Answered step by step

Verified Expert Solution

Question

1 Approved Answer

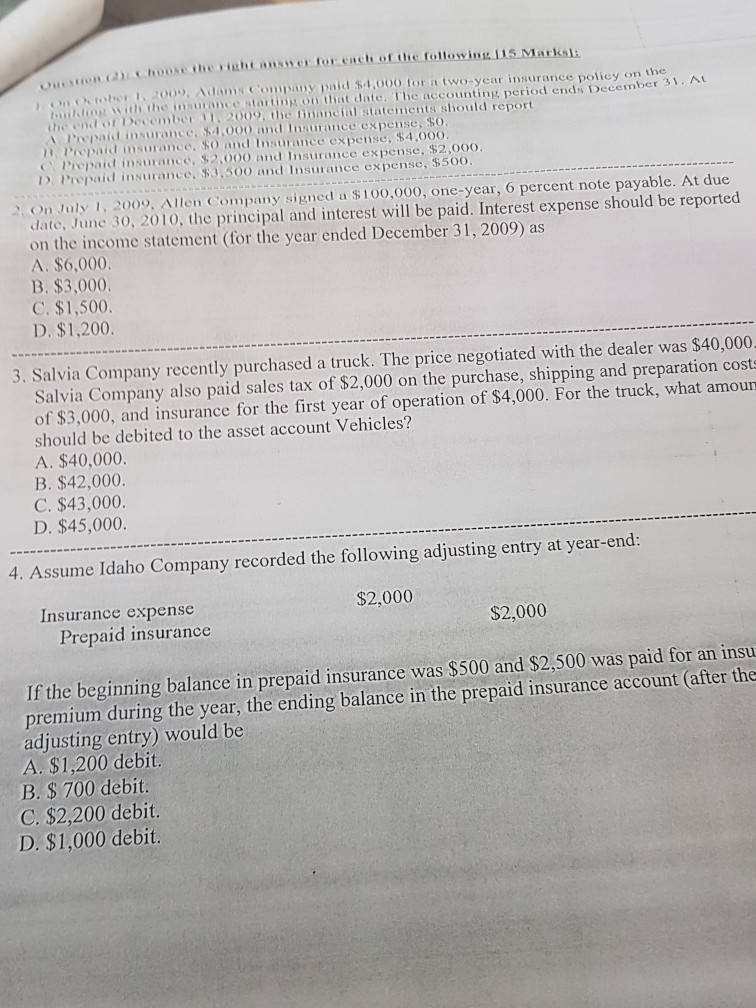

tober 1, 2009, Adams Company paid 84,000 for a two-year insurance policy on the silot with the imsurance stanting on that date. The accounting period

tober 1, 2009, Adams Company paid 84,000 for a two-year insurance policy on the silot with the imsurance stanting on that date. The accounting period ends December the end of December 2009, the financial statements should report Paepaid nsuronce, 1.000 and Insurance expense, $0 Prepaid insuranee, 8O and Imsurance expense, $4,000 Propaid insurance, S2,000 and Insurance expense, $2,000 D Prepaid insurance. 83,500 and Insurance expense, $500 On July 1, 2009. Allen Company signed a $100,000, one-year, 6 percent note payable. At due date, June 30, 2010, the principal and interest will be paid. Interest expense should be reported on the income statement (for the year ended December 31, 2009) as A. $6,000 B, $3,000 C. $1,500 D, $1,200 3. Salvia Company recently purchased a truck. The price negotiated with the dealer was $40,000 Salvia Company also paid sales tax of $2,000 on the purchase, shipping and preparation costs of $3,000, and insurance for the first year of operation of $4,000. For the truck, what amoun should be debited to the asset account Vehicles? A. $40,000 B. $42,000 C. $43,000 D. $45,000 4. Assume Idaho Company recorded the following adjusting entry at year-end Insurance expense $2,000 Prepaid insurance $2,000 If the beginning balance in prepaid insurance was $500 and $2,500 was paid for an insu premium during the year, the ending balance in the prepaid insurance account (after the adjusting entry) would be A. $1,200 debit B. $700 debit C. $2,200 debit D. $1,000 debit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started