Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To Sell or Not to Sell The Japanese girl, Miho, in the earlier bagel case, estimates that she would need to invest about $50,000

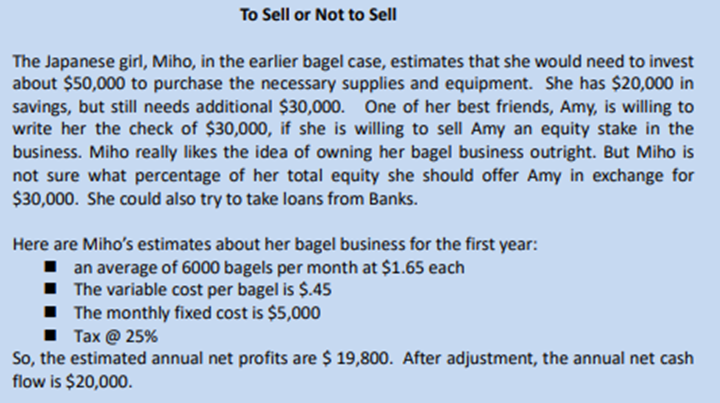

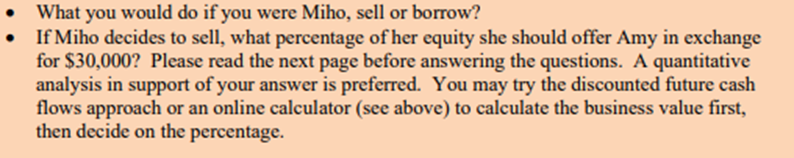

To Sell or Not to Sell The Japanese girl, Miho, in the earlier bagel case, estimates that she would need to invest about $50,000 to purchase the necessary supplies and equipment. She has $20,000 in savings, but still needs additional $30,000. One of her best friends, Amy, is willing to write her the check of $30,000, if she is willing to sell Amy an equity stake in the business. Miho really likes the idea of owning her bagel business outright. But Miho is not sure what percentage of her total equity she should offer Amy in exchange for $30,000. She could also try to take loans from Banks. Here are Miho's estimates about her bagel business for the first year: an average of 6000 bagels per month at $1.65 each The variable cost per bagel is $.45 The monthly fixed cost is $5,000 Tax @ 25% So, the estimated annual net profits are $ 19,800. After adjustment, the annual net cash flow is $20,000. What you would do if you were Miho, sell or borrow? If Miho decides to sell, what percentage of her equity she should offer Amy in exchange for $30,000? Please read the next page before answering the questions. A quantitative analysis in support of your answer is preferred. You may try the discounted future cash flows approach or an online calculator (see above) to calculate the business value first, then decide on the percentage. 1. What is the typical interest rate for commercial loans? 2. What is the duration of the loan you may apply? 3. How long will the business be in operation? 4. What are the appropriate discount rates you may use to calculate the present value of future cash flow? 5. Etc.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started