Answered step by step

Verified Expert Solution

Question

1 Approved Answer

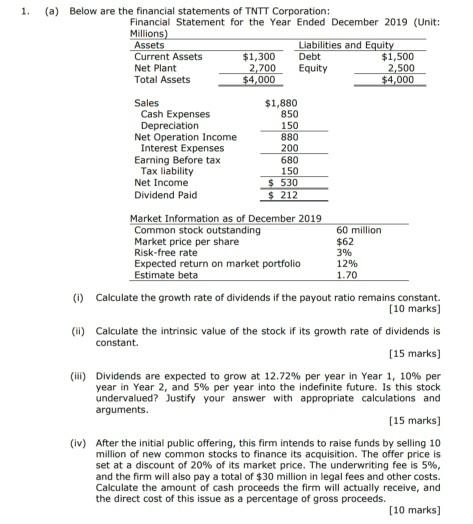

1. (a) Below are the financial statements of TNTT Corporation: Financial Statement for the Year Ended December 2019 (Unit: Millions) Assets Current Assets Net

1. (a) Below are the financial statements of TNTT Corporation: Financial Statement for the Year Ended December 2019 (Unit: Millions) Assets Current Assets Net Plant Total Assets Sales Cash Expenses Depreciation Net Operation Income Interest Expenses Earning Before tax Tax liability Net Income Dividend Paid $1,300 2,700 $4,000 Liabilities and Equity Debt Equity $1,880 850 150 880 200 680 150 $ 530 $ 212 Market Information as of December 2019 Common stock outstanding Market price per share Risk-free rate Expected return on market portfolio Estimate beta 60 million $62 3% 12% 1.70 $1,500 2,500 $4,000 (1) Calculate the growth rate of dividends if the payout ratio remains constant. [10 marks] (ii) Calculate the intrinsic value of the stock if its growth rate of dividends is constant. [15 marks] (iii) Dividends are expected to grow at 12.72% per year in Year 1, 10% per year in Year 2, and 5% per year into the indefinite future. Is this stock undervalued? Justify your answer with appropriate calculations and arguments. [15 marks] (iv) After the initial public offering, this firm intends to raise funds by selling 10 million of new common stocks to finance its acquisition. The offer price is set at a discount of 20% of its market price. The underwriting fee is 5%, and the firm will also pay a total of $30 million in legal fees and other costs. Calculate the amount of cash proceeds the firm will actually receive, and the direct cost of this issue as a percentage of gross proceeds. [10 marks]

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

i Growth rb Where r Rate of return on investment made by co...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started