Question

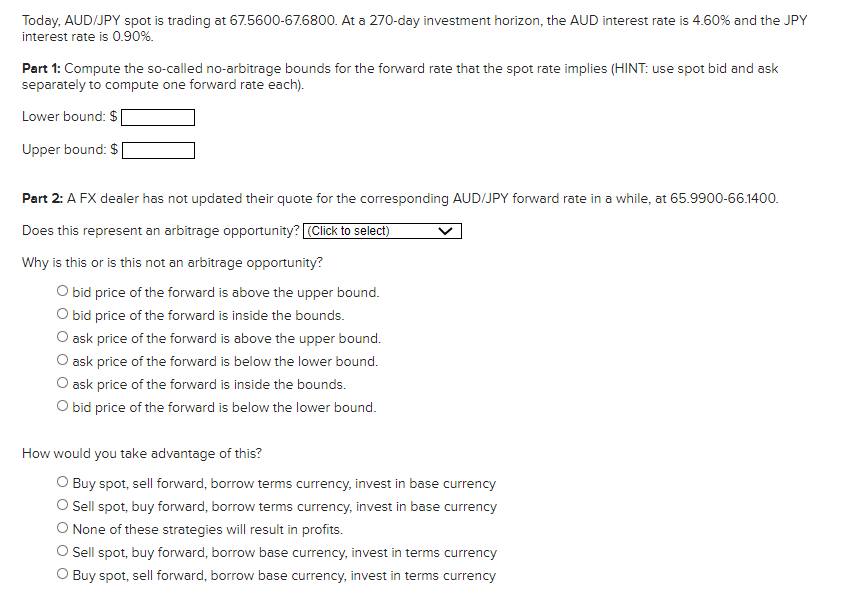

Today, AUD/JPY spot is trading at 67.5600-67.6800. At a 270-day investment horizon, the AUD interest rate is 4.60% and the JPY interest rate is 0.90%.

Today, AUD/JPY spot is trading at 67.5600-67.6800. At a 270-day investment horizon, the AUD interest rate is 4.60% and the JPY interest rate is 0.90%.

Part 1: Compute the so-called no-arbitrage bounds for the forward rate that the spot rate implies (HINT: use spot bid and ask separately to compute one forward rate each).

Lower bound: $

Upper bound: $

Part 2: A FX dealer has not updated their quote for the corresponding AUD/JP Y forward rate in a while, at 65.9900-66.1400.

Y forward rate in a while, at 65.9900-66.1400.

Does this represent an arbitrage opportunity? (Click to select) YES NO Not enough information

Why is this or is this not an arbitrage opportunity?

-

bid price of the forward is above the upper bound.

-

bid price of the forward is inside the bounds.

-

ask price of the forward is above the upper bound.

-

ask price of the forward is below the lower bound.

-

ask price of the forward is inside the bounds.

-

bid price of the forward is below the lower bound.

How would you take advantage of this?

-

Buy spot, sell forward, borrow terms currency, invest in base currency

-

Sell spot, buy forward, borrow terms currency, invest in base currency

-

None of these strategies will result in profits.

-

Sell spot, buy forward, borrow base currency, invest in terms currency

-

Buy spot, sell forward, borrow base currency, invest in terms currency

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started