Question

Tom and Harry became friends when they both worked part-time at Sobeys while in University. Since they graduated, for the past five years they have

Tom and Harry became friends when they both worked part-time at Sobeys while in University. Since they graduated, for the past five years they have owned and operated their own franchise grocery store, Tom and Harry's Fresh Foods Inc. (THFF). Fresh Foods Inc., the franchisor, is well known for its low prices and simple (but clean and orderly) stores.

THFF has experienced increased competition over the past five years as nearby retailers have expanded their operations into groceries and produce. Over the same time, food costs have increased. This is due to a number of factors, including droughts, decreasing the production of some items they sell, and the depreciation of the Canadian dollar to the United States Dollar and Mexican Peso (as much of THFF's produce is imported from these countries, this has resulted in lower margins and a decline in revenue growth).

Lewis & Leonard LLP were approached to be the auditor of THFF as their previous auditor had experienced some staff retirements and turnover and was not able to do the audit this year. Based on discussion with the prior auditor, there had been no major misstatements identified during the previous audit, with the only concerns raised were weaknesses with inventory and pricing controls. The previous auditor identified that Tom and Harry's strong involvement and oversight in all aspects of the business has ensured the successful operation of the business. Based on this, Lewis & Leonard LLP agreed to be the auditors.

The audit is a requirement of franchise agreement with Fresh Foods Inc. The franchise agreement, stipulates a variety of clauses that give Fresh Foods Inc. (the franchisor) the right to cancel the agreement. Fresh Foods Inc. has only used these cancellation clauses in the past for franchisees that did not pay the correct franchise fee on time and for franchisees experiencing significant declines in their profit margins.

The audit is also a requirement of the bank that loaned money to THFF to fund recent store renovations. The loan has a covenant that THFF must maintain at least a 1.5:1 current ratio (current assets divided by current liabilities) or the loan is payable in full to the bank. Tom and Harry also identified a new partner to join them in the business in early 2022 and expect to use a percentage of fiscal 2021's audited net income to determine the amount that the new partner will pay into the business.

Tom and Harry met with the Lewis & Leonard LLP audit team to start this year's audit process. The following points were raised by Tom and Harry:

• THFF primarily hires part-time high school and university students as employees. They were fortunate that until the most recent year, employee turnover was low. This year they had to hire a number of new employees. As there has not been time to give them formal training on store procedures, the new staff were making a number of mistakes, which was expected to decrease as they get more experience.

• To encourage customer loyalty, in 2021 THFF started selling a $400 store membership card. The membership card is valid for one year from the time of purchase and gives holders access to exclusive store coupons and 2% off their purchases. The purchase of the membership card is non-refundable, but Tom and Harry have granted some refunds to a few individuals with special circumstances (such as moving out of town). Other than this new program, revenue recognition is very simple as customers pay cash, credit card or debit card to purchase goods and returns and exchanges are not permitted.

• THFF established an internal audit function that started doing audits of franchisees. They performed a payroll audit of all franchise locations after a number of employees made complaints to the company. THFF's payroll controls were identified as operating effectively.

• During the year, a customer slipped in the store on a puddle of water and broke their leg. The customer was a postal service employee and sued THFF for damages relating to lost wages and time and suffering. THFF is currently negotiating a settlement with the customer to avoid going to trial over the matter. While THFF did not set up a contingent liability for the lawsuit, they are keeping Fresh Foods Inc. updated.

Tom & Harry were excited to start working with the Lewis & Leonard LLP audit team and indicated that if the audit goes well, they would be willing to hire the firm for additional consulting engagements to see if operations can be made more cost-efficient. While the previous auditor generally took eight weeks to do the audit, they were hoping this year the audit could be done in six weeks so that they can finalize the purchase agreement with the new partner soon. In addition to providing the audited financial statements, Tom & Harry were hoping that the audit team could provide a listing of control deficiencies identified by the audit team during the audit with recommendations to improve them. They were also hoping that the audit team would meet with the new buyer and discuss how buying into THFF is a solid investment.

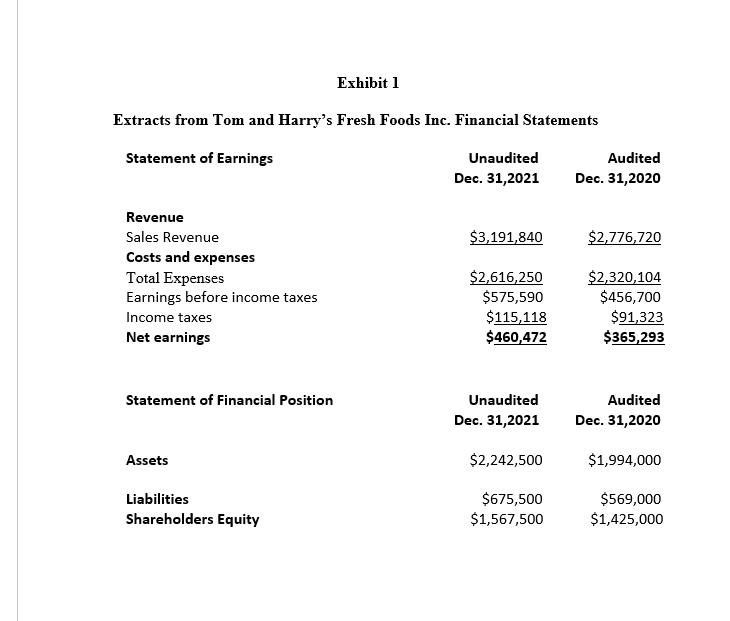

Lewis & Leonard LLP were provided extracts of THFF's financial statements (Exhibit 1).

Required

A) Determine overall planning materiality and performance materiality for the year ending December 31, 2021. (Explain the rationale for all components of the calculation and support your analysis with calculations

B) Identify three case facts that impact the risk of material misstatement (inherent risks or control risks) at the overall financial statement level (OFSL). For each factor identified, indicate if the factor increases or decreases risk, the type of risk (inherent or control), and provide your rationale for why the factor increases or decreases risk.

C) Identify three case facts that increase/decrease the risk of material misstatement at the account balance and assertion level. For each case fact identified indicate the account balance and assertion affected, whether the factor increases or decreases risk, the type of risk (inherent or control) affected, and provide your rationale

Exhibit 1 Extracts from Tom and Harry's Fresh Foods Inc. Financial Statements Statement of Earnings Unaudited Audited Dec. 31,2021 Dec. 31,2020 Revenue Sales Revenue $3,191,840 $2,776,720 Costs and expenses Total Expenses Earnings before income taxes $2,616,250 $575,590 $115,118 $460,472 $2,320,104 $456,700 $91,323 $365,293 Income taxes Net earnings Statement of Financial Position Unaudited Audited Dec. 31,2021 Dec. 31,2020 Assets $2,242,500 $1,994,000 $675,500 $1,567,500 $569,000 $1,425,000 Liabilities Shareholders Equity

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

A Determine overall planning materiality and performance materiality for the year ending December 31 2021 Explain the rationale for all components of the calculation and support your analysis with cal...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started