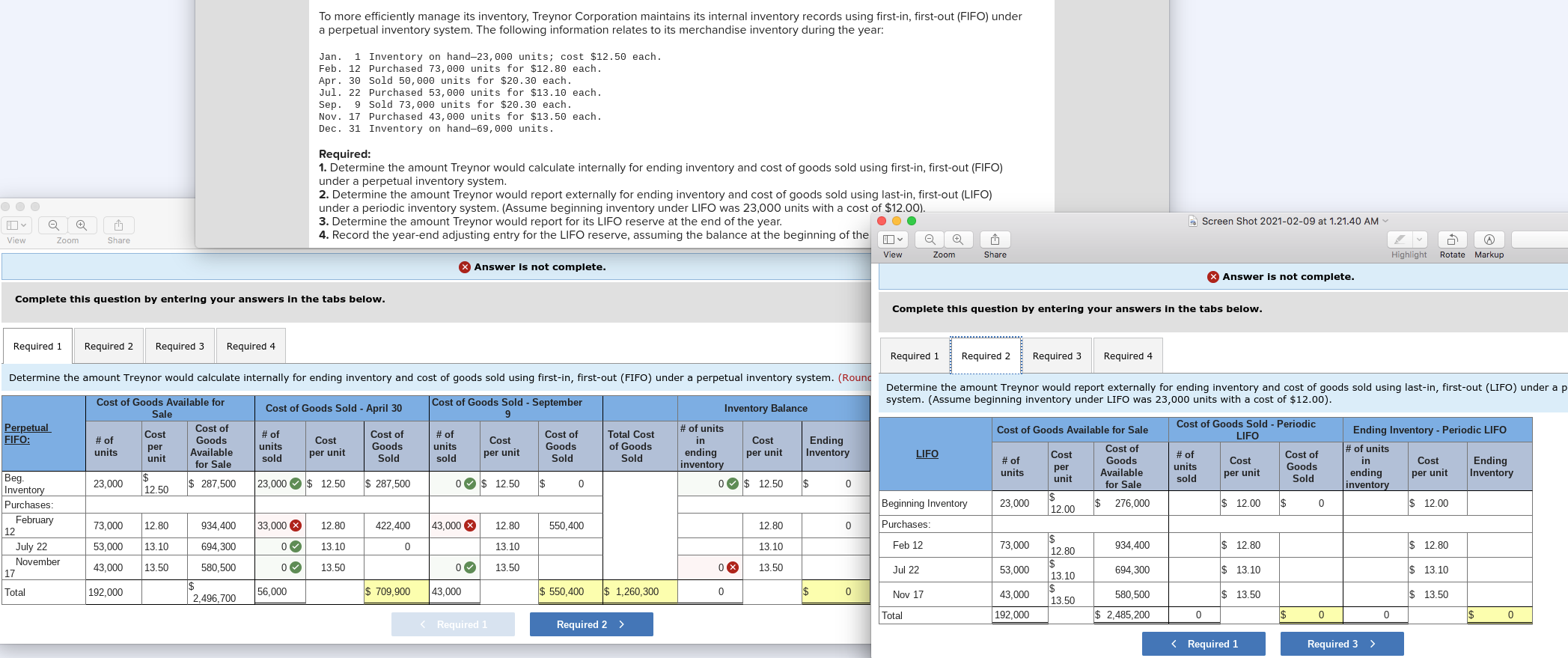

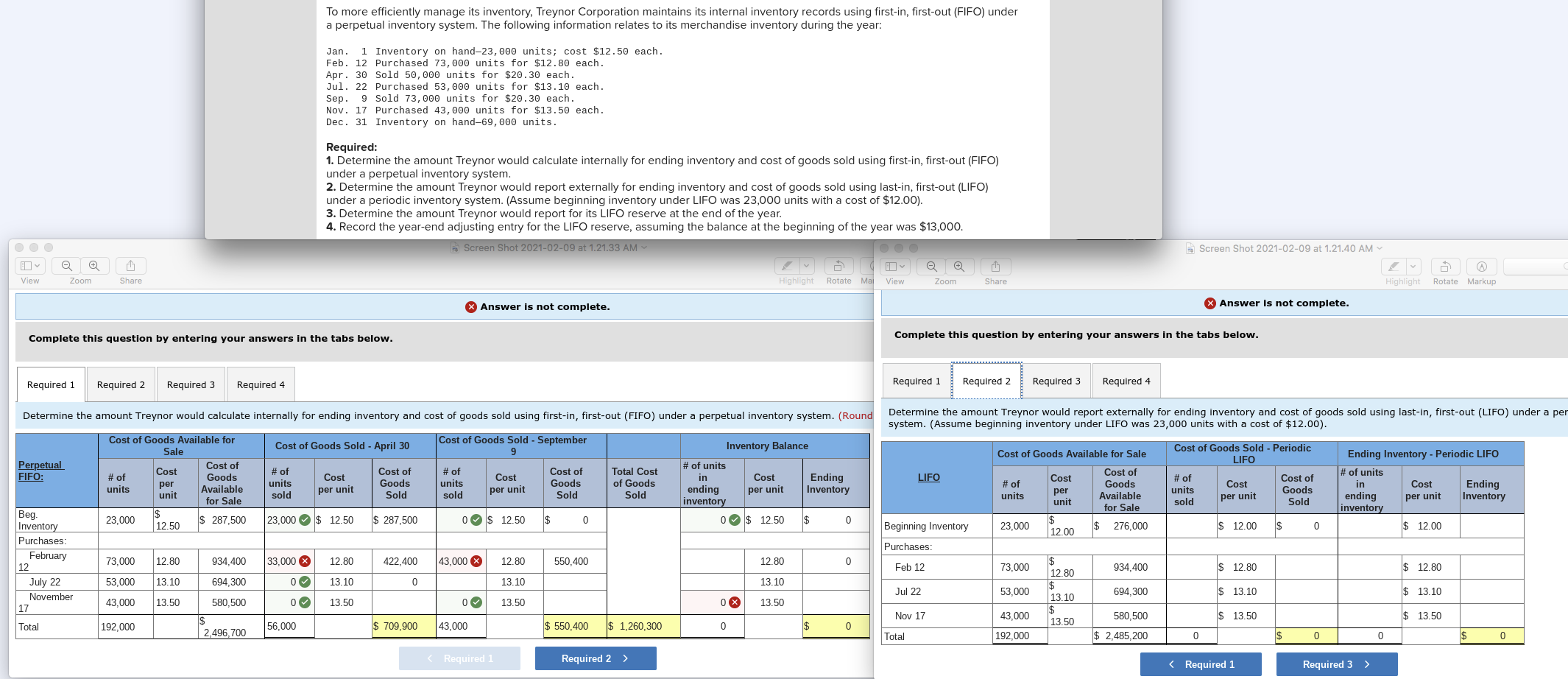

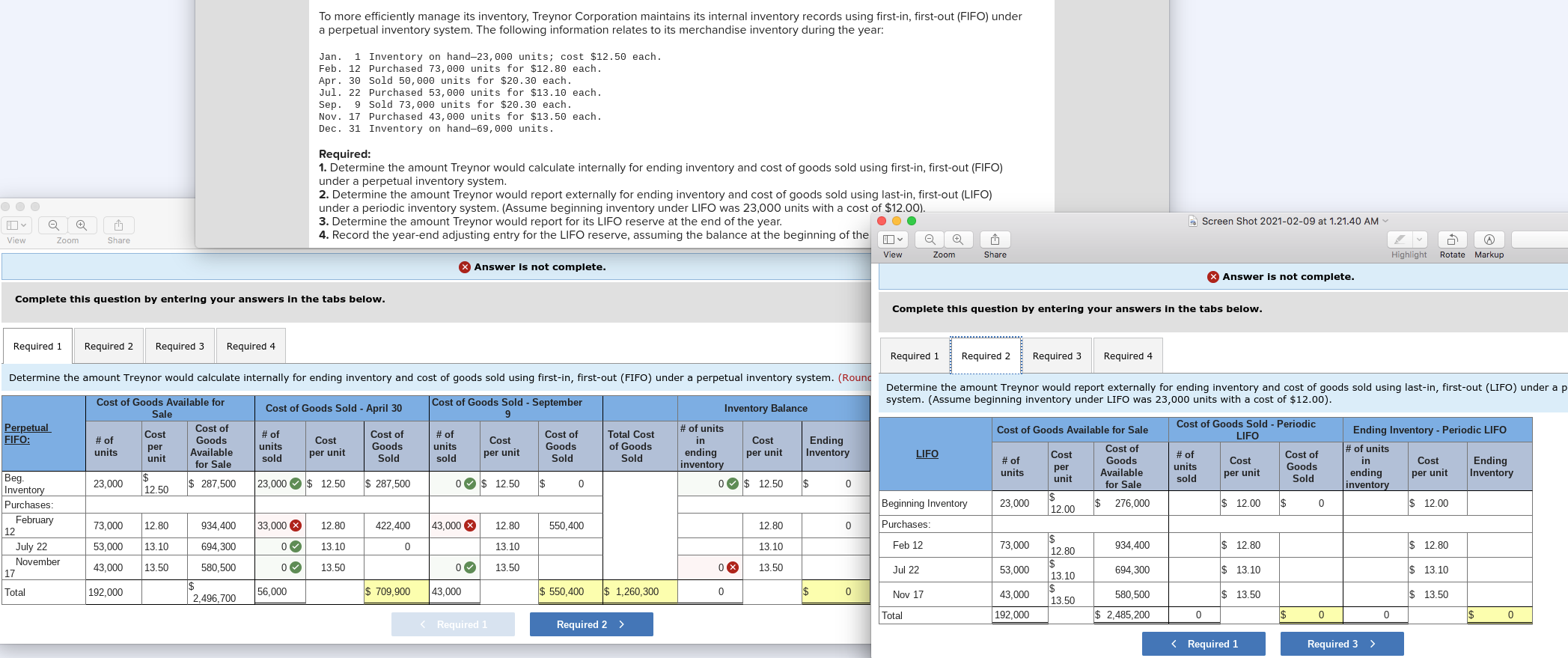

To more efficiently manage its inventory, Treynor Corporation maintains its internal inventory records using first-in, first-out (FIFO) under a perpetual inventory system. The following information relates to its merchandise inventory during the year: Jan. 1 Inventory on hand-23,000 units; cost $12.50 each. Feb. 12 Purchased 73,000 units for $12.80 each. Apr. 30 Sold 50,000 units for $20.30 each. Jul. 22 Purchased 53,000 units for $13.10 each. Sep. 9 Sold 73,000 units for $20.30 each. Nov. 17 Purchased 43,000 units for $13.50 each. Dec. 31 Inventory on hand-69,000 units. Required: 1. Determine the amount Treynor would calculate internally for ending inventory and cost of goods sold using first-in, first-out (FIFO) under a perpetual inventory system. 2. Determine the amount Treynor would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. (Assume beginning inventory under LIFO was 23,000 units with a cost of $12.00). 3. Determine the amount Treynor would report for its LIFO reserve at the end of the year. 4. Record the year-end adjusting entry for the LIFO reserve, assuming the balance at the beginning of the year was $13,000. Screen Shot 2021-02-09 at 1.21.33 AM Screen Shot 2021-02-09 at 1.21.40 AM View Zoom Share Highlight Rotate Map View Zoom Share Highlight Rotate Markup Answer is not complete. Answer is not complete. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 1 Required 2 Required 3 Required 4 Determine the amount Treynor would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a per system. (Assume beginning inventory under LIFO was 23,000 units with a cost of $12.00). Cost of Goods Available for Sale Cost of Goods Sold - Periodic LIFO LIFO Cost per unit # of units Cost of Goods Available for Sale # of units sold Cost of Goods Sold Cost per unit Ending Ending Inventory - Periodic LIFO # of units in Cost ending per unit Inventory inventory Determine the amount Treynor would calculate internally for ending inventory and cost of goods sold using first-in, first-out (FIFO) under a perpetual inventory system. (Round Cost of Goods Available for Cost of Goods Sold - September Sale Cost of Goods Sold - April 30 9 Inventory Balance Perpetual Cost Cost of FIFO: # of # of Goods # of units Cost of Cost # of Cost of Cost Total Cost per units in Goods units units Cost Available Goods Ending of Goods per unit unit sold Sold sold per unit ending Sold per unit Sold for Sale Inventory inventory Beg. $ 23,000 Inventory 12.50 $ 287,500 23,000 $ 12.50 $ 287,500 0 $ 12.50 $ 0 0 $ 12.50 $ 0 Purchases: February 73,000 12.80 12 934,400 33,000 X 12.80 422.400 43,000 X 12.80 550,400 12.80 0 July 22 53,000 13.10 694,300 0 13.10 0 13.10 13.10 November 43,000 13.50 580,500 17 0 13.50 0 13.50 0 % 13.50 Total 192.000 56.000 $ 709,900 43,000 2,496,700 $ 550,400 $ 1,260,300 0 $ 0 Beginning Inventory 23,000 $ 12.00 $ 276,000 $ 12.00 0 12.00 Purchases: Feb 12 73,000 934,400 $ 12.80 $ 12.80 $ 12.80 $ 13.10 Jul 22 53,000 694,300 $ 13.10 $ 13.10 Nov 17 43,000 580,500 $ 13.50 $ 13.50 13.50 Total 192.000 $ 2,485,200 0 0 0 $ 0 To more efficiently manage its inventory, Treynor Corporation maintains its internal inventory records using first-in, first-out (FIFO) under a perpetual inventory system. The following information relates to its merchandise inventory during the year: Jan. 1 Inventory on hand-23,000 units; cost $12.50 each. Feb. 12 Purchased 73,000 units for $12.80 each. Apr. 30 Sold 50,000 units for $20.30 each. Jul. 22 Purchased 53,000 units for $13.10 each. Sep. 9 Sold 73,000 units for $20.30 each. Nov. 17 Purchased 43,000 units for $13.50 each. Dec. 31 Inventory on hand-69,000 units. Required: 1. Determine the amount Treynor would calculate internally for ending inventory and cost of goods sold using first-in, first-out (FIFO) under a perpetual inventory system. 2. Determine the amount Treynor would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a periodic inventory system. (Assume beginning inventory under LIFO was 23,000 units with a cost of $12.00). 3. Determine the amount Treynor would report for its LIFO reserve at the end of the year. OO 4. Record the year-end adjusting entry for the LIFO reserve, assuming the balance at the beginning of the 0 Screen Shot 2021-02-09 at 1.21.40 AM View Zoom Share View Zoom Share Highlight Rotate Markup Answer is not complete. Answer is not complete. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required 1 Required Required 3 Required 4 Required 1 Required 2 Required 3 Required 4 Determine the amount Treynor would calculate internally for ending inventory and cost of goods sold using first-in, first-out (FIFO) under a perpetual inventory system. (Round Determine the amount Treynor would report externally for ending inventory and cost of goods sold using last-in, first-out (LIFO) under a p system. (Assume beginning inventory under LIFO was 23,000 units with a cost of $12.00). Cost of Goods Sold - April 30 Cost of Goods Sold - September 9 Inventory Balance Perpetual FIFO: Cost of Goods Available for Sale Cost of Cost # of Goods per units unit Available for Sale $ 23,000 $ 287,500 12.50 Cost of Goods Sold - Periodic LIFO Cost # of units sold Cost of Goods Sold # of units sold Cost of Goods Cost per unit Total Cost of Goods Sold Ending Inventory per unit # of units in Cost ending inventory 0 $ 12.50 Sold LIFO per unit Cost of Goods Available for Sale Cost of Cost # of Goods units per Available unit for Sale $ 23,000 $ 12.00 276,000 # of units sold Cost per unit Cost of Goods Sold Ending Inventory - Periodic LIFO # of units in Cost Ending ending per unit Inventory inventory 23,000 $ 12.50 $ 287,500 0 $ 12.50 $ 0 $ 0 $ 12.00 $ 0 $ 12.00 Beg. Inventory Purchases: February 12 July 22 November 17 73,000 12.80 934,400 33,000 X 12.80 422,400 43,000 X 12.80 550,400 12.80 0 Beginning Inventory Purchases: Feb 12 53,000 13.10 694,300 0 13.10 0 13.10 13.10 73,000 934,400 $ 12.80 $ 12.80 43.000 13.50 0 13.50 0 13.50 0 % 13.50 Jul 22 53,000 $ 12.80 $ 13.10 $ 13.50 694,300 $ 13.10 580,500 $ 2,496,700 $ 13.10 Total 192,000 56,000 $ 709,900 43,000 $ 550,400 $ 1,260,300 0 $ 0 Nov 17 43,000 580,500 $ 13.50 $ 13.50 Total 192,000 $ 2,485,200 0 $ 0 0 $ 0