Answered step by step

Verified Expert Solution

Question

1 Approved Answer

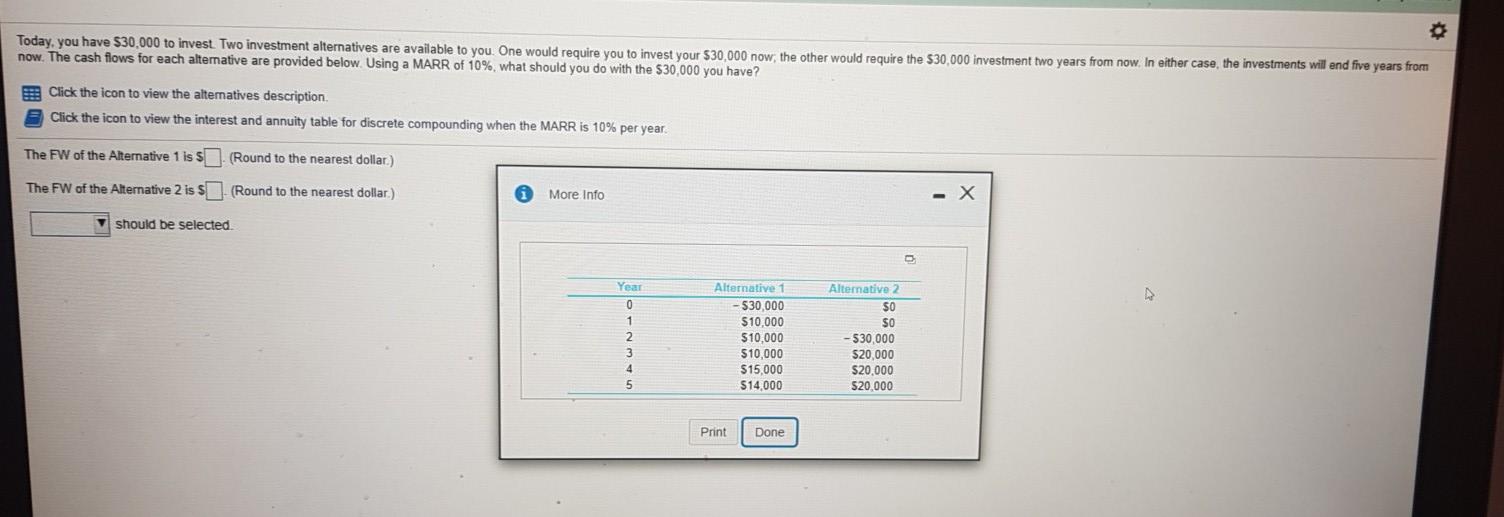

Today, you have $30,000 to invest. Two investment alternatives are available to you. One would require you to invest your $30,000 now, the other would

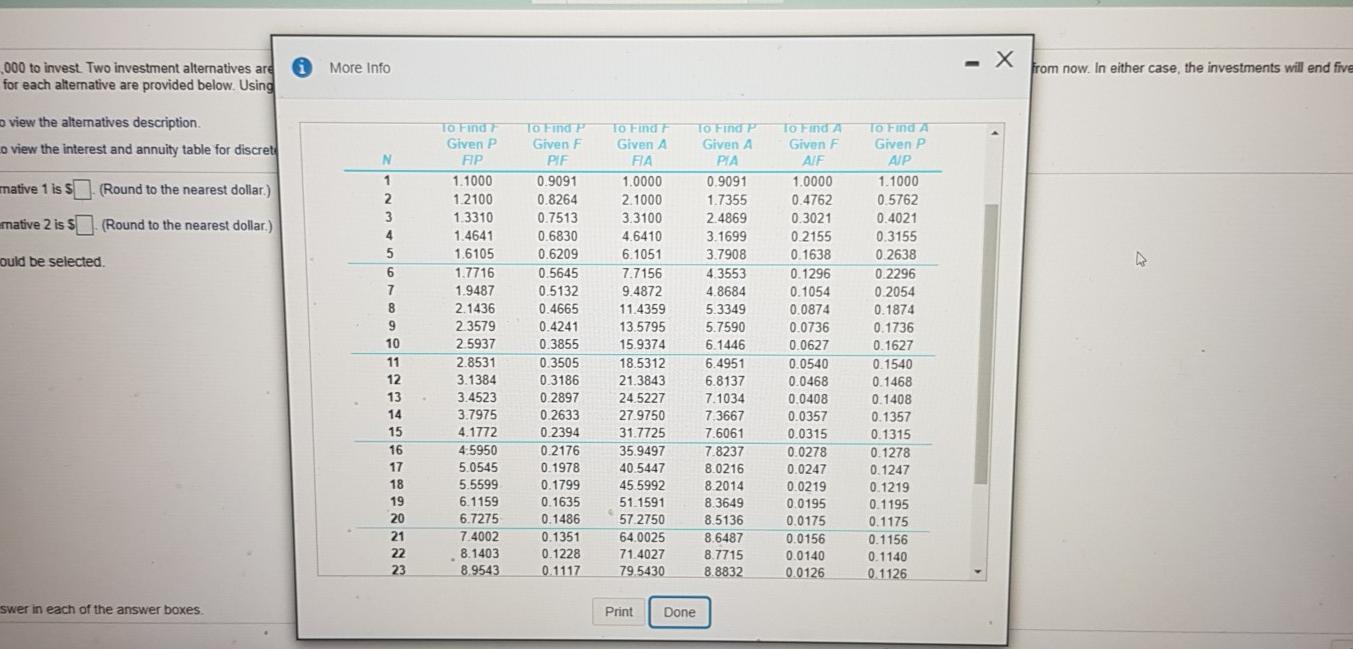

Today, you have $30,000 to invest. Two investment alternatives are available to you. One would require you to invest your $30,000 now, the other would require the $30,000 investment two years from now. In either case, the investments will end five years from now. The cash flows for each alternative are provided below. Using a MARR of 10%, what should you do with the 530,000 you have? Click the icon to view the alternatives description Click the icon to view the interest and annuity table for discrete compounding when the MARR is 10% per year The FW of the Alternative 1 is 5 (Round to the nearest dollar.) The FW of the Alternative 2 is (Round to the nearest dollar.) More Info - X V should be selected Year 0 Alternative 1 - 530,000 $10,000 $10,000 $10,000 $15,000 $14,000 Alternative 2 $0 SO - 530,000 $20,000 $20,000 520,000 4 Print Done - X More Info 000 to invest Two Investment alternatives are for each alternative are provided below. Using from now. In either case, the investments will end five view the alternatives description o view the interest and annuity table for discrete mative 1 is S (Round to the nearest dollar) mative 2 is s (Round to the nearest dollar) ould be selected. N 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 To Find Given P FIP 1.1000 1.2100 1 3310 1.4641 1.6105 1.7716 1.9487 2.1436 2.3579 2.5937 2.8531 3.1384 3.4523 3.7975 4.1772 4.5950 5.0545 5.5599 6.1159 6.7275 7.4002 8.1403 8.9543 To Find P Given PIE 0.9091 0.8264 0.7513 0.6830 0.6209 0.5645 0.5132 0.4665 0.4241 0.3855 0.3505 0.3186 0.2897 0.2633 0.2394 0.2176 0.1978 0.1799 0.1635 0.1486 0.1351 0.1228 0 1117 to Find Given A FIA 1.0000 2.1000 3.3100 4.6410 6.1051 7.7156 9.4872 11.4359 13.5795 15.9374 18.5312 21.3843 24.5227 27.9750 31.7725 35.9497 40.5447 45.5992 51.1591 57 2750 64.0025 71.4027 79.5430 To Find P Given A PIA 0.9091 1.7355 2.4869 3.1699 3.7908 4.3553 4.8684 5.3349 5.7590 6.1446 6.4951 6.8137 7.1034 7.3667 7.6061 7.8237 8.0216 8 2014 8.3649 8.5136 8.6487 8.7715 8.8832 To Find A Given F AIF 1.0000 0.4762 0.3021 0.2155 0.1638 0.1296 0.1054 0.0874 0.0736 0.0627 0.0540 0.0468 0.0408 0.0357 0.0315 0.0278 0.0247 0.0219 0.0195 0.0175 0.0156 0.0140 0.0126 To Find Given P AIP 1.1000 0.5762 0.4021 0.3155 0.2638 0.2296 0.2054 0.1874 0.1736 0.1627 0.1540 0.1468 0.1408 0.1357 0.1315 0.1278 0.1247 0.1219 0.1195 0.1175 0.1156 0.1140 0 1126 swer in each of the answer boxes Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started