Question

Today is your aunt's 40th birthday. She expects to retire at age 65 and actuarial tables suggests that your aunt will live to be 100.

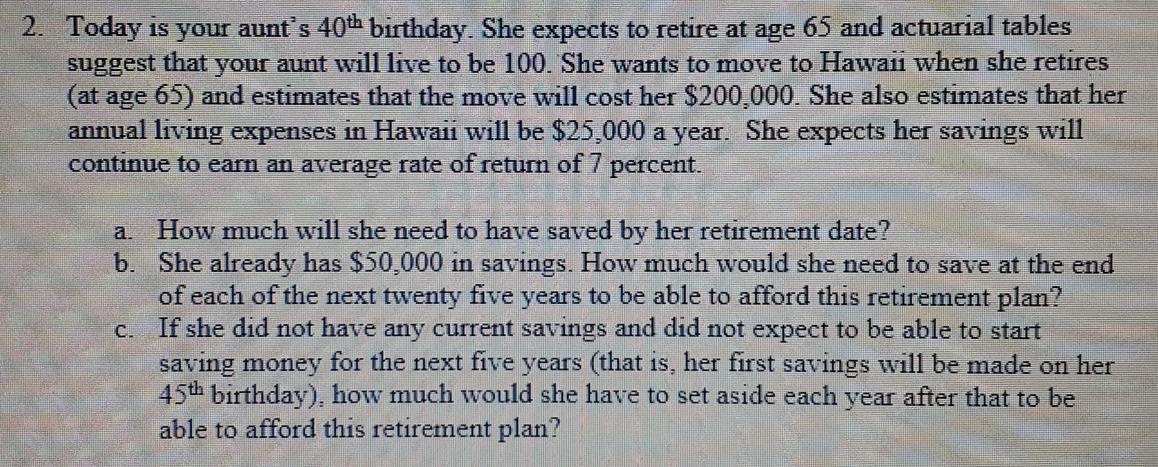

Today is your aunt's 40th birthday. She expects to retire at age 65 and actuarial tables suggests that your aunt will live to be 100. She wants to move to Hawaii when she retires (at age 65) and that the move will cost her $200,000. She also estimates that her annual living expenses in Hawaii will be $25,000 a year. She expects her savings will continue to earn an average rate of return of 7 percent.

A. How much will she need to have saved by her retirement date? B. She already has $50,000 in savings. How much would she need to save at the end of each of the next twenty five years to be able to afford this retirement plan? C. If she did not have any current savings and did not expect to be able to start saving money for the next five years (that is, her first savings will be made on her 45th birthday), how much would she have to set aside each year after that to be able to afford this retirement plan?

if this could be done in excel, that would be greatly appreciated

If this could be done in excel, that would be most appreciated

2. Today is your aunt's 40th birthday. She expects to retire at age 65 and actuarial tables suggest that your aunt will live to be 100. She wants to move to Hawaii when she retires (at age 65) and estimates that the move will cost her $200,000. She also estimates that her annual living expenses in Hawaii will be $25,000 a year. She expects her savings will continue to earn an average rate of return of 7 percent. a. How much will she need to have saved by her retirement date? b. She already has $50,000 in savings. How much would she need to save at the end of each of the next twenty five years to be able to afford this retirement plan? If she did not have any current savings and did not expect to be able to start saving money for the next five years (that is, her first savings will be made on her 45th birthday), how much would she have to set aside each year after that to be able to afford this retirement planStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started