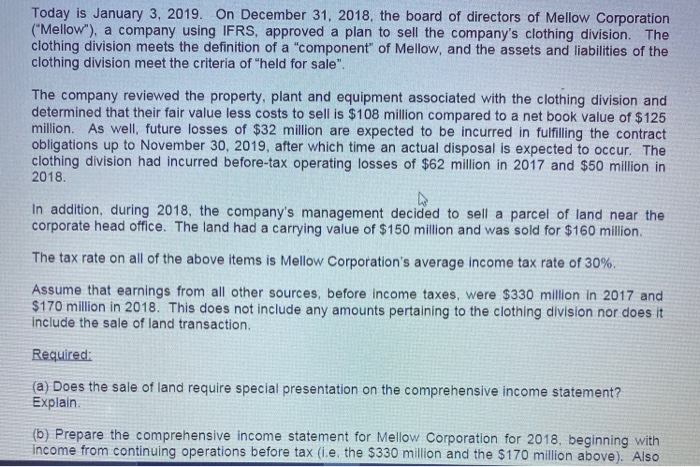

Today is January 3, 2019. On December 31, 2018, the board of directors of Mellow Corporation ("Mellow"), a company using IFRS, approved a plan to sell the company's clothing division. The clothing division meets the definition of a "component" of Mellow, and the assets and liabilities of the clothing division meet the criteria of "held for sale". The company reviewed the property, plant and equipment associated with the clothing division and determined that their fair value less costs to sell is $108 million compared to a net book value of $125 million. As well, future losses of $32 million are expected to be incurred in fulfilling the contract obligations up to November 30, 2019, after which time an actual disposal is expected to occur. The clothing division had incurred before-tax operating losses of $62 million in 2017 and $50 million in 2018. In addition, during 2018, the company's management decided to sell a parcel of land near the corporate head office. The land had a carrying value of $150 million and was sold for $160 million The tax rate on all of the above items is Mellow Corporation's average income tax rate of 30%. Assume that earnings from all other sources, before income taxes, were $330 million in 2017 and $170 million in 2018. This does not include any amounts pertaining to the clothing division nor does it include the sale of land transaction Required: (a) Does the sale of land require special presentation on the comprehensive income statement? Explain (b) Prepare the comprehensive income statement for Mellow Corporation for 2018, beginning with income from continuing operations before tax (.e. the $330 million and the $170 million above). Also Today is January 3, 2019. On December 31, 2018, the board of directors of Mellow Corporation ("Mellow"), a company using IFRS, approved a plan to sell the company's clothing division. The clothing division meets the definition of a "component" of Mellow, and the assets and liabilities of the clothing division meet the criteria of "held for sale". The company reviewed the property, plant and equipment associated with the clothing division and determined that their fair value less costs to sell is $108 million compared to a net book value of $125 million. As well, future losses of $32 million are expected to be incurred in fulfilling the contract obligations up to November 30, 2019, after which time an actual disposal is expected to occur. The clothing division had incurred before-tax operating losses of $62 million in 2017 and $50 million in 2018. In addition, during 2018, the company's management decided to sell a parcel of land near the corporate head office. The land had a carrying value of $150 million and was sold for $160 million The tax rate on all of the above items is Mellow Corporation's average income tax rate of 30%. Assume that earnings from all other sources, before income taxes, were $330 million in 2017 and $170 million in 2018. This does not include any amounts pertaining to the clothing division nor does it include the sale of land transaction Required: (a) Does the sale of land require special presentation on the comprehensive income statement? Explain (b) Prepare the comprehensive income statement for Mellow Corporation for 2018, beginning with income from continuing operations before tax (.e. the $330 million and the $170 million above). Also