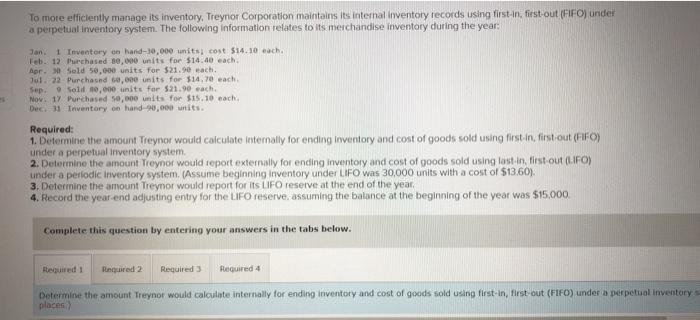

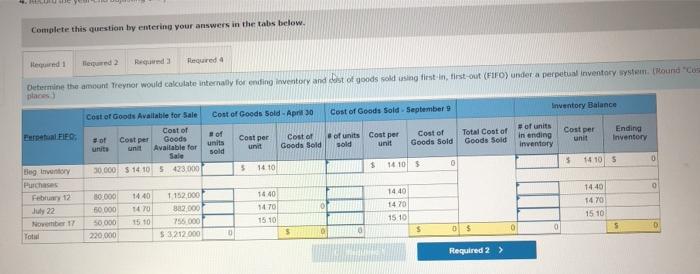

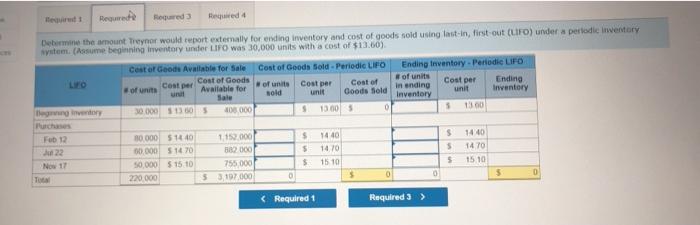

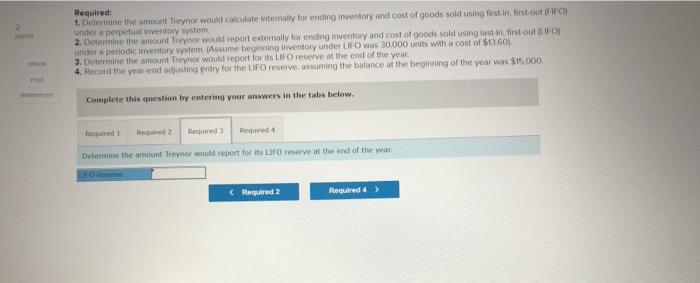

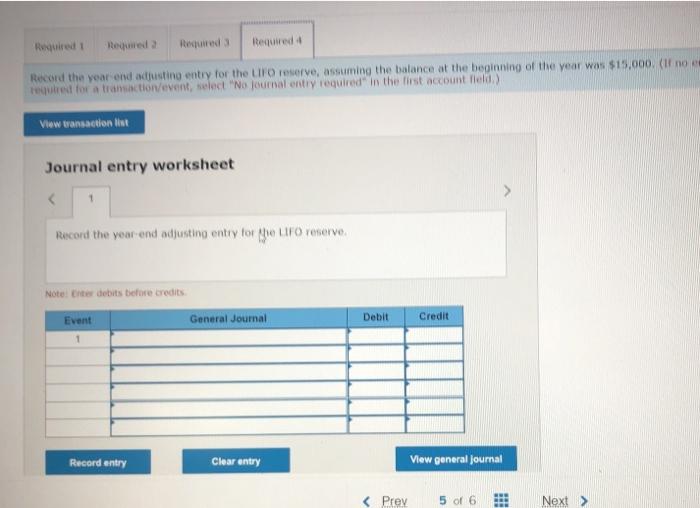

To more efficiently manage its inventory, Treynor Corporation maintains its internal inventory records using first-in, first-out (FFO) under a perpetual inventory system. The following information relates to its merchandise inventory during the year: Jan. Inventory on hand-30,000 units cost $14.10 each Feb. 13 Purchased 10,000 units for $14.40 each Apr. Sold 50,000 units for $21.90 each Jul. 22 Purchased 6,000 units for $14.70 each Sep. Selit 10.000 units for $21.90 each Nov. 17 Purchased 50,000 units for $15.10 each Dec 31 Tnventory on hand 90,000 units. Required: 1. Determine the amount Treynor would calculate internally for ending inventory and cost of goods sold using first.in, first-out (FFO) under a perpetual inventory system 2. Detormine the amount Treynor would report externally for ending inventory and cost of goods sold using lost in first out (FO) under a periodic inventory system. (Assume beginning inventory under LIFO was 30,000 units with a cost of $13.60). 3. Determine the amount Treynor would report for its UFO reserve at the end of the year 4. Record the year end adjusting entry for the LIFO reserve, assuming the balance at the beginning of the year was $15,000 Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required Required 4 Determine the amount Treynor would calculate internally for ending inventory and cost of goods sold using first-In, first-out (FIFO) under a perpetual inventory places Complete this question by entering your answers in the tabs below. Hud 1 Heures Renda Tegured Determine the amount Treynor would calculate internally for ending inventory and cost of goods sold using flestin, first-out (FIFO) under a perpetual inventory system. Mound" places Cost of Goods Sold September 9 Inventory Balance Cost of Goods Sold - April 30 Cost of Goods Available for Sale Cost of #of Cost per Goods units unit Available for Perpetual FIFO of units sold Cost of Goods Sold of units Cost per sold unit Cost per unit Cost of Goods Sold Total Coot of Goods Sold Cost per unit of units in ending Inventory Ending Inventory Sale 5 0 1410 5 5 $ 30.000 $1410 5423.000 1410 1410 1440 0 14.40 Blog Inventory Purchases February 12 July 22 November 17 Total 30 000 50 000 14:40 1470 15 10 1640 1470 1470 01 1 152.000 822.000 755.000 $ 3212000 1470 15 10 15 10 15 10 50.000 220.000 0 $ S 5 0 0 Required 2 > Roque Het Roque 3 Heged 4 Determine the amount Treynor would report externally for ending inventory and cost of goods sold using lastin, first-out (FO) under a periodic Inventory system (Assume beginning inventory under LIFO was 30,000 units with a cost of $13.60) Castor Goods Available for Sale Cost of Goods Sold - Periodic LIFO Ending Inventory - Periodic LIFO LO Cost per Cost of Goods of units of units of units Cost per Cost of Available for Cost per Ending unt sold Sale unit In ending Goods Sold unit Inventory Inventory engine 30.000 $130 S 0 000 13.00 0 5 13.00 Purchase Feb 12 30.000 $1440 115.000 $ 14 40 $ 1440 22 00.000 51470 582 000 1470 5 1470 No 1 50,000 $15.10 755.000 $ 15 10 5 15 10 220.000 53,197,000 $ 0 0 5 0 Required: 1. Determine the amount They would calculate internally for ending inventory and cost of goods sold using fustin, first out (FIFO) under a perpetual inventory system 2. Determine the amount Treyner would report externally for ending inventory and cost of goods sold using last first-out (FO) inder a periodic Inventory system (Assume beginning inventory under UFO was 30,000 units with a cost of $0.60) 3. Determine the amount Treynor would report for its LIFO reserve at the end of the year 4. Record the year end adjusting entry for the LIFO reserve ostming the balance at the beginning of the year was $15.000 Complete this question by entering your answers in the tabs below. Required 1 Hered Required red Dutermine the amount Tieroor would report for its LIFO reserve at the end of the year. Required Rewed 2 Required Itequired 4 Record the year and adjusting entry for the UFO reserve, assuming the balance at the beginning of the year was $15,000. (If no e reguled for a transaction/event, select "No journal entry required in the first account hela.) View transaction list Journal entry worksheet