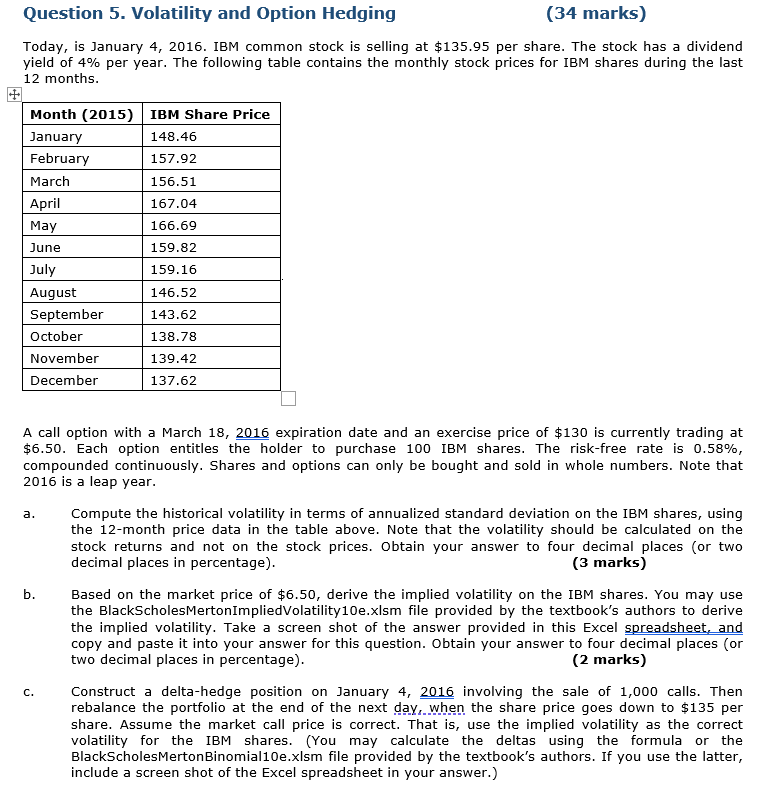

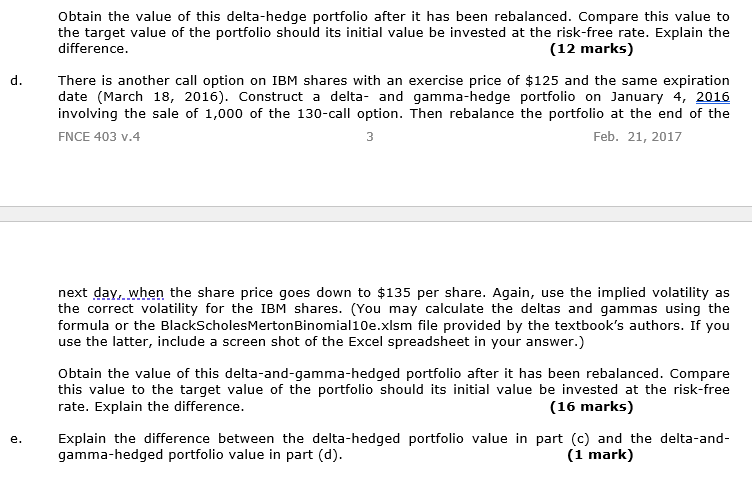

Today, is January 4, 2016. IBM common stock is selling at $135.95 per share. The stock has a dividend yield of 4% per year. The following table contains the monthly stock prices for IBM shares during the last 12 months. A call option with a March 18, 2016 expiration date and an exercise price of $130 is currently trading at $6.50. Each option entitles the holder to purchase 100 IBM shares. The risk-free rate is 0.58%, compounded continuously. Shares and options can only be bought and sold in whole numbers. Note that 2016 is a leap year. a. Compute the historical volatility in terms of annualized standard deviation on the IBM shares, using the 12-month price data in the table above. Note that the volatility should be calculated on the stock returns and not on the stock prices. Obtain your answer to four decimal places (or two decimal places in percentage). (3 marks) b. Based on the market price of $6.50, derive the implied volatility on the IBM shares. You may use the BlackScholesMertonImpliedVolatility10e.xlsm file provided by the textbook's authors to derive the implied volatility. Take a screen shot of the answer provided in this Excel spreadsheet, and copy and paste it into your answer for this question. Obtain your answer to four decimal places (or two decimal places in percentage). (2 marks) c. Construct a delta-hedge position on January 4, 2016 involving the sale of 1,000 calls. Then rebalance the portfolio at the end of the next day yswhen the share price goes down to $135 per share. Assume the market call price is correct. That is, use the implied volatility as the correct volatility for the IBM shares. (You may calculate the deltas using the formula or the BlackScholesMertonBinomial10e.xlsm file provided by the textbook's authors. If you use the latter, include a screen shot of the Excel spreadsheet in your answer.) Obtain the value of this delta-hedge portfolio after it has been rebalanced. Compare this value to the target value of the portfolio should its initial value be invested at the risk-free rate. Explain the difference. (12 marks) There is another call option on IBM shares with an exercise price of $125 and the same expiration date (March 18, 2016). Construct a delta- and gamma-hedge portfolio on January 4, 2016 involving the sale of 1,000 of the 130 -call option. Then rebalance the portfolio at the end of the FNCE 403 V.4 Feb. 21,2017 next day ys when the share price goes down to $135 per share. Again, use the implied volatility as the correct volatility for the IBM shares. (You may calculate the deltas and gammas using the formula or the BlackScholesMertonBinomial10e.xlsm file provided by the textbook's authors. If you use the latter, include a screen shot of the Excel spreadsheet in your answer.) Obtain the value of this delta-and-gamma-hedged portfolio after it has been rebalanced. Compare this value to the target value of the portfolio should its initial value be invested at the risk-free rate. Explain the difference. (16 marks) Explain the difference between the delta-hedged portfolio value in part (c) and the delta-andgamma-hedged portfolio value in part (d). (1 mark) Today, is January 4, 2016. IBM common stock is selling at $135.95 per share. The stock has a dividend yield of 4% per year. The following table contains the monthly stock prices for IBM shares during the last 12 months. A call option with a March 18, 2016 expiration date and an exercise price of $130 is currently trading at $6.50. Each option entitles the holder to purchase 100 IBM shares. The risk-free rate is 0.58%, compounded continuously. Shares and options can only be bought and sold in whole numbers. Note that 2016 is a leap year. a. Compute the historical volatility in terms of annualized standard deviation on the IBM shares, using the 12-month price data in the table above. Note that the volatility should be calculated on the stock returns and not on the stock prices. Obtain your answer to four decimal places (or two decimal places in percentage). (3 marks) b. Based on the market price of $6.50, derive the implied volatility on the IBM shares. You may use the BlackScholesMertonImpliedVolatility10e.xlsm file provided by the textbook's authors to derive the implied volatility. Take a screen shot of the answer provided in this Excel spreadsheet, and copy and paste it into your answer for this question. Obtain your answer to four decimal places (or two decimal places in percentage). (2 marks) c. Construct a delta-hedge position on January 4, 2016 involving the sale of 1,000 calls. Then rebalance the portfolio at the end of the next day yswhen the share price goes down to $135 per share. Assume the market call price is correct. That is, use the implied volatility as the correct volatility for the IBM shares. (You may calculate the deltas using the formula or the BlackScholesMertonBinomial10e.xlsm file provided by the textbook's authors. If you use the latter, include a screen shot of the Excel spreadsheet in your answer.) Obtain the value of this delta-hedge portfolio after it has been rebalanced. Compare this value to the target value of the portfolio should its initial value be invested at the risk-free rate. Explain the difference. (12 marks) There is another call option on IBM shares with an exercise price of $125 and the same expiration date (March 18, 2016). Construct a delta- and gamma-hedge portfolio on January 4, 2016 involving the sale of 1,000 of the 130 -call option. Then rebalance the portfolio at the end of the FNCE 403 V.4 Feb. 21,2017 next day ys when the share price goes down to $135 per share. Again, use the implied volatility as the correct volatility for the IBM shares. (You may calculate the deltas and gammas using the formula or the BlackScholesMertonBinomial10e.xlsm file provided by the textbook's authors. If you use the latter, include a screen shot of the Excel spreadsheet in your answer.) Obtain the value of this delta-and-gamma-hedged portfolio after it has been rebalanced. Compare this value to the target value of the portfolio should its initial value be invested at the risk-free rate. Explain the difference. (16 marks) Explain the difference between the delta-hedged portfolio value in part (c) and the delta-andgamma-hedged portfolio value in part (d). (1 mark)