Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today is March. You own Splendid Tubes, a copper tubing manufacturing company, in Seattle. You plan to purchase 2,500,000 pounds of copper in May and

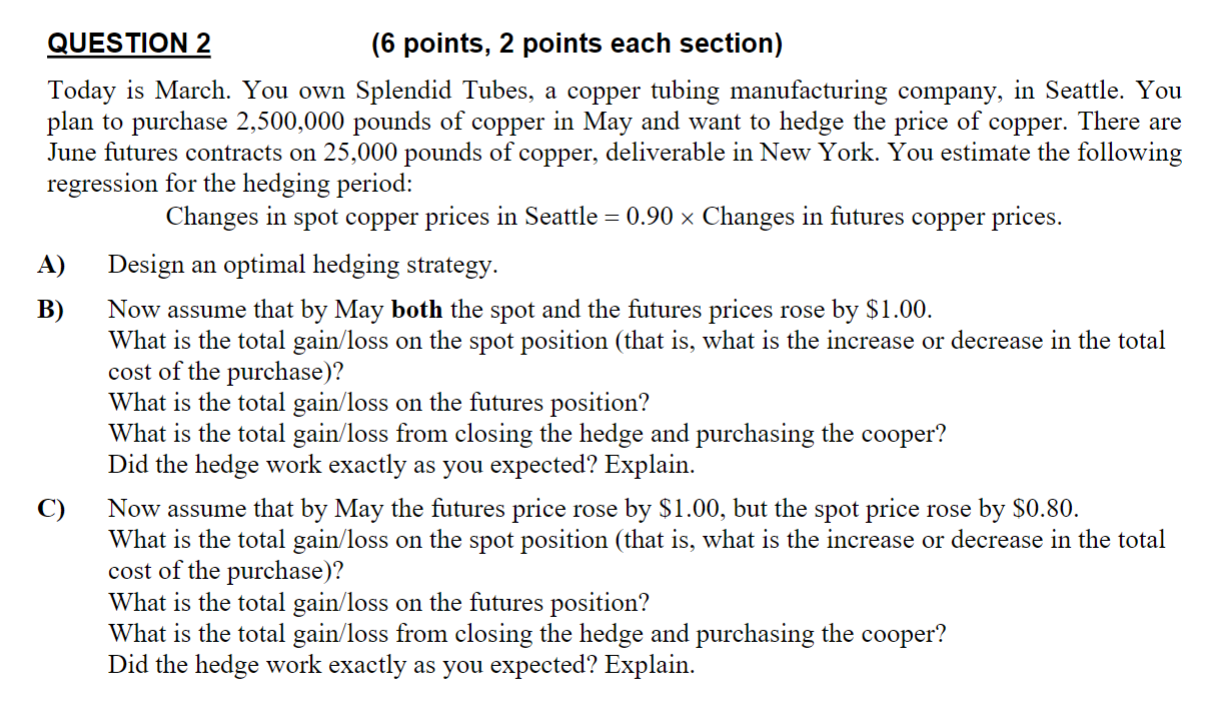

Today is March. You own Splendid Tubes, a copper tubing manufacturing company, in Seattle. You plan to purchase 2,500,000 pounds of copper in May and want to hedge the price of copper. There are June futures contracts on 25,000 pounds of copper, deliverable in New York. You estimate the following regression for the hedging period: Changes in spot copper prices in Seattle =0.90 Changes in futures copper prices. A) Design an optimal hedging strategy. B) Now assume that by May both the spot and the futures prices rose by $1.00. What is the total gain/loss on the spot position (that is, what is the increase or decrease in the total cost of the purchase)? What is the total gain/loss on the futures position? What is the total gain/loss from closing the hedge and purchasing the cooper? Did the hedge work exactly as you expected? Explain. C) Now assume that by May the futures price rose by $1.00, but the spot price rose by $0.80. What is the total gain/loss on the spot position (that is, what is the increase or decrease in the total cost of the purchase)? What is the total gain/loss on the futures position? What is the total gain/loss from closing the hedge and purchasing the cooper? Did the hedge work exactly as you expected? Explain

Today is March. You own Splendid Tubes, a copper tubing manufacturing company, in Seattle. You plan to purchase 2,500,000 pounds of copper in May and want to hedge the price of copper. There are June futures contracts on 25,000 pounds of copper, deliverable in New York. You estimate the following regression for the hedging period: Changes in spot copper prices in Seattle =0.90 Changes in futures copper prices. A) Design an optimal hedging strategy. B) Now assume that by May both the spot and the futures prices rose by $1.00. What is the total gain/loss on the spot position (that is, what is the increase or decrease in the total cost of the purchase)? What is the total gain/loss on the futures position? What is the total gain/loss from closing the hedge and purchasing the cooper? Did the hedge work exactly as you expected? Explain. C) Now assume that by May the futures price rose by $1.00, but the spot price rose by $0.80. What is the total gain/loss on the spot position (that is, what is the increase or decrease in the total cost of the purchase)? What is the total gain/loss on the futures position? What is the total gain/loss from closing the hedge and purchasing the cooper? Did the hedge work exactly as you expected? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started