Answered step by step

Verified Expert Solution

Question

1 Approved Answer

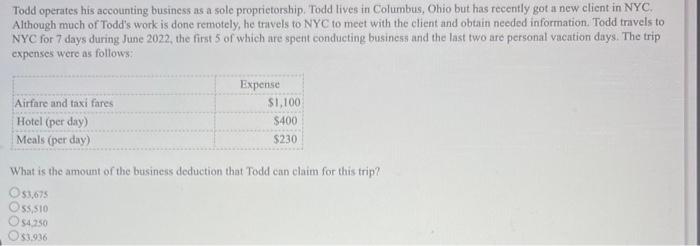

Todd operates his accounting business as a sole proprietorship. Todd lives in Columbus, Ohio but has recently got a new client in NYC. Although much

Todd operates his accounting business as a sole proprietorship. Todd lives in Columbus, Ohio but has recently got a new client in NYC. Although much of Todd's work is done remotely, he travels to NYC to meet with the client and obtain needed information. Todd travels to NYC for 7 days during June 2022 , the first 5 of which are spent conducting business and the last two are personal vacation days. The trip expenses were as follows: What is the amount of the business deduction that Todd can claim for this trip? 53,07555,51054,25051,936

Todd operates his accounting business as a sole proprietorship. Todd lives in Columbus, Ohio but has recently got a new client in NYC. Although much of Todd's work is done remotely, he travels to NYC to meet with the client and obtain needed information. Todd travels to NYC for 7 days during June 2022 , the first 5 of which are spent conducting business and the last two are personal vacation days. The trip expenses were as follows: What is the amount of the business deduction that Todd can claim for this trip? 53,07555,51054,25051,936

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started