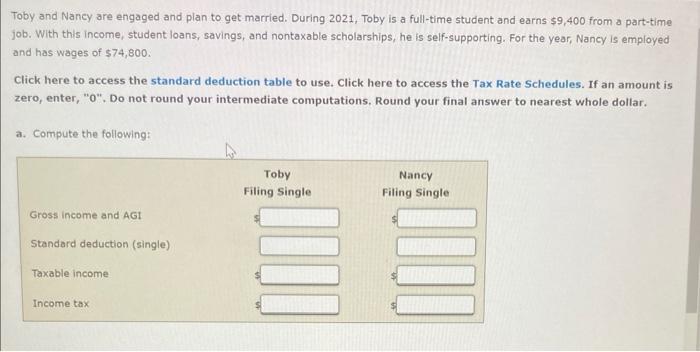

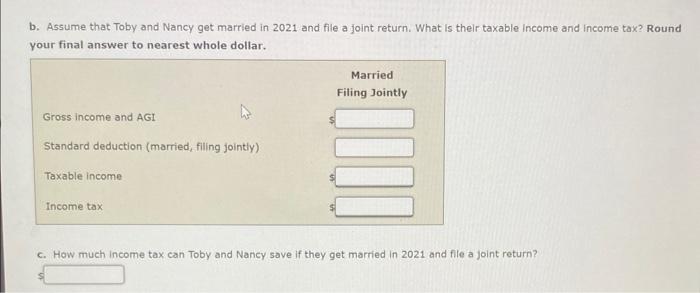

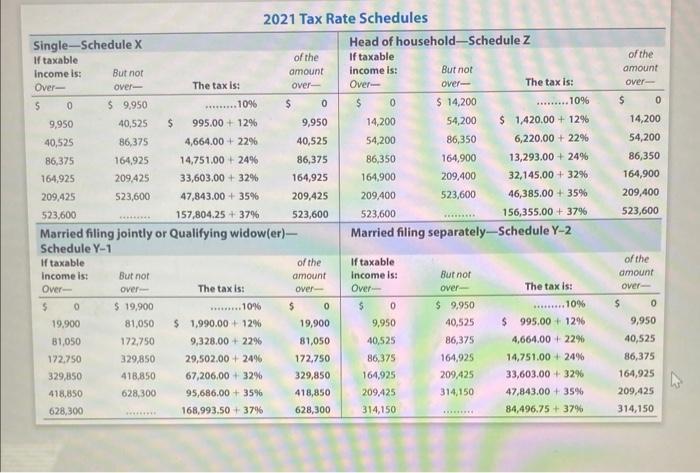

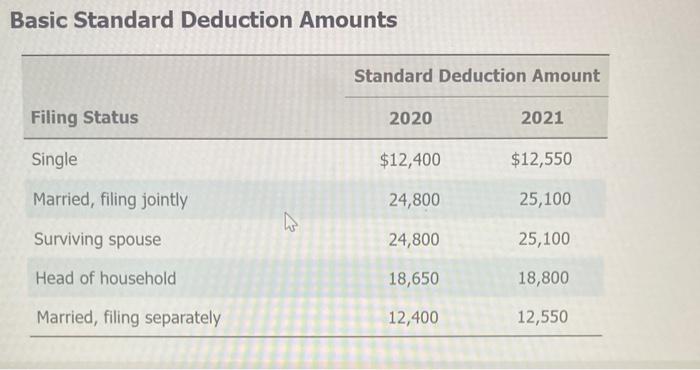

Toby and Nancy are engaged and plan to get married. During 2021, Toby is a full-time student and earns $9,400 from a part-time job. With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Nancy is employed and has wages of $74,800. Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero, enter, "0". Do not round your intermediate computations. Round your final answer to nearest whole dollar. a. Compute the following: Toby Nancy Filing Single Filing Single Gross income and AGI Standard deduction (single) Taxable income Income tax b. Assume that Toby and Nancy get married in 2021 and file a joint return. What is their taxable income and income tax? Round your final answer to nearest whole dollar. Married Filing Jointly Gross income and AGI Standard deduction (married, filing jointly) Taxable income Income tax c. How much Income tax can Toby and Nancy save if they get married in 2021 and file a joint return? 2021 Tax Rate Schedules of the amount over- 0 9,950 40,525 86,375 164,925 209,425 523,600 of the amount over- 0 19,900 81,050 172,750 329,850 418,850 628,300 Single-Schedule X If taxable income is: But not Over- over- The tax is: 5 0 $ 9,950 10% 9,950 40,525 $ 995.00+12% 40,525 86,375 4,664.00+22% 86,375 164,925 14,751.00 +24% 164,925 209,425 33,603,00+32% 209,425 523,600 47,843.00 + 35% 523,600 157,804.25 + 37% ******** Married filing jointly or Qualifying widow(er)- Schedule Y-1 If taxable income is: But not Over- over- The tax is: $ 0 $ 19,900 .........10% 19,900 81,050 $ 1,990.00+12% 81,050 172,750 9,328.00 +22% 172,750 329,850 29,502.00 +24% 329,850 418,850 67,206.00+32% 418,850 628,300 95,686.00+ 35% 628,300 168,993.50+ 37% $ $ Head of household-Schedule Z If taxable income is: But not over- Over- The tax is: $ 0 $ 14,200 ......... 10% $ 1,420.00+12% 14,200 54,200 86,350 54,200 6,220.00 +22% 86,350 164,900 13,293.00 24% 164,900 209,400 32,145.00+ 32% 209,400 523,600 46,385.00+ 35% 523,600 ********* 156,355.00+ 37% Married filing separately-Schedule Y-2 If taxable income is: Over- But not over- The tax is: $ 0 $ 9,950 10% 9,950 40,525 $ 995.00+12% 40,525 86,375 4,664.00+22% 86,375 164,925 14,751.00 24% 164,925 209,425 33,603.00+32% 209,425 314,150 47,843.00+ 35% 314,150 ** 84,496.75+ 37% of the amount over- 0 14,200 54,200 86,350 164,900 209,400 523,600 of the amount over- 0 9,950 40,525 86,375 164,925 209,425 314,150 $ $ Basic Standard Deduction Amounts Filing Status Single Married, filing jointly Surviving spouse Head of household Married, filing separately Standard Deduction Amount 2020 2021 $12,400 $12,550 24,800 25,100 24,800 25,100 18,650 18,800 12,400 12,550