Answered step by step

Verified Expert Solution

Question

1 Approved Answer

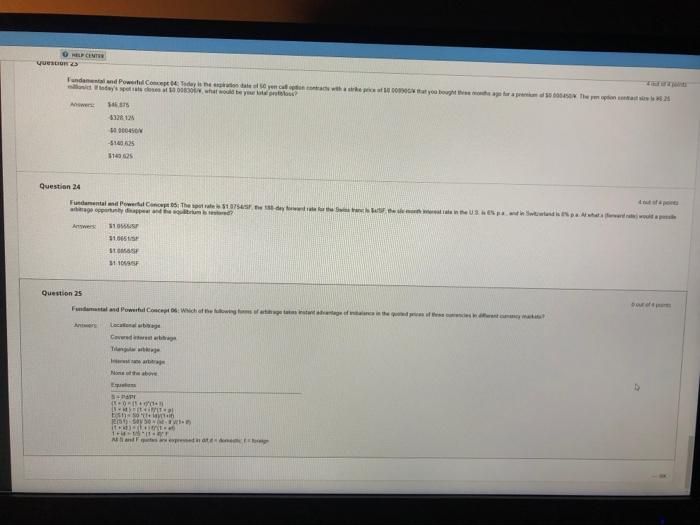

Today is the expiration date of 50 yen call option contracts with a strike price of $0.008900/* that you bought three months ago for a

Today is the expiration date of 50 yen call option contracts with a strike price of $0.008900/* that you bought three months ago for a premium of $0.000450/. The yen option contract size is $6.25

million/ct. If today's spot rate closes at $0.008300/* what would be your total profit/loss

$46,875

-$328 125

-$0.000450/V

-$140,625

$140 625

The spot rate is $1.0754/S, the 180-day forward rate for the Swiss franc is &x/SF, the six-month interest rate in the U.S. is 6% p.a, and in Switzerland is 8% p.a. At what x (forward rate) would a possible

arbitrage opportunity disappear and the equilibrium is restored?

$1.0555/SF

1.0651/SF

$1.0858/SF

$1.1059/SF

Which of the following forms of arbitrage takes instant advantage of imbalance in the quoted prices of three currencies in different currency markets?

Locational arbitrage.

Covered interest arbitrage

Triangular arbitrage

Interest rate arbitrage.

None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started