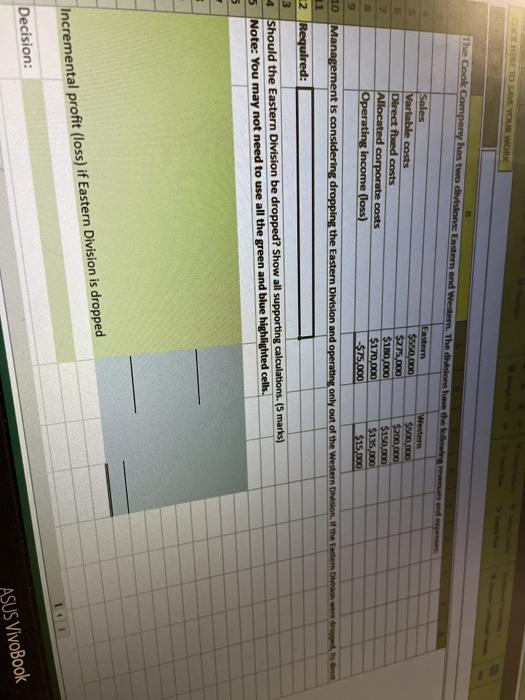

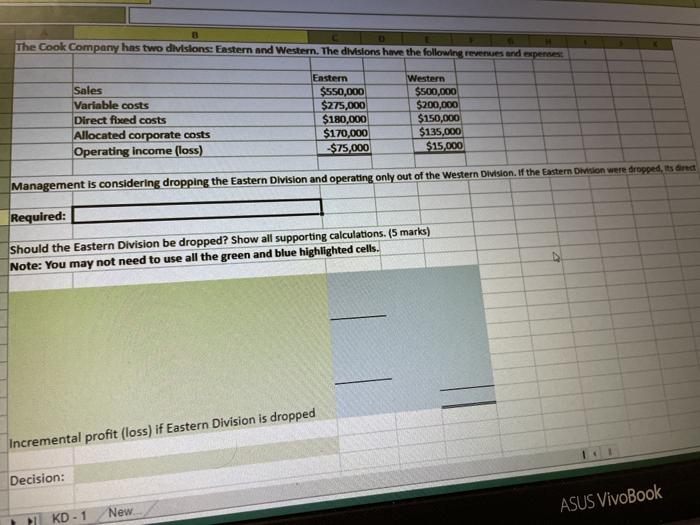

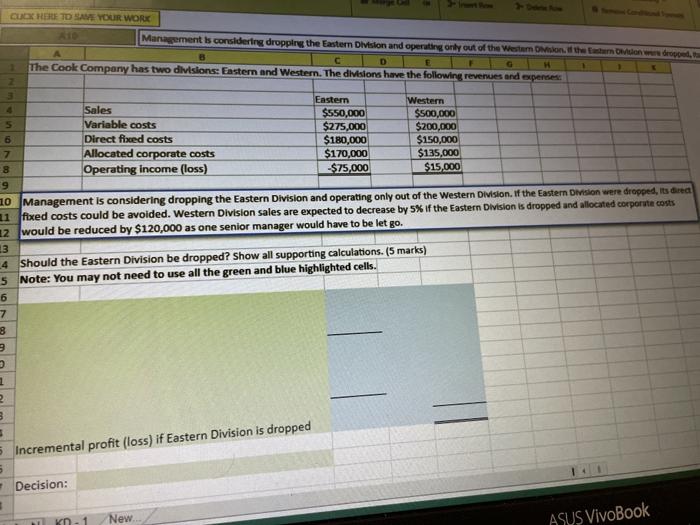

TO SAVE YOUR WORY The Cook Company has two divisions Easter and Westem. The divisions have the flowed Sales Western Variable costs $500,000 Direct feed costs $275,000 $200,000 $180,000 Allocated corporate costs $150.000 $170,000 $135,000 Operating income (loss) $75,000 $15,000 9 10 Management is considering dropping the Eastern Division and operating only out of the Western Division. If the Eastern Dinion were dropped one 11 2 Required: 3 4 Should the Eastern Division be dropped? Show all supporting calculations. (5 marks) 5 Note: You may not need to use all the green and blue highlighted cells. 5 Incremental profit (loss) if Eastern Division is dropped Decision: ASUS VivoBook 3 The Cook Company has two divisions: Eastern and Western. The divisions have the following revenues and expenses Sales Variable costs Direct fixed costs Allocated corporate costs Operating Income (loss) Eastern $550,000 $275,000 $180,000 $170,000 $75,000 Western $500,000 $200,000 $150,000 $135.000 $15,000 Management is considering dropping the Eastern Division and operating only out of the Western Division. If the Eastern Division were dropped, 15 dna Required: Should the Eastern Division be dropped? Show all supporting calculations, (5 marks) Note: You may not need to use all the green and blue highlighted cells. Incremental profit (loss) if Eastern Division is dropped Decision: New KD-1 ASUS VivoBook CUCK HERE TO SAVE YOUR WORK Management is considering dropping the Eastern Division and operating only out of the Western Dinion than one drop, G H 1 The Cook Company has two divisions: Eastern and Western. The divisions have the following reverses and expenses 3 Eastem Western Sales $550,000 $500,000 5 Variable costs $275,000 $200,000 Direct fixed costs $180,000 $150,000 Allocated corporate costs $170,000 $135,000 8 Operating Income (loss) $75,000 $15,000 9 10 Management is considering dropping the Eastern Division and operating only out of the Western Division. If the Eastern Division were dropped, its dea 11 fixed costs could be avoided. Western Division sales are expected to decrease by 5% if the Eastern Division is dropped and allocated corporate costs 12 would be reduced by $120,000 as one senior manager would have to be let go. ON 9 Nm 4 Should the Eastern Division be dropped? Show all supporting calculations. (5 marks) 5 Note: You may not need to use all the green and blue highlighted cells. 6 7 8 3 2 2 3 3 $_Incremental profit (loss) if Eastern Division is dropped 5 Decision: KO New ASUS VivoBook