Question

Today is June 28, 2010. Baffinland Iron Mines Corporation (BIM) is an early-stage mining company listed on the Toronto Stock Exchange (TSX) under the symbol

Today is June 28, 2010. Baffinland Iron Mines Corporation (BIM) is an early-stage mining company listed on

the Toronto Stock Exchange (TSX) under the symbol BIM.

You are a partner at Glengarry Ventures (GV) that invests in early-stage natural resource companies. GV

typically invests in companies that have not yet finished building out their properties but have published a

resource estimate compliant with the National Instrument 43-101. For early stage natural resource companies

listed on the TSX, GV participates in their ongoing capital raises, including private placements.

A fellow investor at another resource investment firm has brought BIM to your attention. BIM is raising a

private placement that closes on June 30, 2010, at 5pm. While BIM appears to meet your investment criteria,

you are concerned about the future of the iron ore market, the valuation of the company, the timing of the

investment, and other pertinent issues.

The following questions are related to BIM and are based on this document and the following documents

available on the course website:

1. Mining & Steel Primer - UBS

2. Baffinland - Definitive Feasibility Study (DFS)

3. Baffinland - FS - 2010 Q3

4. Baffinland - AIF - 2009

In these documents, assume CAD = USD. That is, replace CAD wherever it is used in DFS with USD, or

simply assume a generic dollar for all amounts.

The analysis should clearly answer the required questions. If a recommendation is required, the solution submission should make an unambiguous recommendation. If a valuation is required, the submission should come up with a clear valuation figure. Answer each required question in a separate section. Use for longer tables, complicated calculations, larger charts, etc. Maximum length of 10 single-spaced, standard-font, letter-sized pages (plus the Title Page and Appendix)

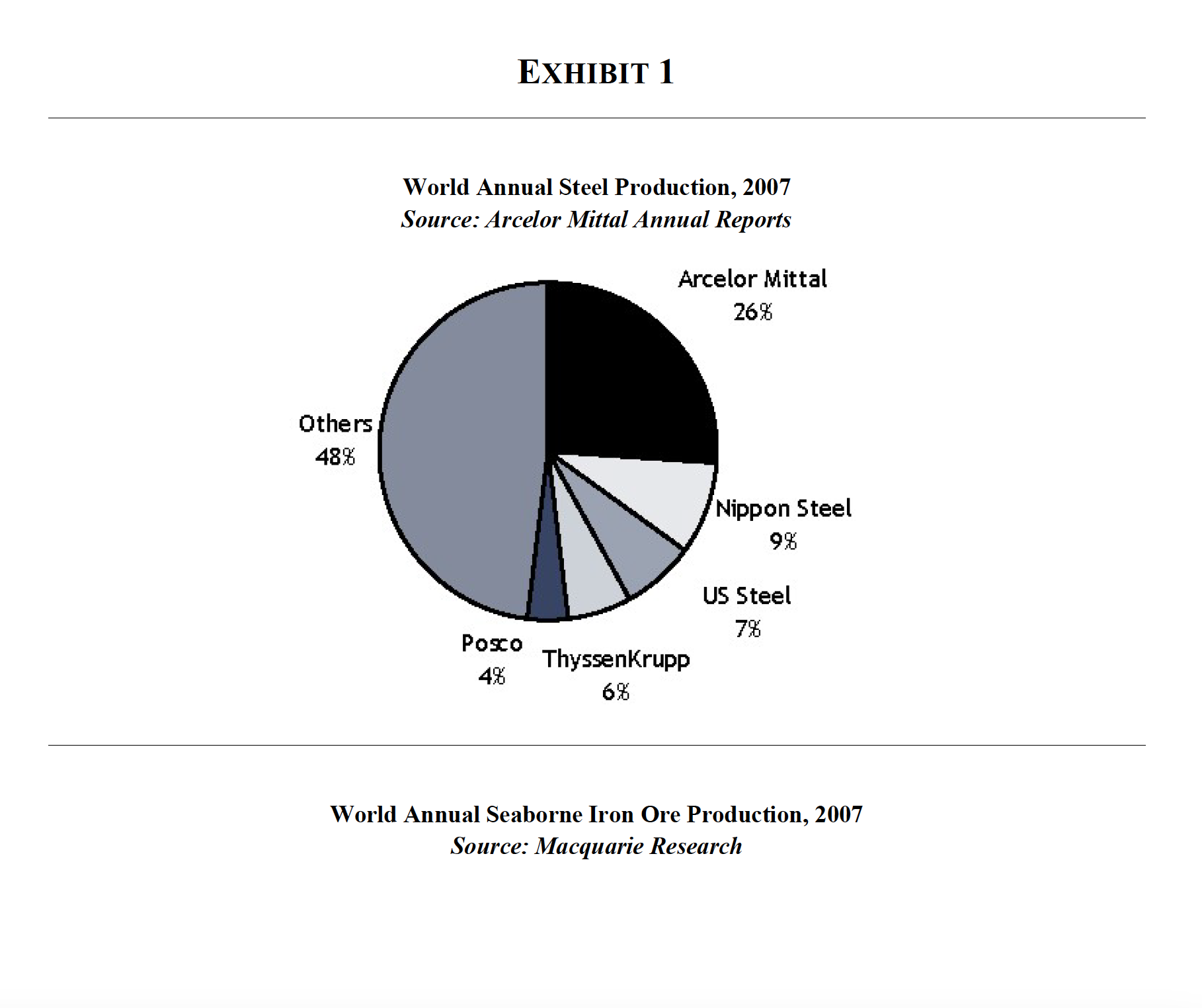

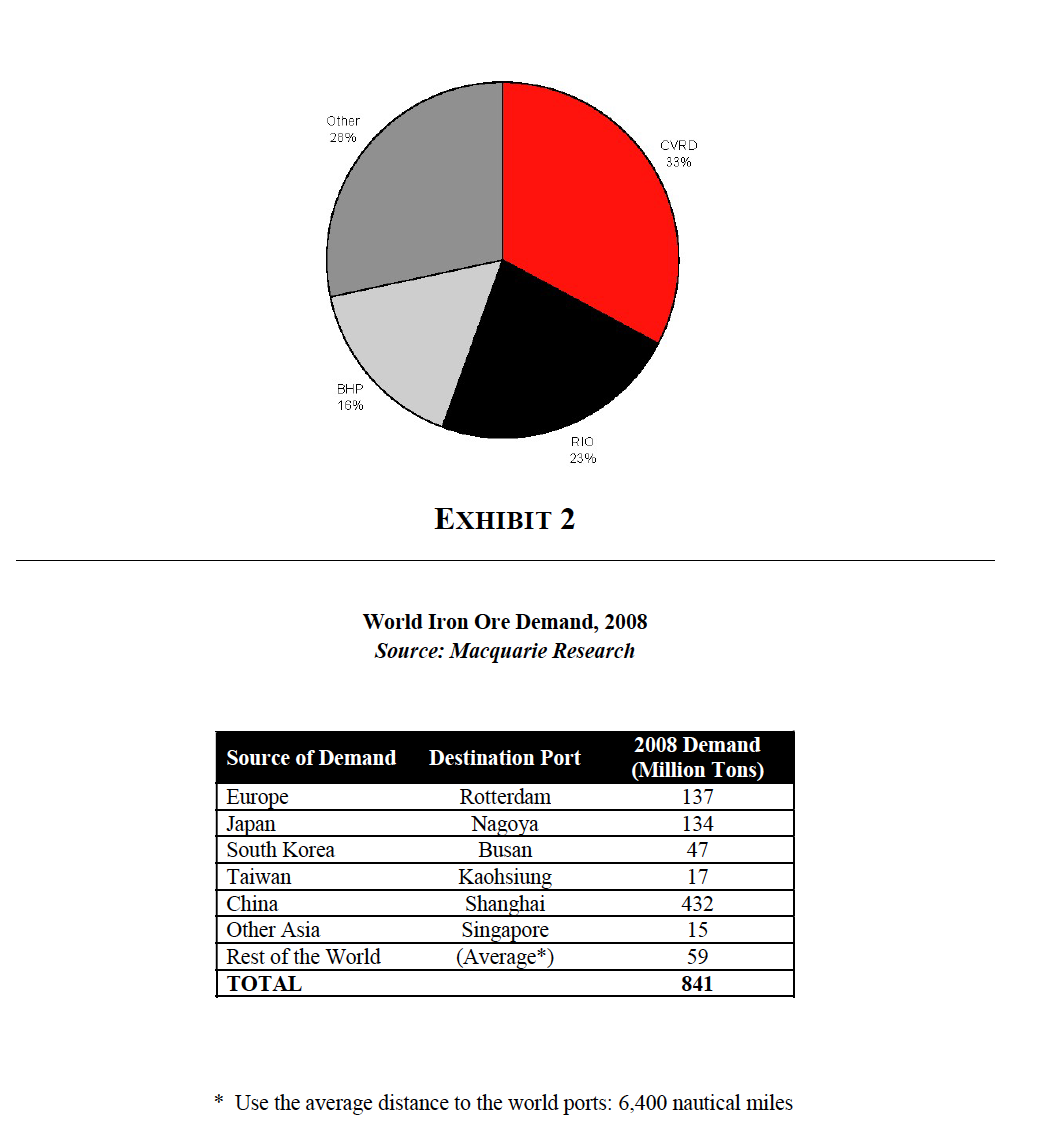

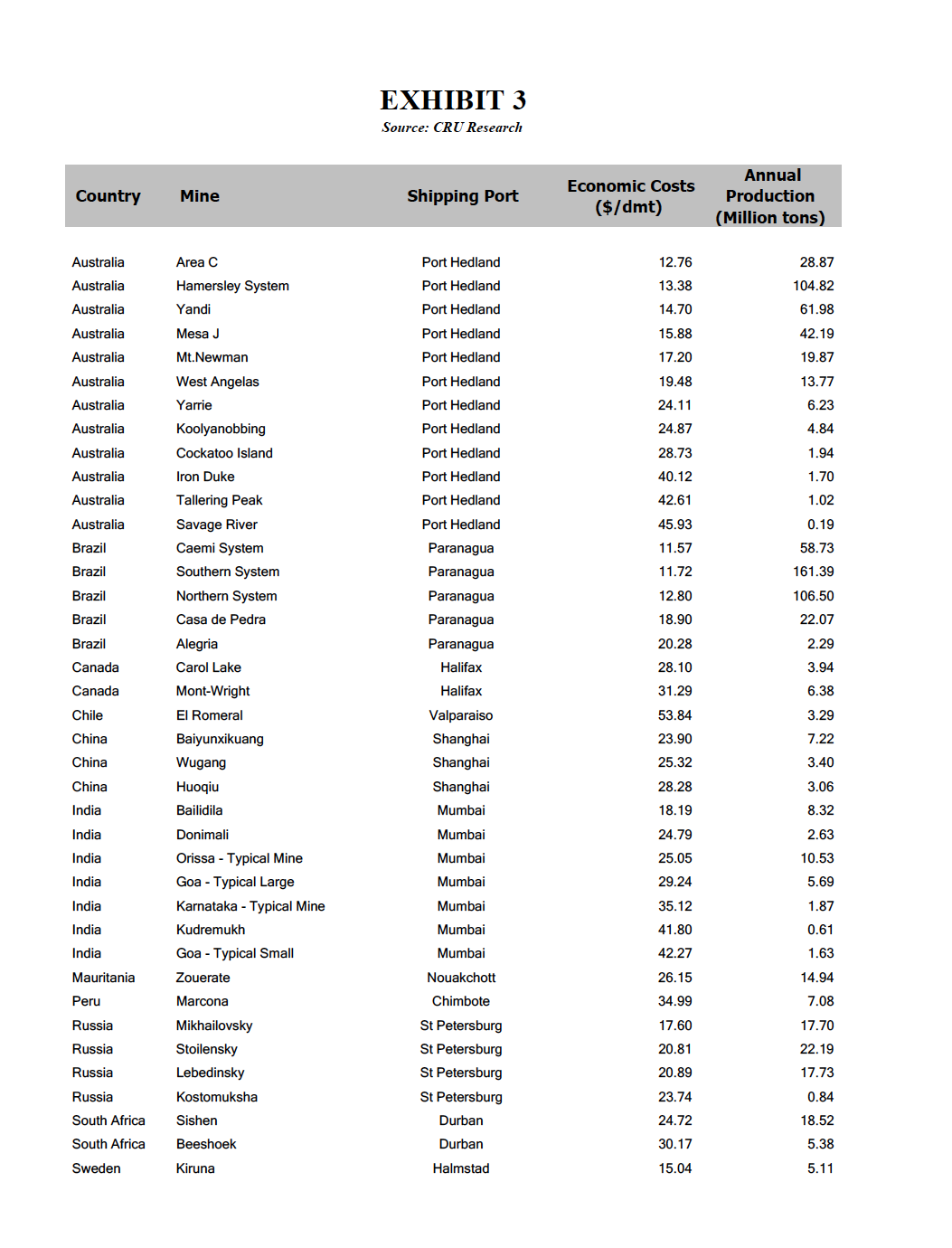

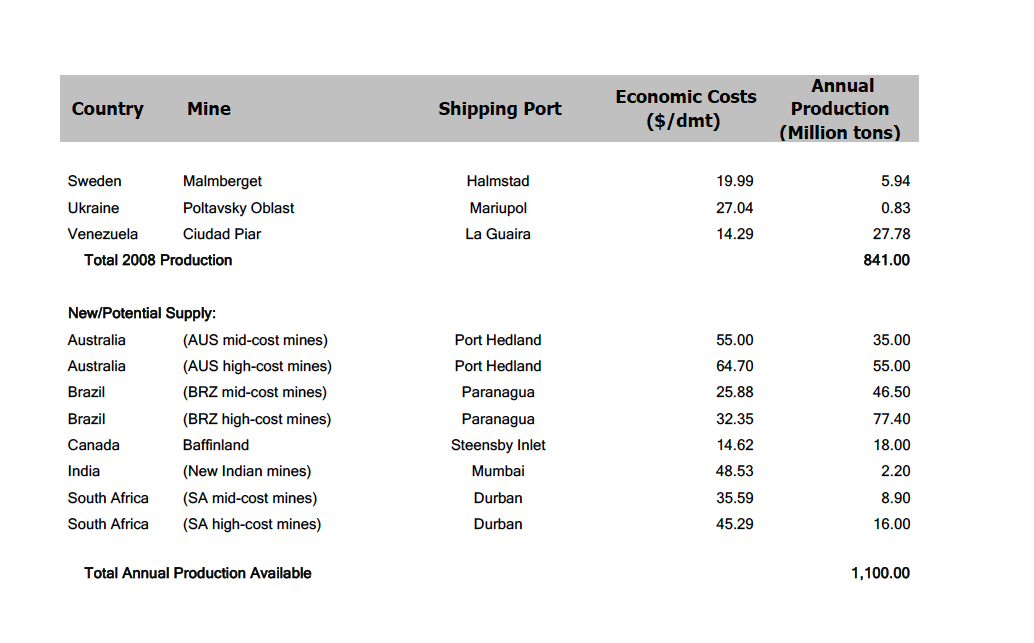

IRON ORE MARKET Consider the seaborne-only (SB) iron ore trade market - that is, exclude the in-land, captive mines. Assume the following information is provided to you: ? The global demand of SB iron ore in 2008 is outlined in Exhibit 2. The million tons have an average 64.7% Fe grade (i.e. same as BIM) and are split into 25% lumps and 75% fines (i.e. exact opposite of BIM's mix). ? The demand and supply data provided is for the seaborne iron ore trade. Seaborne iron ore production is a part of the overall iron ore production. Many users, such as Arcelor Mittal, source some of their iron ore from own, captive mines. Such captive mines do not directly contribute to the discovery of the seaborne market price. ? The demand in Europe, Japan, South Korea, Taiwan, Other Asia, and the Rest of the World (i.e. everywhere but China) is expected to remain flat for the foreseeable future. ? The demand in China is expected to stay flat in 2009 but then, starting in 2010, grow at its own annual real GDP growth rates until 2014. After 2014 and for the foreseeable future, the annual demand will stay flat at 691 million tons. The IMF's estimates of China's real GDP growth rates until 2014 can be found by running a database query at the following webpage: https://www.imf.org/en/Publications/SPROLLs/world-economic-outlook-databases ? The global supply of SB iron ore in 2008 is detailed in Exhibit 3. The exhibit uses the same assumptions as on the demand side in Exhibit 2. ? The increase in supply is indicated in the potential new mines that can come to market in Australia, Brazil, South Africa, Canada, and India, under the same assumptions and with profitable long-term economics. ? The economic costs are the operating and transportation costs of each mine up to the shipping point. That is, they do not include ocean shipping. The terms are FOB shipping; thus, the buyer pays the transportation costs from the shipping port to its own destination. Each demand market and supply source has been assigned a destination and shipping port respectively. ? To calculate the buyer's ocean shipping cost per ton (with 64.7% Fe content), assume $10 per ton of fixed cost, plus a per-nautical-mile charge per ton based on the distance between the shipping and destination ports. The distances between two ports can be calculated by running a database query at the following webpage: http://www.sea-distances.com/ ? Use BIM's ocean shipping cost estimate to determine the per-nautical-mile charge per ton. The distance between Steensby Inlet (BIM's shipping port) and Rotterdam (BIM's intended market) is 3,100 nautical miles. ? The distance between Steensby Inlet and Shanghai is not provided to you. It may help to include Baffinland on the list of potential suppliers to China (in case Chinese demand turns out to be very high). The distance to use between Steensby Inlet and Shanghai is 12,190 nautical miles.

? Use the FOB shipping price that BIM will receive at Steensby Inlet (i.e. excluding the reimbursement of the freight costs). ? Iron ore lumps sell at a 20% premium to fines. (Ignore any pellets or other product forms.) The premium is calculated FOB shipping (that is, before ocean shipping costs). For a 25% lumps/75% fines mix, there is no premium adjustment necessary, as the economic costs already reflect this mix. For BIM, you will need to make an adjustment after calculating the long-term market price to revise it to the price it should receive for its mix. ? The relationship between shipping and destination prices is simple: FOB destination price = FOB shipping price + shipping costs. The price that should be adjusted for mix is the FOB shipping price. Shipping cost is the same for all mixes. ? Tons referenced in the case study are dry metric tons (dmt), i.e. metric tons adjusted for moisture content. For general knowledge, due to the Imperial system, bulk weight is measured in short tons (vs metric tons) in the US. One short ton equals 0.9 metric tons approximately. This information is not used in the case. 1. [20 marks] Is Europe (Rotterdam) an attractive market for BIM's iron ore? Will there be demand for BIM's product that BIM can sell with a positive contribution margin? Include your supporting analysis. 2. [10 marks] What should be the minimum long-term FOB destination price at Shanghai in 2015? 3. [10 marks] What should be the minimum long-term FOB destination price at Rotterdam in 2015? 4. [10 marks] Accounting for the mix change, calculate the minimum long-term FOB shipping and destination prices at Steensby Inlet and Rotterdam respectively that BIM should receive in 2015.

1. [20 marks] Is Europe (Rotterdam) an attractive market for BIM's iron ore? Will there be demand

for BIM's product that BIM can sell with a positive contribution margin? Include your supporting

analysis.

2. [10 marks] What should be the minimum long-term FOB destination price at Shanghai in 2015?

3. [10 marks] What should be the minimum long-term FOB destination price at Rotterdam in 2015?

4. [10 marks] Accounting for the mix change, calculate the minimum long-term FOB shipping and

destination prices at Steensby Inlet and Rotterdam respectively that BIM should receive in 2015.

BAFFINLAND IRON MINE 5. [20 marks] Compute the unlevered project IRR of Baffinland Iron Mine as of June 30, 2010. Refer to DFS, available on the course website. Assume all cash flows take place mid-year on June 30. Construct only an annual cash flow model (i.e. no quarterly or monthly details). Although DFS already provides project NPV and IRR, they are based on different assumptions. You will use the following assumptions (some unchanged and others revised) to re-compute the IRR: ? Use the Life of Mine Production Schedule (DFS Table 25-1) to determine annual production. Ignore the 1.6 million tons produced prior to the start of operations (the PM line). Year 1 in DFS Table 25-1 should correspond with 2014. ? Add a 40% premium to the long-term FOB destination price calculated in 4 above to calculate your sales price. The premium reflects the tightness of the global iron ore market and the effects of the resulting supplier power that the iron ore producers will possess. Assume the price will remain unchanged for the life of the mine. ? Use a Nunavut royalty rate of 2% payable on gross sales. ? Use the Operating Cost Summary (DFS Table 25-7) for annual operating expenses. Assume the per-ton figure remains unchanged for the life of the mine. You will include or exclude ocean shipping depending upon what sales price you are using. ? Use the Capital Cost Summary (DFS Table 25-6) and Additional Works Budget (DFS Table 3-3) to determine the total capital expenditures (capex). Exclude, however, the Total Contingency included in DFS Table 25-6. Note that you will include only the 2010 amount from DFS Table 3-3; this amount will be paid shortly after June 30, 2010. ? Assume the capital costs (excluding Additional Works) will be incurred in equal payments over the following three years (2011, 2012, and 2013). That is, the buildout (incl. commissioning) will take 3 years. All capital expenditures will be capitalized and amortized over the life of the mine once the production has started. ? Taxes are impacted by depreciation and amortization as well as interest expense. Use the federal and Nunavut tax rates included in DFS Section 25.9 (that is, the combined federal and Nunavut income tax rate of 27%). The Nunavut Royalties and Mining Tax is the same as the Nunavut royalty rate of 2% used in the case.

6. [20 marks] Compute the levered project IRR of Baffinland Iron Mine on June 30, 2010. For this question, you are given additional information: ? Each year's capital expenditures (2010, 2011, 2012, and 2013) will be funded 75% with debt and 25% with equity. Therefore, a loan worth 75% of the mid-year capital expenditure payment will fund that year's payment. ? The interest rate applicable on the debt is subsidized by the Government of Canada and will remain fixed at 2% for the life of the mine. ? All interest accrued during the buildout phase will be added to the debt balance outstanding. Once operational, i.e. starting 2014, the debt and the interest will be repaid in 15 equal annual installments which will end in 2028. ? Assume that the interest accrued before production will be treated as capitalized cost for tax purposes. This capitalized interest will be amortized in the same manner as capital expenditures referenced in 6 above. ? Each annual repayment will, however, include an interest component and a principal component. The interest component will be deductible against income for tax purposes.

Others 48% EXHIBIT 1 World Annual Steel Production, 2007 Source: Arcelor Mittal Annual Reports Arcelor Mittal 26% Nippon Steel 9% US Steel 7% Posco ThyssenKrupp 4% 6% World Annual Seaborne Iron Ore Production, 2007 Source: Macquarie Research

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started