Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Today, you have $30,000 to invest. Two investment alternatives are available to you. One would require you to invest your $30,00 a MARR of 12%,

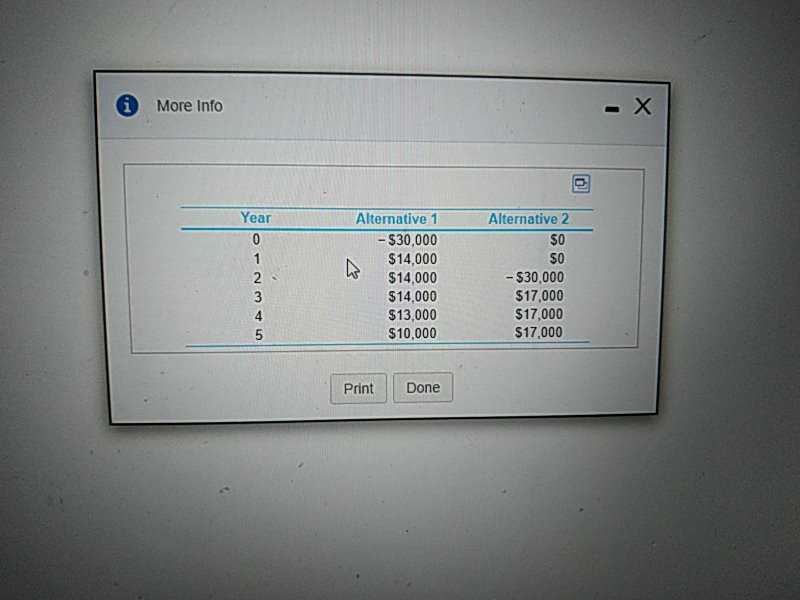

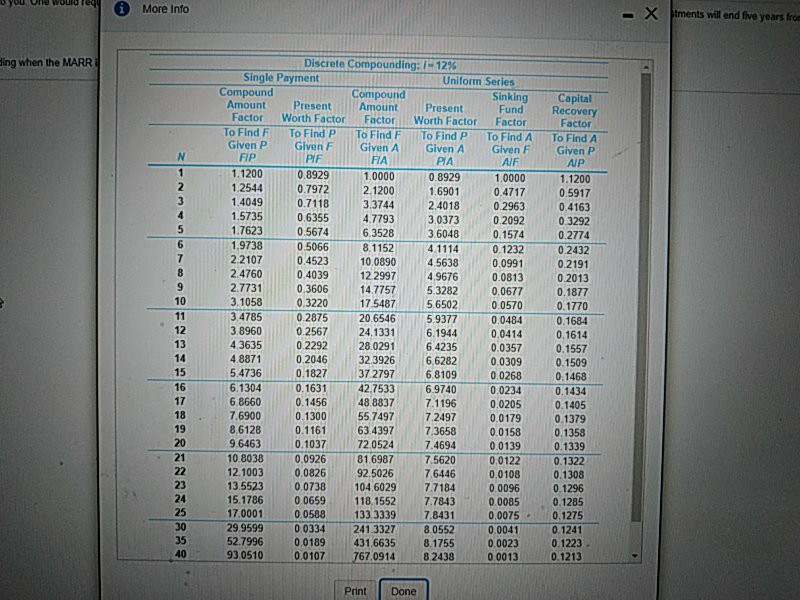

Today, you have $30,000 to invest. Two investment alternatives are available to you. One would require you to invest your $30,00 a MARR of 12%, what should you do with the $30,000 you have? Click the icon to view the alternatives description. Click the icon to view the interest and annuity table for discrete compounding when the MARR is 12% per year. The FW of the Alternative 1 is (Round to the nearest dollar.) The FW of the Alternative 2 is $(Round to the nearest dollar.) should be selected, ailable to you. One would require you to invest your $30,000 now, the other would require the $30,000 investment two years from now. In either case, the inve ompounding when the MARR is 12% per year. other would require the $30,000 investment two years from now. In either case, the investments will end five years from now. The cash flows for each alterative are provided below. Using i More Info - X Year 0 1 2 3 4 5 Alternative 1 - $30,000 $14,000 $14,000 $14,000 $13,000 $10,000 Alternative 2 SO $0 - $30,000 $17,000 $17,000 $17,000 Print Done More Info - Xtments will end five years from ing when the MARR 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 30 35 40 Discrete Compounding:/-12% Single Payment Uniform Series Compound Compound Sinking Amount Present Amount Present Fund Factor Worth Factor Factor Worth Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Glven F FIP PF FIA PIA AIF 1.1200 0.8929 1.0000 0.8929 1.0000 1.2544 0.7972 2.1200 1.6901 0.4717 1.4049 0.7118 3.3744 2.4018 0.2963 1.5735 0.6355 4.7793 3.0373 0.2092 1.7623 0.5674 6,3528 3.6048 0.1574 1.9738 0.5066 8.1152 4 1114 0.1232 2.2107 0.4523 10.0890 4.5638 0.0991 2.4760 0.4039 12 2997 4.9676 0.0813 2.7731 0.3606 14.7757 5.3282 0.0677 3.1058 0.3220 17.5487 5.6502 0.0570 3.4785 0.2875 20.6546 5.9377 0.0484 3.8960 0.2567 24.1331 6.1944 0.0414 4.3635 0.2292 28.0291 6.4235 0.0357 4.8871 0.2046 32.3926 6,6282 0.0309 5.4736 0.1827 37 2797 6.8109 0.0268 6.1304 0.1631 42.7533 6.9740 0.0234 6.8660 0.1456 48.8837 7.1196 0.0205 7,6900 0.1300 55.7497 7.2497 0.0179 8.6128 0.1161 63.4397 7.3658 0.0158 9.6463 0.1037 72.0524 7.4694 0.0139 10.8038 0.0926 81.6987 7.5620 0.0122 12.1003 0.0826 92.5026 7.6446 0.0108 13.5523 0.0738 104,6029 7.7184 0.0096 15.1786 0.0659 118.1552 7.7843 0.0085 17.0001 0.0588 133.3339 7.8431 0.0075 29.9599 0.0334 241.3327 8.0552 0.0041 52.7996 0.0189 431,6635 8.1755 0.0023 93 0510 0.0107 767,0914 8 2438 0.0013 Capital Recovery Factor To Find A Given P AP 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770 0.1684 0.1614 0.1557 0.1509 0.1468 0.1434 0.1405 0.1379 0.1358 0.1339 0.1322 0.1308 0.1296 0.1285 0.1275 0.1241 0.1223 0.1213 Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started