Today is February 15, 2021, and you, CPA, have been hired as a consultant for Mod Threads Apparel Ltd. (MT). MT is a women?s clothing

Today is February 15, 2021, and you, CPA, have been hired as a consultant for Mod Threads Apparel Ltd. (MT). MT is a women?s clothing manufacturer located in Ajax, Ontario, that sells its products to a variety of mid-sized retailers across Canada. It specializes in reproducing the latest runway trends quickly at affordable price points for the fashion-forward consumer who wants to wear trendy clothing without the high prices charged by the luxury designers.

MT has two divisions:

1. Textilemanufacturing:locatedoverseasinBangladesh;producesthematerialused in the production of finished clothing.

2. Clothingmanufacturing:locatedinCanada;producesthefinishedapparelproduct.

MT is a decentralized organization, and the managers of the two divisions have complete autonomy over their departments.

In the meeting, Gertrude states, ?I have been receiving a lot of complaints recently from Kathleen Degenhardt, the clothing division manager. She tells me that the price she is paying for textiles from the textile division is not fair and is negatively impacting her division?s results. Albert Morgan is the manager of the textile division, and I trust him. He tells me that the transfer pricing policy is very fair and that if we change the policy, the company?s performance will suffer. I am unsure what to do here. Can you please analyze the transfer pricing policy used between divisions (Appendix III) and recommend necessary changes? I would like to know the overall financial impact of the change in transfer pricing policy you recommend.?

Gertrude continues on. ?I am at my wits? end! Last year, Albert requested new looming machines to speed up production by decreasing labour requirements. Since providing his team with the machines, I have heard nothing but complaints from Kathleen about the poor-quality material produced by the textile division. MT employs a total quality management (TQM) approach, so these issues should not be happening.?Please take a look at the production processes in place (Appendix III) and provide me with advice on how we can fix the quality issues happening at MT.?

Appendix IIIMod Threads Apparel Ltd.Divisional transfer pricing policies and production processes

Textile manufacturing division (Albert Morgan, manager)

The transfer price to the clothing division is equal to the market price that the clothing division would pay to a third-party supplier. The average transfer price is currently $4.00 per square metre of textile material (market price). Variable cost for the textile material is $1.50 per square metre.

The textile division must supply the clothing division first, and then it can sell any excess to third parties. The textile division currently has excess capacity, and this is expected to continue. Though Kathleen has repeatedly complained about the impact of the transfer price on her division?s results, Gertrude has continued to recommend that Albert and Kathleen work together to negotiate the transfer price between their divisions. Albert is unwilling to consider a change to the transfer price policy. Gertrude is hesitant to intervene, as she doesn?t want to upset Albert. Albert?s bonus is based on the net income of the textile division.

New looming machines were purchased last year to speed up production of textiles, which Albert wanted installed and running as quickly as possible. There have been numerous quality issues with textiles produced on the new machines. The threads are not woven as tightly as they were on the old looming machines, causing the textiles to disintegrate easily.

Staff have complained that the new looming machines break frequently. The training materials are not written in their native language, so staff often attempt to fix the machines as best they can, but this takes them a long time.

Albert is aware of the machine issues and buys his staff lunch when they fix the machines themselves. Albert instructs his staff not to discard textiles that have threads not woven tightly. Though some staff have expressed concern with the quality of the textiles, Albert has assured them it will not affect the finished product.

Clothing manufacturing division (Kathleen Degenhardt, manager)

To meet demand, the clothing division must first purchase textiles for clothing production from the textile division, and then it can purchase from external sources if needed. The clothing division purchased 9 million square metres of textiles from the textile division in 2020 and 10 million square metres in 2019. Purchasing from external sources was not required.

There have been significant delays in receiving material from the textile division. Albert?s division is frequently running behind schedule and blames the new machines for the delays. Kathleen has been pressuring Gertrude to allow her division to purchase textiles from external sources due to the quality issues with the new looming machines.

Kathleen met with Albert last year in an effort to renegotiate the transfer price between divisions. Albert refused to consider a transfer price less than the market price. Kathleen has not discussed this with Albert since this initial discussion. Kathleen?s bonus is based on the net income of the clothing division.

Kathleen has received several calls from unhappy retailers due to poor-quality clothing. MT?s largest retail customer has threatened to cancel its contract with MT unless the quality issues are resolved upon the next shipment. In addition to the angry calls, Kathleen has been busy processing many returns from retailers. MT has a 100% refund policy with its three largest retailers when the products have ?critical quality issues.? The retailers have stated that their customers are returning MT?s clothing to the retailers at unprecedented rates because the clothing is falling apart after being worn only a few times.

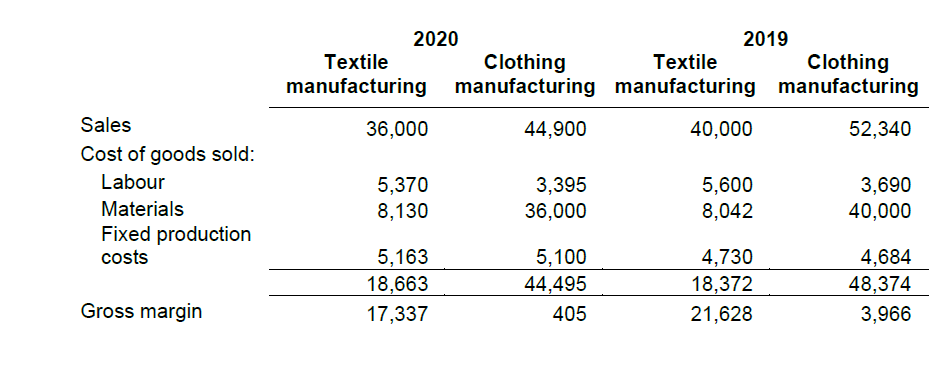

Appendix IVMod Threads Apparel Ltd. Divisional performanceFor the year ended December 31, 2020 (in C$?000s)

Can you please help with the two questions above where it is bolded and in italics? So with the transfer pricing policy and the TQM?

Sales Cost of goods sold: Labour Materials Fixed production costs Gross margin 2020 Textile Clothing Textile Clothing manufacturing manufacturing manufacturing manufacturing 44,900 52,340 36,000 5,370 8,130 5,163 18,663 17,337 3,395 36,000 2019 5,100 44,495 405 40,000 5,600 8,042 4,730 18,372 21,628 3,690 40,000 4,684 48,374 3,966

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

solution Transfer Pricing Policy Analysis The transfer pricing policy used between divisions is based on the market price that the clothing division w...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started