Question

Today, you observed the following information in the bond-related market. All the rates are annualised. iT is the current interest rate for a T-year bond,

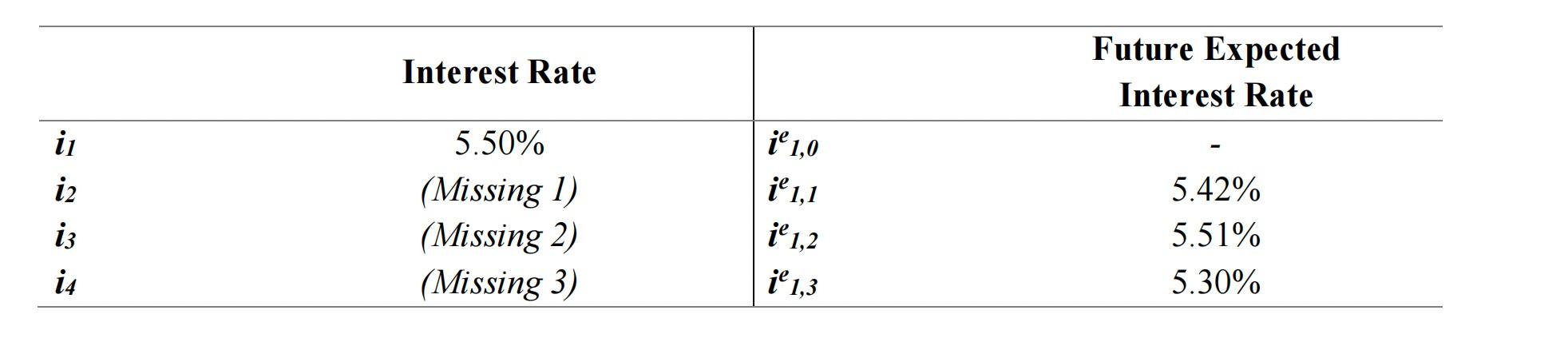

Today, you observed the following information in the bond-related market. All the rates are annualised. iT is the current interest rate for a T-year bond, ie 1,t is the expected interest rate (of a 1-year bond) invested at time t

a. Using the Expectations Theory, fill the three missing spaces in the above table with detailed steps and then briefly comment on your results. Also explain the assumptions of Expectations Theory you use to get the missing information.

b. Plot the interest rate term structure as of today and comment your plot.

c. Given the term structure, explain which type of bond you would rather hold and why

i iz i3 i4 Interest Rate 5.50% (Missing 1) (Missing 2) (Missing 3) i 1.0 je 1,1 i 1.2 ie 1,3 Future Expected Interest Rate 5.42% 5.51% 5.30% i iz i3 i4 Interest Rate 5.50% (Missing 1) (Missing 2) (Missing 3) i 1.0 je 1,1 i 1.2 ie 1,3 Future Expected Interest Rate 5.42% 5.51% 5.30%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started