Answered step by step

Verified Expert Solution

Question

1 Approved Answer

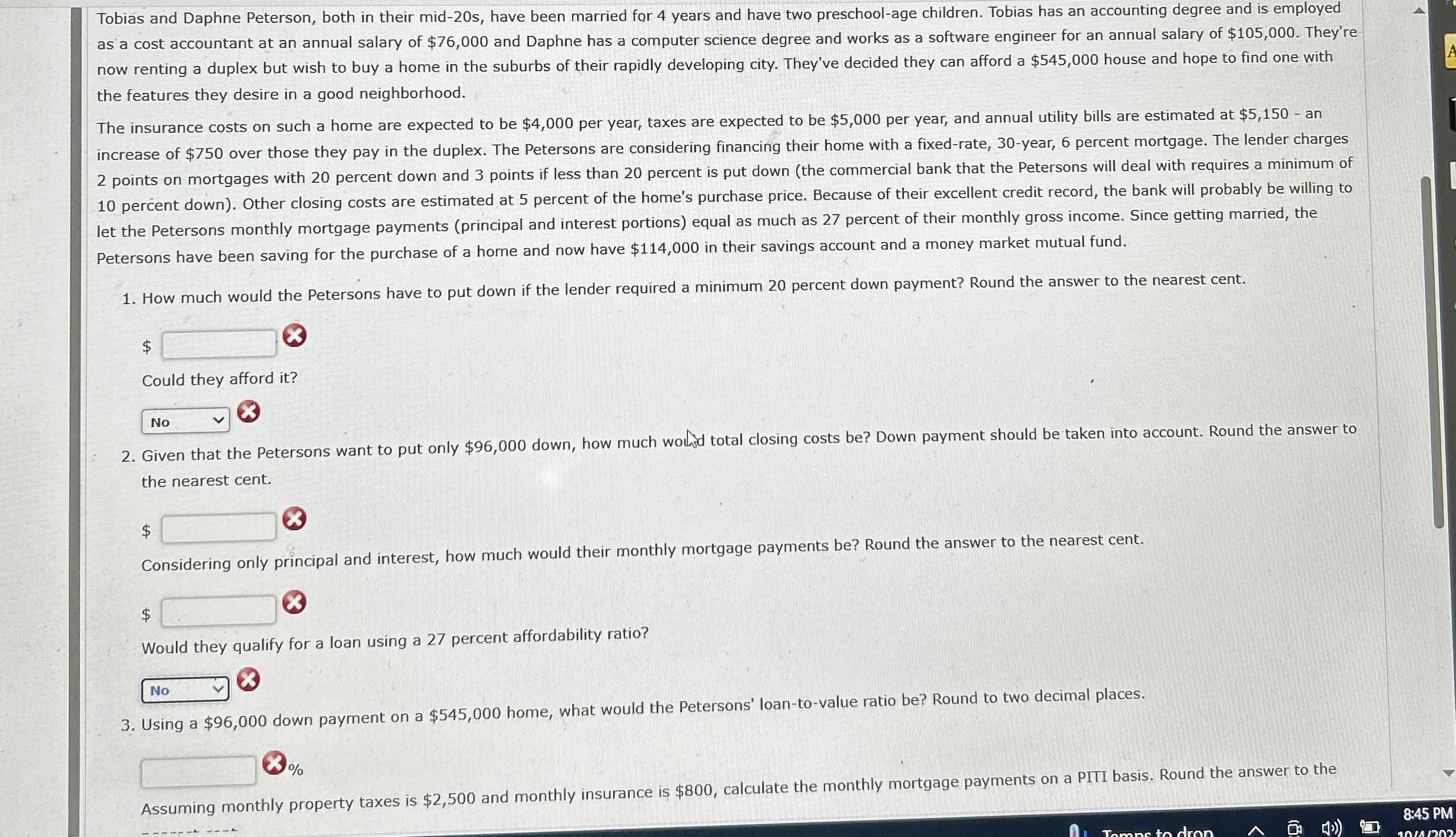

Tobias and Daphne Peterson, both in their mid - 2 0 s , have been married for 4 years and have two preschool - age

Tobias and Daphne Peterson, both in their mids have been married for years and have two preschoolage children. Tobias has an accounting degree and is employed

as a cost accountant at an annual salary of $ and Daphne has a computer science degree and works as a software engineer for an annual salary of $ They're

now renting a duplex but wish to buy a home in the suburbs of their rapidly developing city. They've decided they can afford a $ house and hope to find one with

the features they desire in a good neighborhood.

The insurance costs on such a home are expected to be $ per year, taxes are expected to be $ per year, and annual utility bills are estimated at $ an

increase of $ over those they pay in the duplex. The Petersons are considering financing their home with a fixedrate, year, percent mortgage. The lender charges

points on mortgages with percent down and points if less than percent is put down the commercial bank that the Petersons will deal with requires a minimum of

percent down Other closing costs are estimated at percent of the home's purchase price. Because of their excellent credit record, the bank will probably be willing to

let the Petersons monthly mortgage payments principal and interest portions equal as much as percent of their monthly gross income. Since getting married, the

Petersons have been saving for the purchase of a home and now have $ in their savings account and a money market mutual fund.

How much would the Petersons have to put down if the lender required a minimum percent down payment? Round the answer to the nearest cent.

$

Could they afford it

Given that the Petersons want to put only $ down, how much wolyd total closing costs be Down payment should be taken into account. Round the answer to

the nearest cent.

$

Considering only principal and interest, how much would their monthly mortgage payments be Round the answer to the nearest cent.

$

Would they qualify for a loan using a percent affordability ratio?

Using a $ down payment on a $ home, what would the Petersons' loantovalue ratio be Round to two decimal places.

Assuming monthly property taxes is $ and monthly insurance is $ calculate the monthly mortgage payments on a PIII basis. Round the answer to the

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started