Question

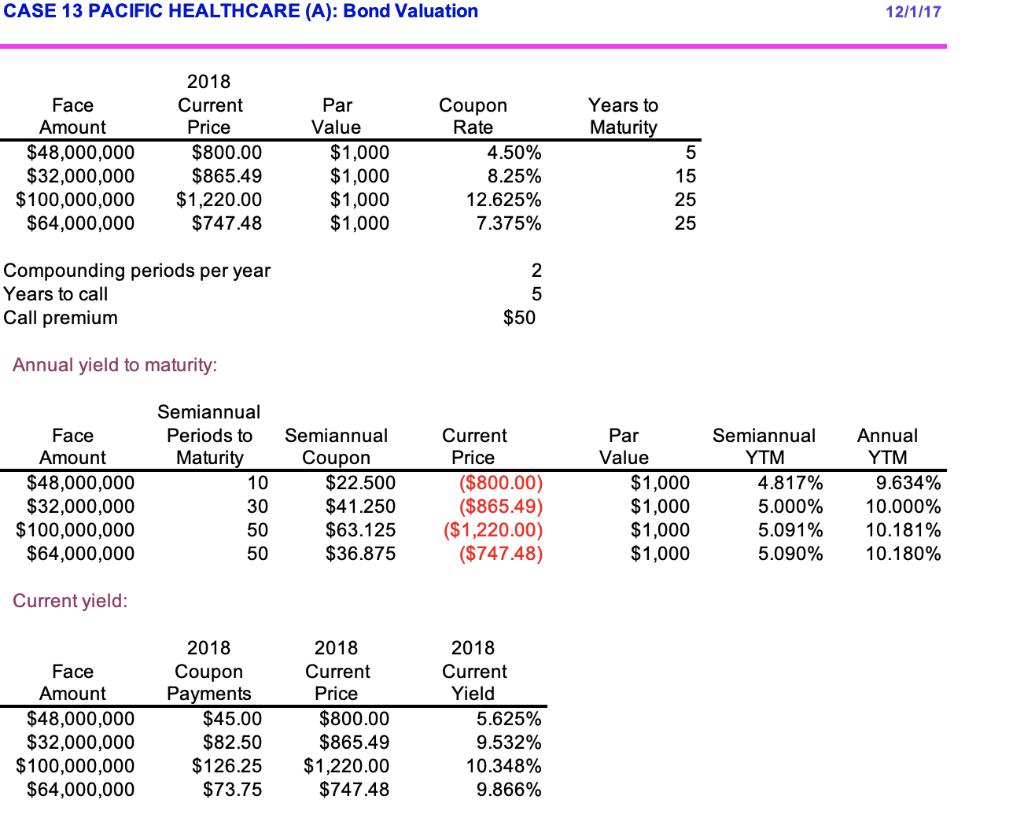

To prepare for the meeting, create a summary of the yields of each bond by completing the table shown in Exhibit 13. 2. Remember that

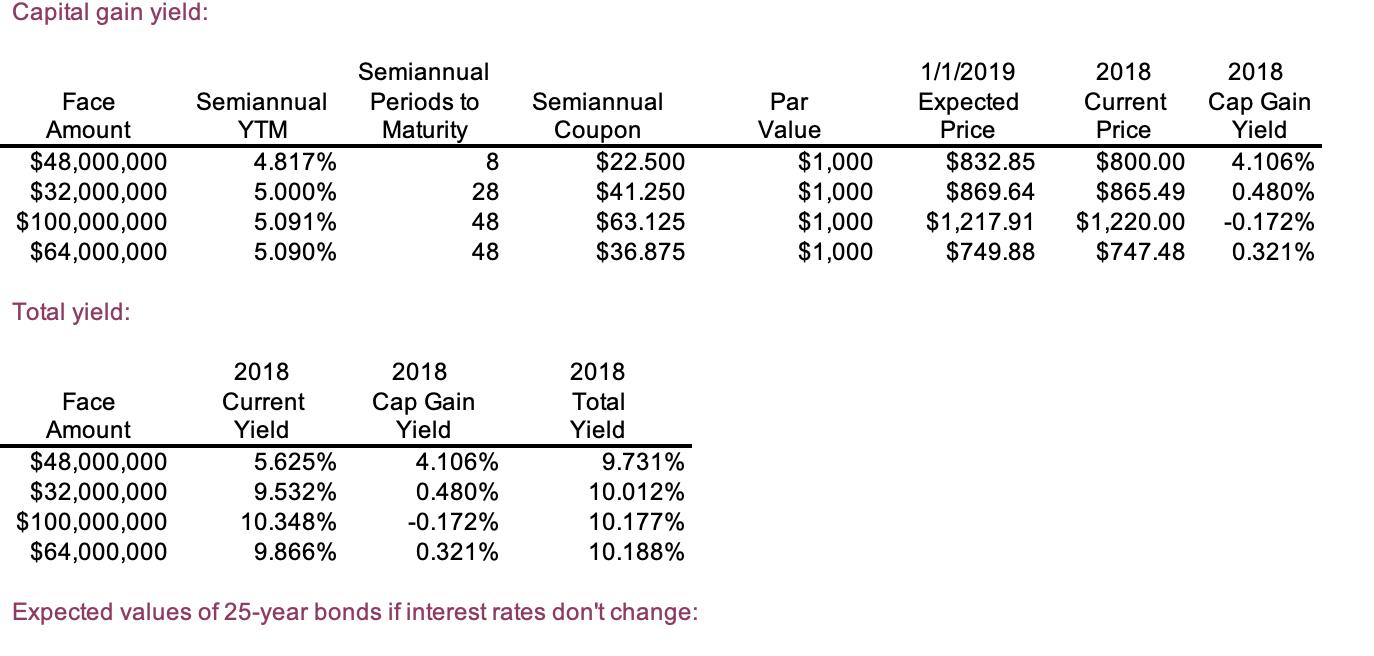

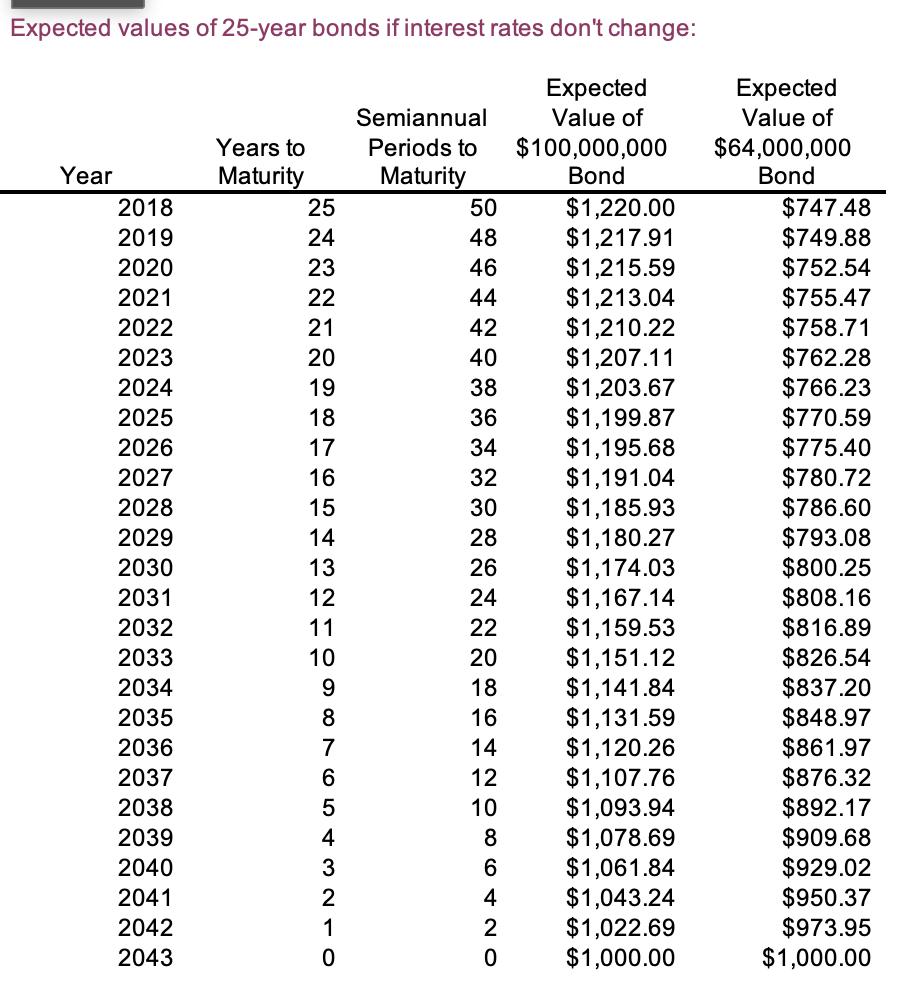

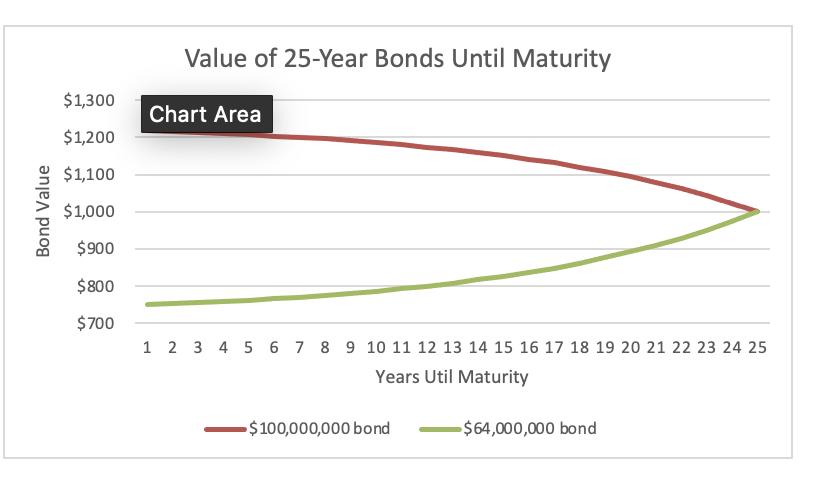

To prepare for the meeting, create a summary of the yields of each bond by completing the table shown in Exhibit 13. 2. Remember that the YTM of each bond is assumed to be the required rate of return of each bond and that the semiannual YTM must be multiplied by two to get the stated (nominal) YTM.2. At the meeting, a committee member asks, “The two 25-year bonds have the same maturity date, so why do the current yields and capital gain yields of these bonds differ?” How do you reply to the committee member? (Hint: No additional calculations are required.) 3. Next, the committee member notices that there is an expected capital gain on one of the 25-year bonds and a capital loss on the other and so asks, “assuming current interest rates don’t change, will these gains and losses continue over the life of the bond?” (Hint: In one figure, graph the expected value of each bond over the 25 years to maturity.)

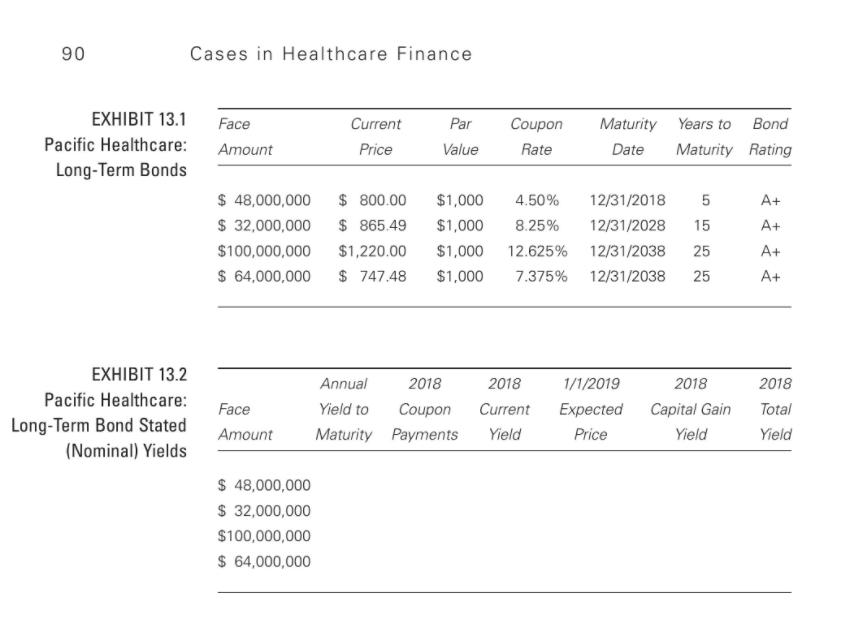

90 EXHIBIT 13.1 Face Pacific Healthcare: Long-Term Bonds Cases in Healthcare Finance EXHIBIT 13.2 Pacific Healthcare: Long-Term Bond Stated (Nominal) Yields Amount Current Price $ 48,000,000 $ 800.00 $ 32,000,000 $ 865.49 $100,000,000 $1,220.00 $ 64,000,000 $ 48,000,000 $32,000,000 $100,000,000 $ 64,000,000 Par Value Bond Coupon Maturity Years to Maturity Rating Rate Date $1,000 4.50% $1,000 8.25% $1,000 12.625% $ 747.48 $1,000 7.375% Annual 2018 2018 Face Yield to Coupon Current Amount Maturity Payments Yield 12/31/2018 5 12/31/2028 15 12/31/2038 25 12/31/2038 25 1/1/2019 Expected Price 2018 Capital Gain Yield A+ A+ A+ A+ 2018 Total Yield

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To create a summary of the yields of each bond we need additional information such as the bond details coupon rates and market prices Please provide the necessary data so that we can complete the tabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started