Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Hungry Bunny Company provide two services to its customers, Dine-in and Drive Thru. The company is considering dropping its Drive Thru service. Dropping

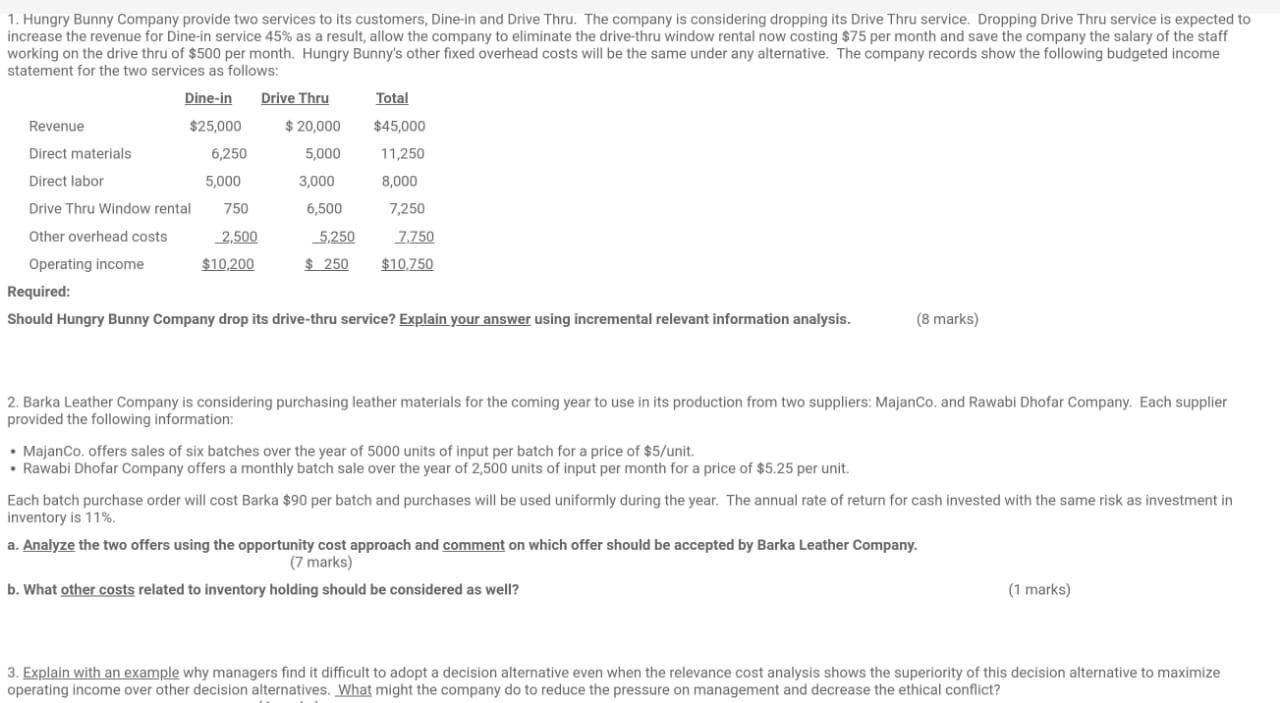

1. Hungry Bunny Company provide two services to its customers, Dine-in and Drive Thru. The company is considering dropping its Drive Thru service. Dropping Drive Thru service is expected to increase the revenue for Dine-in service 45% as a result, allow the company to eliminate the drive-thru window rental now costing $75 per month and save the company the salary of the staff working on the drive thru of $500 per month. Hungry Bunny's other fixed overhead costs will be the same under any alternative. The company records show the following budgeted income statement for the two services as follows: Dine-in Drive Thru $25,000 $ 20,000 5,000 Revenue Direct materials Direct labor Drive Thru Window rental Other overhead costs Operating income 6,250 5,000 750 2,500 $10,200 3,000 6,500 5.250 $250 Total $45,000 11,250 8,000 7,250 7.750 $10,750 Required: Should Hungry Bunny Company drop its drive-thru service? Explain your answer using incremental relevant information analysis. (8 marks) 2. Barka Leather Company is considering purchasing leather materials for the coming year to use in its production from two suppliers: MajanCo. and Rawabi Dhofar Company. Each supplier provided the following information: MajanCo. offers sales of six batches over the year of 5000 units of input per batch for a price of $5/unit. Rawabi Dhofar Company offers a monthly batch sale over the year of 2,500 units of input per month for a price of $5.25 per unit. Each batch purchase order will cost Barka $90 per batch and purchases will be used uniformly during the year. The annual rate of return for cash invested with the same risk as investment in inventory is 11%. a. Analyze the two offers using the opportunity cost approach and comment on which offer should be accepted by Barka Leather Company. (7 marks) b. What other costs related to inventory holding should be considered as well? (1 marks) 3. Explain with an example why managers find it difficult to adopt a decision alternative even when the relevance cost analysis shows the superiority of this decision alternative to maximize operating income over other decision alternatives. What might the company do to reduce the pressure on management and decrease the ethical conflict?

Step by Step Solution

★★★★★

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Dinein Drive Thru Total Revenue 30750 20000 50750 Direct materials 76875 5000 126875 Direct labor 50...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started