Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tom and Laura are applying for a home loan to buy their first home. Their targeted property's price is $620,000 and the bank agrees

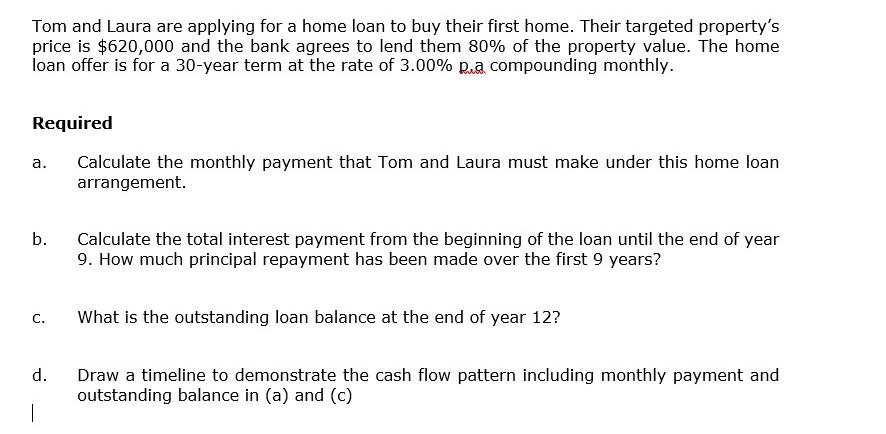

Tom and Laura are applying for a home loan to buy their first home. Their targeted property's price is $620,000 and the bank agrees to lend them 80% of the property value. The home loan offer is for a 30-year term at the rate of 3.00% pa compounding monthly. Required a. b. Calculate the monthly payment that Tom and Laura must make under this home loan arrangement. Calculate the total interest payment from the beginning of the loan until the end of year 9. How much principal repayment has been made over the first 9 years? C. What is the outstanding loan balance at the end of year 12? d. Draw a timeline to demonstrate the cash flow pattern including monthly payment and outstanding balance in (a) and (c)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answers a Monthly payment calculation The monthly payment can be calculated using the formula Monthly Payment Loan Amount x Interest Rate x 1 1 Intere...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started