Question

Todd Stratton has a capital balance of $ 2 4 , 0 0 0 ; Susan Smith's balance is $ 2 5 , 0 0

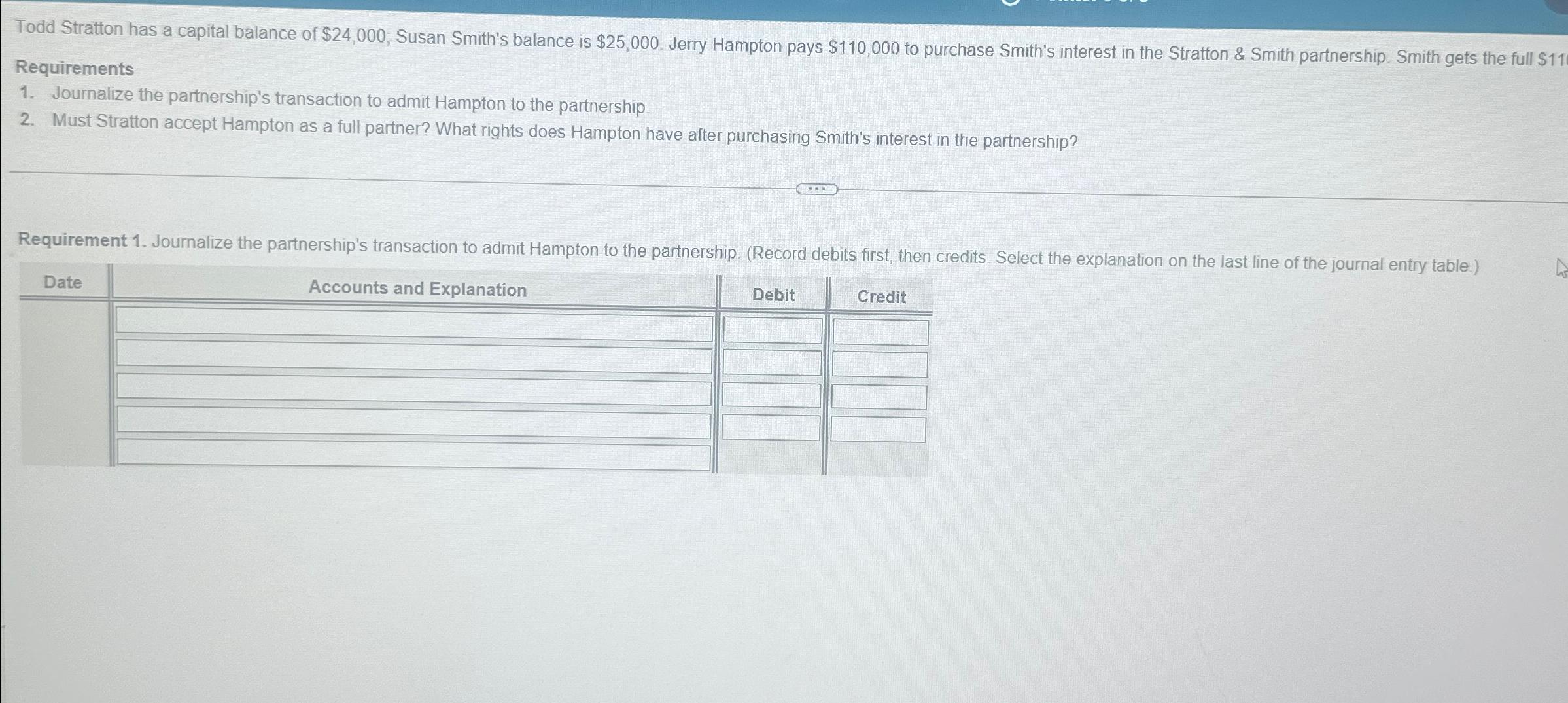

Todd Stratton has a capital balance of $; Susan Smith's balance is $ Jerry Hampton pays $ to purchase Smith's interest in the Stratton & Smith partnership. Smith gets the full $RequirementsJournalize the partnership's transaction to admit Hampton to the partnership.Must Stratton accept Hampton as a full partner? What rights does Hampton have after purchasing Smith's interest in the partnership?Requirement Journalize the partnership's transaction to admit Hampton to the partnership. Record debits first, then credits. Select the explanation on the last line of the journal entry tabletableDateAccounts and Explanation,Debit,Credit

Todd Stratton has a capital balance of $24,000; Susan Smith's balance is $25,000. Jerry Hampton pays $110,000 to purchase Smith's interest in the Stratton & Smith partnership. Smith gets the full $11 Requirements 1. Journalize the partnership's transaction to admit Hampton to the partnership. 2. Must Stratton accept Hampton as a full partner? What rights does Hampton have after purchasing Smith's interest in the partnership? Requirement 1. Journalize the partnership's transaction to admit Hampton to the partnership. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started