Answered step by step

Verified Expert Solution

Question

1 Approved Answer

To view image easier, right click and open in a new tab or save image For each of the last six quarters, Managers L and

To view image easier, right click and open in a new tab or save image

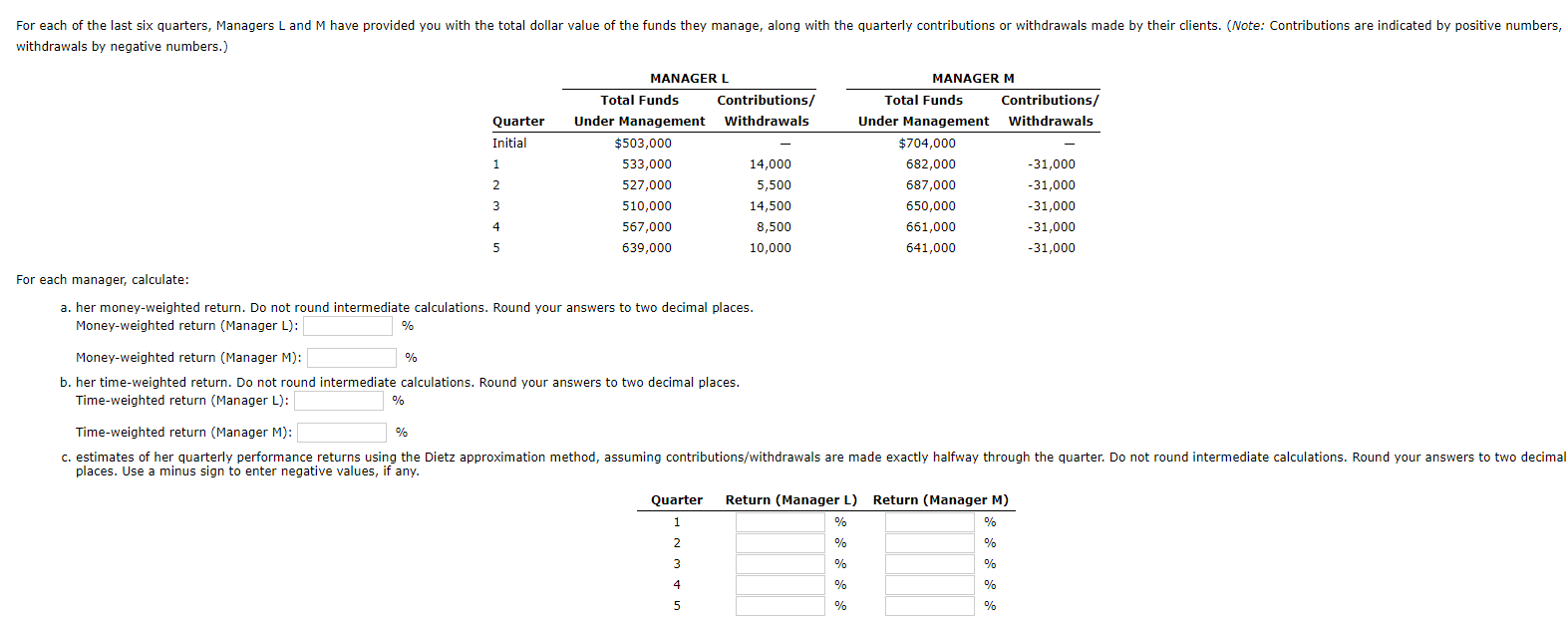

For each of the last six quarters, Managers L and M have provided you with the total dollar value of the funds they manage, along with the quarterly contributions or withdrawals made by their clients. (Note: Contributions are indicated by positive numbers, withdrawals by negative numbers.) Quarter Initial 1 MANAGER L Total Funds Contributions/ Under Management withdrawals $503,000 533,000 14,000 527,000 510,000 14,500 567,000 8,500 639,000 10,000 MANAGER M Total Funds Contributions/ Under Management withdrawals $704,000 682,000 -31,000 687,000 -31,000 650,000 -31,000 661,000 -31,000 641,000 -31,000 2 5,500 3 4 5 For each manager, calculate: a. her money-weighted return. Do not round intermediate calculations. Round your answers to two decimal places. Money-weighted return (Manager L): % % Money-weighted return (Manager M): b. her time-weighted return. Do not round intermediate calculations. Round your answers to two decimal places. Time-weighted return (Manager L): % Time-weighted return (Manager M): % C. estimates of her quarterly performance returns using the Dietz approximation method, assuming contributions/withdrawals are made exactly halfway through the quarter. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. Quarter 1 Return (Manager L) Return (Manager M) % % % % % % 2 3 4 % % 5 % % For each of the last six quarters, Managers L and M have provided you with the total dollar value of the funds they manage, along with the quarterly contributions or withdrawals made by their clients. (Note: Contributions are indicated by positive numbers, withdrawals by negative numbers.) Quarter Initial 1 MANAGER L Total Funds Contributions/ Under Management withdrawals $503,000 533,000 14,000 527,000 510,000 14,500 567,000 8,500 639,000 10,000 MANAGER M Total Funds Contributions/ Under Management withdrawals $704,000 682,000 -31,000 687,000 -31,000 650,000 -31,000 661,000 -31,000 641,000 -31,000 2 5,500 3 4 5 For each manager, calculate: a. her money-weighted return. Do not round intermediate calculations. Round your answers to two decimal places. Money-weighted return (Manager L): % % Money-weighted return (Manager M): b. her time-weighted return. Do not round intermediate calculations. Round your answers to two decimal places. Time-weighted return (Manager L): % Time-weighted return (Manager M): % C. estimates of her quarterly performance returns using the Dietz approximation method, assuming contributions/withdrawals are made exactly halfway through the quarter. Do not round intermediate calculations. Round your answers to two decimal places. Use a minus sign to enter negative values, if any. Quarter 1 Return (Manager L) Return (Manager M) % % % % % % 2 3 4 % % 5 % %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started