Question

Today's Date Ford Motor Co. Coupon: Matuirity: Term to Matuirity Rating: Price: General Motors Corp. Coupon: Matuirity: Term to Matuirity Rating: Price: Semi-annual YTM

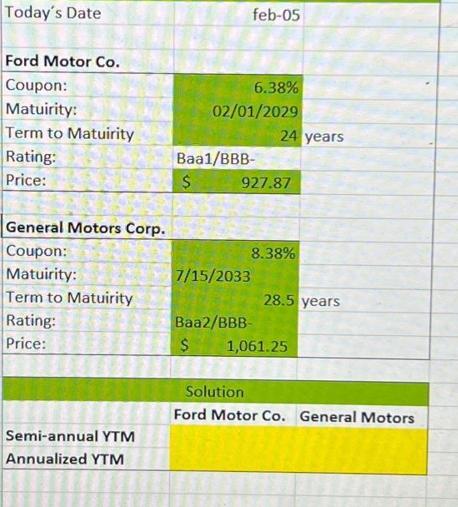

Today's Date Ford Motor Co. Coupon: Matuirity: Term to Matuirity Rating: Price: General Motors Corp. Coupon: Matuirity: Term to Matuirity Rating: Price: Semi-annual YTM Annualized YTM feb-05 6.38% 02/01/2029 Baal/BBB- $ 7/15/2033 927.87 24 years 8.38% Baa2/BBB- $ 28.5 years 1,061.25 Solution Ford Motor Co. General Motors

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Solution FM Co GM Corp Semi Annual YTM 350 392 Annualized YTM 70...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Financial Management

Authors: Eugene F. Brigham, Joel F. Houston

13th edition

978-1285027371, 128502737X, 978-1133541141

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App