Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To plan for an imminent expansion, BC Kitchenette Ltd. has just entered into a forward rate agreement (FRA) with TD whereby the latter agreed to

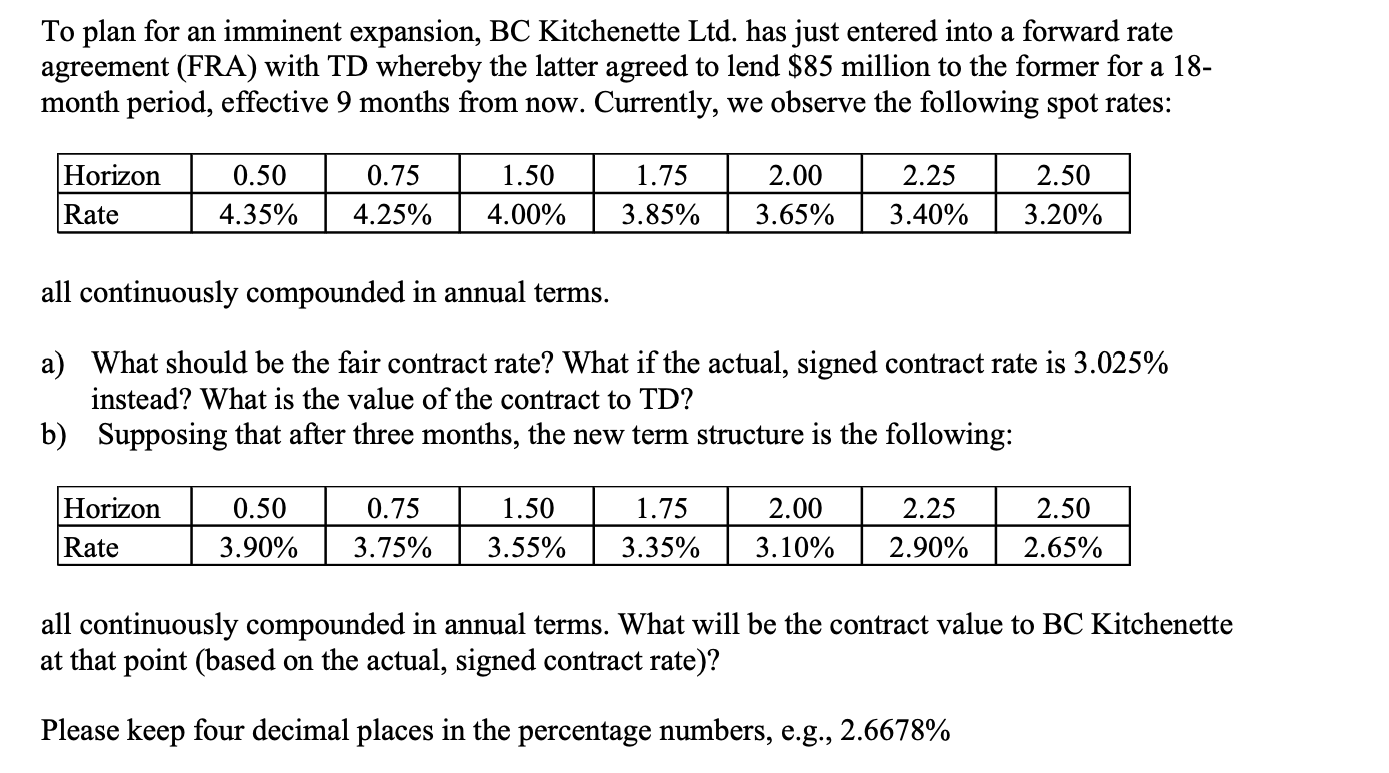

To plan for an imminent expansion, BC Kitchenette Ltd. has just entered into a forward rate agreement (FRA) with TD whereby the latter agreed to lend $85 million to the former for a 18month period, effective 9 months from now. Currently, we observe the following spot rates: all continuously compounded in annual terms. a) What should be the fair contract rate? What if the actual, signed contract rate is 3.025% instead? What is the value of the contract to TD? b) Supposing that after three months, the new term structure is the following: all continuously compounded in annual terms. What will be the contract value to BC Kitchenette at that point (based on the actual, signed contract rate)? Please keep four decimal places in the percentage numbers, e.g., 2.6678%

To plan for an imminent expansion, BC Kitchenette Ltd. has just entered into a forward rate agreement (FRA) with TD whereby the latter agreed to lend $85 million to the former for a 18month period, effective 9 months from now. Currently, we observe the following spot rates: all continuously compounded in annual terms. a) What should be the fair contract rate? What if the actual, signed contract rate is 3.025% instead? What is the value of the contract to TD? b) Supposing that after three months, the new term structure is the following: all continuously compounded in annual terms. What will be the contract value to BC Kitchenette at that point (based on the actual, signed contract rate)? Please keep four decimal places in the percentage numbers, e.g., 2.6678% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started