Answered step by step

Verified Expert Solution

Question

1 Approved Answer

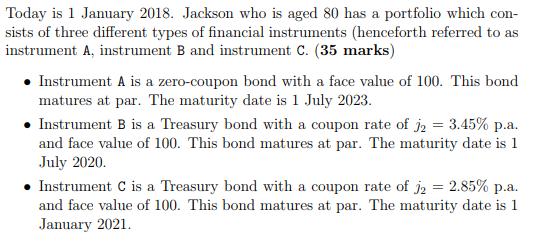

Today is 1 January 2018. Jackson who is aged 80 has a portfolio which con- sists of three different types of financial instruments (henceforth

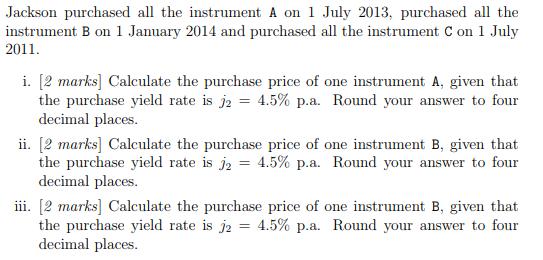

Today is 1 January 2018. Jackson who is aged 80 has a portfolio which con- sists of three different types of financial instruments (henceforth referred to as instrument A, instrument B and instrument C. (35 marks) Instrument A is a zero-coupon bond with a face value of 100. This bond matures at par. The maturity date is 1 July 2023. Instrument B is a Treasury bond with a coupon rate of j2 = 3.45% p.a. and face value of 100. This bond matures at par. The maturity date is 1 July 2020. Instrument C is a Treasury bond with a coupon rate of j2 = 2.85% p.a. and face value of 100. This bond matures at par. The maturity date is 1 January 2021. Jackson purchased all the instrument A on 1 July 2013, purchased all the instrument B on 1 January 2014 and purchased all the instrument C on 1 July 2011. i. [2 marks] Calculate the purchase price of one instrument A, given that the purchase yield rate is j2 = 4.5 % p.a. Round your answer to four decimal places. ii. [2 marks] Calculate the purchase price of one instrument B, given that the purchase yield rate is j2 = 4.5% p.a. Round your answer to four decimal places. iii. [2 marks] Calculate the purchase price of one instrument B, given that the purchase yield rate is j2 = 4.5% p.a. Round your answer to four decimal places.

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

i Instrument A Zero Coupon Bond Face Value 100Y...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started