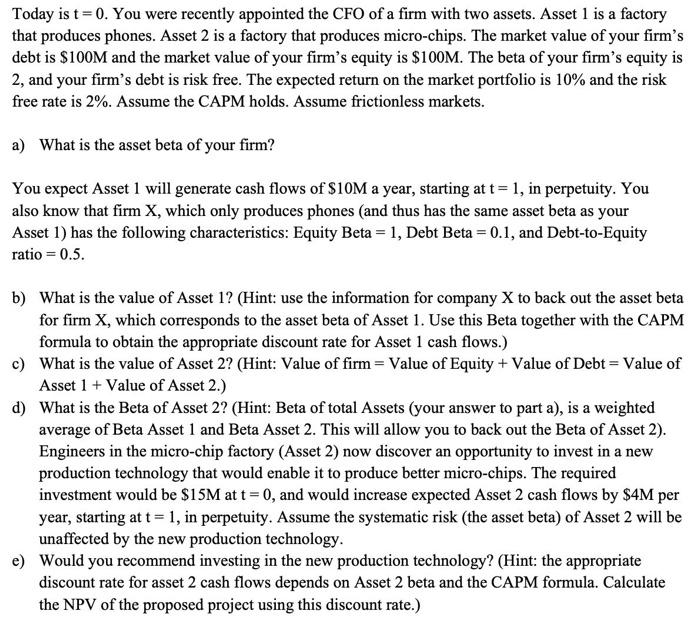

Today is t = 0. You were recently appointed the CFO of a firm with two assets. Asset 1 is a factory that produces phones. Asset 2 is a factory that produces micro-chips. The market value of your firm's debt is $100M and the market value of your firm's equity is $100M. The beta of your firm's equity is 2, and your firm's debt is risk free. The expected return on the market portfolio is 10% and the risk free rate is 2%. Assume the CAPM holds. Assume frictionless markets. a) What is the asset beta of your firm? You expect Asset 1 will generate cash flows of $10M a year, starting at t = 1, in perpetuity. You also know that firm X, which only produces phones (and thus has the same asset beta as your Asset 1) has the following characteristics: Equity Beta = 1, Debt Beta = 0.1, and Debt-to-Equity ratio = 0.5. b) What is the value of Asset 1? (Hint: use the information for company X to back out the asset beta for firm X, which corresponds to the asset beta of Asset 1. Use this Beta together with the CAPM formula to obtain the appropriate discount rate for Asset 1 cash flows.) c) What is the value of Asset 2? (Hint: Value of firm = Value of Equity + Value of Debt = Value of Asset 1 + Value of Asset 2.) d) What is the Beta of Asset 2? (Hint: Beta of total Assets (your answer to part a), is a weighted average of Beta Asset 1 and Beta Asset 2. This will allow you to back out the Beta of Asset 2). Engineers in the micro-chip factory (Asset 2) now discover an opportunity to invest in a new production technology that would enable it to produce better micro-chips. The required investment would be $15M at t = 0, and would increase expected Asset 2 cash flows by $4M per year, starting at t = 1, in perpetuity. Assume the systematic risk (the asset beta) of Asset 2 will be unaffected by the new production technology. e) Would you recommend investing in the new production technology? (Hint: the appropriate discount rate for asset 2 cash flows depends on Asset 2 beta and the CAPM formula. Calculate the NPV of the proposed project using this discount rate.)