Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tobias Limited received its registration certificate on 10 February 2020. The article 2 of the Memorandum of incorporation provides for an authorized share capital

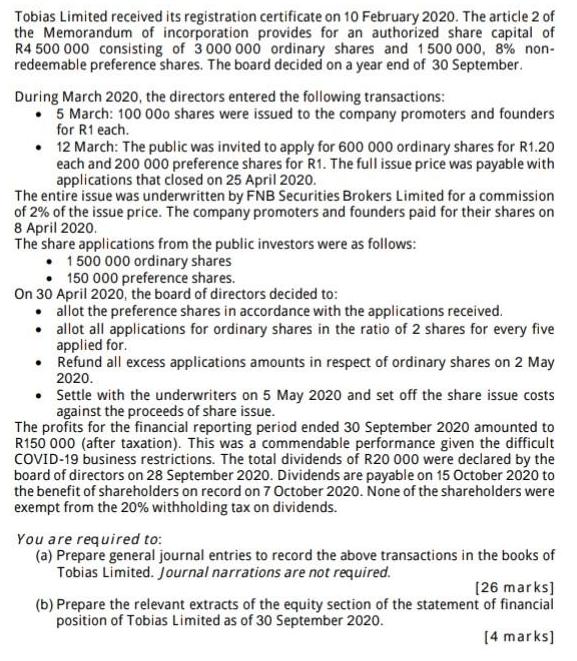

Tobias Limited received its registration certificate on 10 February 2020. The article 2 of the Memorandum of incorporation provides for an authorized share capital of R4 500 000 consisting of 3 000 000 ordinary shares and 1500 000, 8% non- redeemable preference shares. The board decided on a year end of 30 September. During March 2020, the directors entered the following transactions: 5 March: 100 00 shares were issued to the company promoters and founders for R1 each. 12 March: The public was invited to apply for 600 000 ordinary shares for R1.20 each and 200 000 preference shares for R1. The full issue price was payable with applications that closed on 25 April 2020. The entire issue was underwritten by FNB Securities Brokers Limited for a commission of 2% of the issue price. The company promoters and founders paid for their shares on 8 April 2020. The share applications from the public investors were as follows: 1 500 000 ordinary shares 150 000 preference shares. On 30 April 2020, the board of directors decided to: allot the preference shares in accordance with the applications received. allot all applications for ordinary shares in the ratio of 2 shares for every five applied for. Refund all excess applications amounts in respect of ordinary shares on 2 May 2020. Settle with the underwriters on 5 May 2020 and set off the share issue costs against the proceeds of share issue. The profits for the financial reporting period ended 30 September 2020 amounted to R150 000 (after taxation). This was a commendable performance given the difficult COVID-19 business restrictions. The total dividends of R20 000 were declared by the board of directors on 28 September 2020. Dividends are payable on 15 October 2020 to the benefit of shareholders on record on 7 October 2020. None of the shareholders were exempt from the 20% withholding tax on dividends. You are required to: (a) Prepare general journal entries to record the above transactions in the books of Tobias Limited. Journal narrations are not required. [26 marks] (b) Prepare the relevant extracts of the equity section of the statement of financial position of Tobias Limited as of 30 September 2020. (4 marks]

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Introduction A journal entry is a way for a corporation to record all of its individual financial tr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started