Question

Today is February 25 th 2045. You are an audit manager at Lyn LLP. Lyn LLP has been approached by Lala Electronic Vehicles Ltd (

Today is February 25th 2045. You are an audit manager at Lyn LLP. Lyn LLP has been approached by Lala Electronic Vehicles Ltd ( Lala)to become their auditor. The engagement partner at their previous audit Firm Jerry McGuire (JM) LLP retired left abruptly due to conflicts with the firm and is difficult to reach. After several attempts at communicating with JM LLP as the predecessor auditor, Lyn got an email from JM LLP addressed to whom is may concern / successor auditor stating: "we are unaware of any concerns that would prevent you from taking over the engagement."

Lala is a privately owned vehicle manufacturer based in the Vancouver Area with a year end of Dec 31st. Lala has built and sold diesel SUVs since 1999. In 2025 laws passed by the Canadian government banned the sale of hydrocarbon (gasoline and diesel) powered vehicles by January 1st, 2045. In response, Lala implemented a strategy to redesign its SUV into an electric vehicle and convert its manufacturing facilities) by 2044. Lala met the strategic goals in early 2044. The year 2044 was a transition year in which Lala manufactured and sold both hydrocarbon and Electronic SUVs. In the fourth quarter of that year the company offered a 20% discount on all its remaining diesel SUVs in stock. However even with the discount, as at December 31st Lala still had some unsold diesel SUVs.

Dave Simpson and Buster Douglas, who together own 60% of Lala, are majority owners and control the company. Eleven other shareholders own the remaining 40% of the company's common shares. Dave and Buster are CEO and COO respectively. During your first meeting with Dave you learn the following:

- The finance team is currently led by the accounting manager, Linda Parker. Linda has been with the company for 20 years and risen through the ranks having started as a bookkeeper in 2025. Linda has been the acting CFO since the summer of 2044. Her boss of 7 years Joe Blow CPA resigned as CFO in March, 2044 and the replacement CFO who was hired in April 2044 as a replacement for Joe resigned abruptly in June 2044 following a dispute with Dave in relation to the capitalization of research & development expenses.

- The diesel SUV business had done well over the past few years. However, the legislated transition to EVs put significant financial pressure on the company starting in 2040 and required large investments in new manufacturing equipment for the transition to manufacturing EVs. Lala obtained a bank loan from Guaranty Trust Bank on Mar 18, 2044. As a condition of the loan, the bank required that Lala maintains a current ratio (current assets divided by current liabilities) of at least 1:1, otherwise the loan would become due within 15 days.

- Lala invested over $1,000,000 in new manufacturing equipment in 2044 but given their EV sales haven't picked up significantly their liquidity position deteriorated further. The year 2045 is effectively Lala's first year manufacturing only EV SUVs. Dave and Buster have considered bringing on a strategic partner that has been a dedicated EV manufacturer for much longer. They believe that this potential new investor/partner will help them overcome the liquidity challenges. As well, Lala will be in a much better position to capitalize on what experts predict to be an excellent year for the EV industry because there will not be any competition from new non-EV sales starting in 2045.

- In the November 2044, Tesla expressed an interest to acquire 51% of Lala. Tesla and Lala agree that the valuation of a fair purchase price will be determined based on the net book value of the company (i.e. shareholders' equity).

- Some unique aspects of the EV industry include the discretion EV manufacturers have in revenue recognition. While, every vehicle sold is expected to last 10 years, the battery that comes with the vehicle only has a 5-year life cycle. The purchase contract includes a clause that the customer will purchase and take delivery a second battery within the vehicle's 10 year-life. EV manufacturers have discretion in deciding the timing and amount of the battery's revenue to be recognized over the contract term. Additionally, manufacturers have discretion over the capitalization of expenses related to research and development.

- At the end of the meeting Dave jokes that given their liquidity position, the investment from Tesla is a do or die situation. He also mentions that his daughter Lisa Simpson, is an audit senior at Lyn LLP.

A summary of Lala's financial statements is included below:

Required:

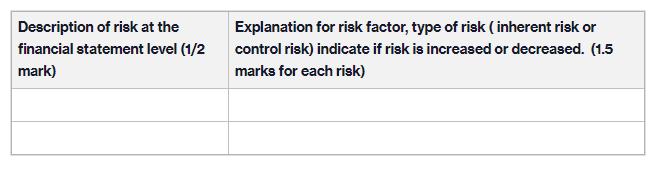

Identify 2 case facts that impact the risk of material misstatement (inherent risks or control risks) at the overall financial statement level (OFSL). For each factor identified, indicate if the factor increases or decreases risk, the type of risk (inherent or control) and provide your rationale for why/how the factor increases or decreases risk.

Description of risk at the financial statement level (1/2 mark) Explanation for risk factor, type of risk ( inherent risk or control risk) indicate if risk is increased or decreased. (1.5 marks for each risk)

Step by Step Solution

3.33 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Management Instability Impact on Risk Increases Inherent Risk at the Overall Financial Statement Lev...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started