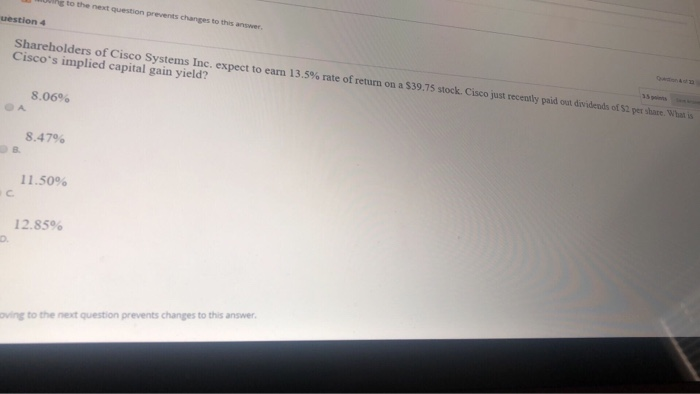

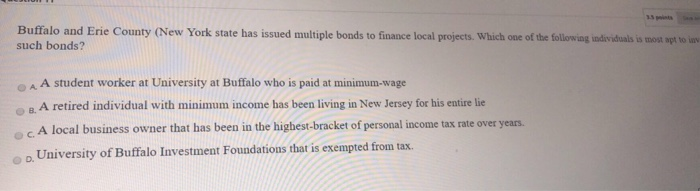

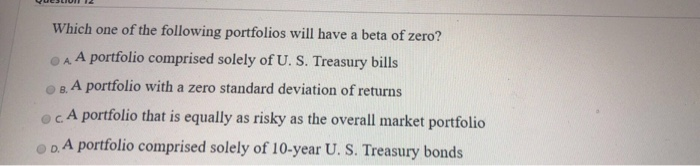

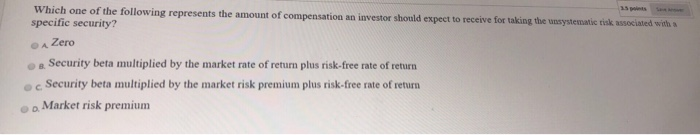

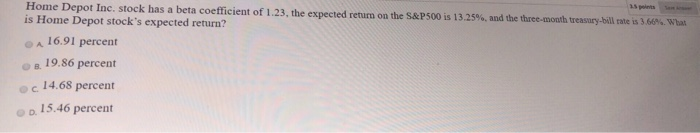

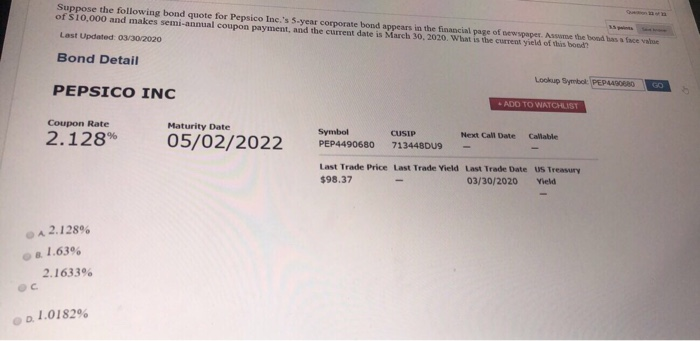

to the next question prevents changes to this answer uestion 4 Shareholders of Cisco Systems Inc. expect to earn 13.5% rate of return on a $39.75 stock. Cisco just recently paid out dividends of Cisco's implied capital gain yield? 8.06% the What 8.479 11.50% 12.85% oving to the next question prevents changes to this answer Buffalo and Erie County (New York state has issued multiple bonds to finance local projects. Which one of the following individuals is most spt to in such bonds? AA student worker at University at Buffalo who is paid at minimum wage A retired individual with minimum income has been living in New Jersey for his entire lie A local business owner that has been in the highest-bracket of personal income tax rate over years. University of Buffalo Investment Foundations that is exempted from tax. Which one of the following portfolios will have a beta of zero? OAA portfolio comprised solely of U. S. Treasury bills 8. A portfolio with a zero standard deviation of returns cA portfolio that is equally as risky as the overall market portfolio . A portfolio comprised solely of 10-year U. S. Treasury bonds Which one of the following represents the amount of compensation an investor should expect to receive for taking the systematisk specific security? ociated with on Zero - Security beta multiplied by the market rate of retum plus risk-free rate of return Security beta multiplied by the market risk premium plus risk-free rate of return Market risk premium Home Depot Inc. stock has a beta coefficient of 1.23, the expected return on the S&P500 is 13.25%, and the three month treasury-bille is 3.6. What is Home Depot stock's expected return? 16.91 percent - 19.86 percent c 14.68 percent 15.46 percent Suppose the following bond quote for Pepsico Inc.'s 5-year corporate bond appears in the financial page of wspaper. Assume the bends faces of S10,000 and makes semi-annual coupon payment, and the current date is March 30, 2020. What is the current yield of this bood Last Updated: 03/30/2020 Bond Detail Lookup Symbok PEPSARO PEPSICO INC GO ADD TO WATCHLIST Maturity Date Coupon Rate 2.128% Symbol PEP4490680 05/02/2022 CUSIP 713448009 Next Call Date - Callable Last Trade Price Last Trade Yield Last Trade Date US Treasury $98.37 03/30/2020 Yield A 2.12896 8.1.63% 2.1633% oc . 1.01829