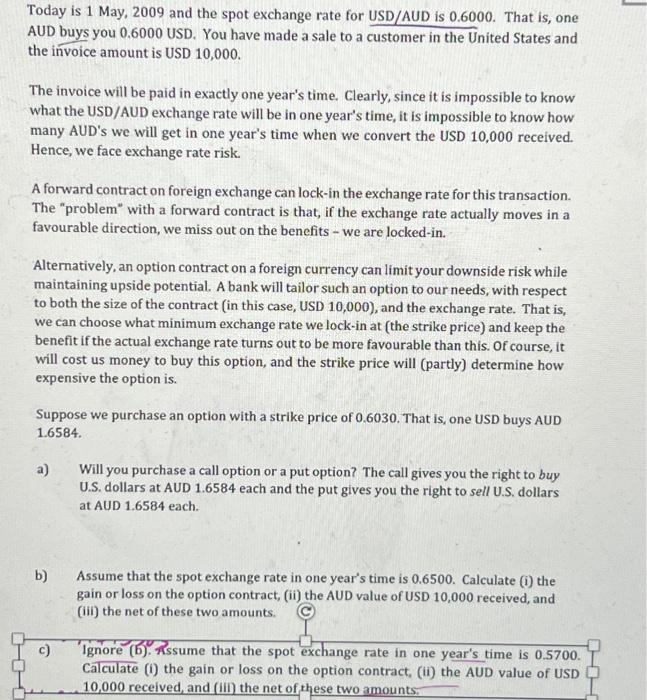

Today is 1 May, 2009 and the spot exchange rate for USD/AUD is 0.6000 . That is, one AUD buys you 0.6000 USD. You have made a sale to a customer in the United States and the invoice amount is USD 10,000 . The invoice will be paid in exactly one year's time. Clearly, since it is impossible to know what the USD/AUD exchange rate will be in one year's time, it is impossible to know how many AUD's we will get in one year's time when we convert the USD 10,000 received. Hence, we face exchange rate risk. A forward contract on foreign exchange can lock-in the exchange rate for this transaction. The "problem" with a forward contract is that, if the exchange rate actually moves in a favourable direction, we miss out on the benefits - we are locked-in. Alternatively, an option contract on a foreign currency can limit your downside risk while maintaining upside potential. A bank will tailor such an option to our needs, with respect to both the size of the contract (in this case, USD 10,000), and the exchange rate. That is, we can choose what minimum exchange rate we lock-in at (the strike price) and keep the benefit if the actual exchange rate turns out to be more favourable than this. of course, it will cost us money to buy this option, and the strike price will (partly) determine how expensive the option is. Suppose we purchase an option with a strike price of 0.6030 . That is, one USD buys AUD 1.6584 a) Will you purchase a call option or a put option? The call gives you the right to buy U.S. dollars at AUD 1.6584 each and the put gives you the right to sell U.S. dollars at AUD 1.6584 each. b) Assume that the spot exchange rate in one year's time is 0.6500 . Calculate (i) the gain or loss on the option contract, (ii) the AUD value of USD 10,000 received, and (iii) the net of these two amounts. c) 'gnore (b). Rssume that the spot exchange rate in one year's time is 0.5700 . Calculate (i) the gain or loss on the option contract, (ii) the AUD value of USD 10,000 received, and (iii) the net of these two amounts