Question

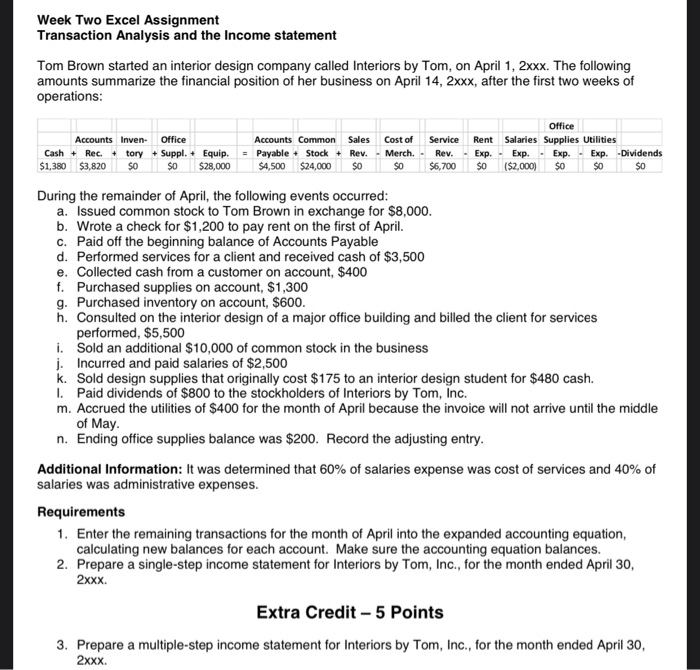

Tom Brown started an interior design company called Interiors by Tom, on April 1, 2xxx. The following amounts summarize the financial position of her business

Tom Brown started an interior design company called Interiors by Tom, on April 1, 2xxx. The following amounts summarize the financial position of her business on April 14, 2xxx, after the first two weeks of operations: During the remainder of April, the following events occurred:

a. Issued common stock to Tom Brown in exchange for $8,000.

b. Wrote a check for $1,200 to pay rent on the first of April.

c. Paid off the beginning balance of Accounts Payable

d. Performed services for a client and received cash of $3,500

e. Collected cash from a customer on account, $400

f. Purchased supplies on account, $1,300

g. Purchased inventory on account, $600.

h. Consulted on the interior design of a major office building and billed the client for services performed, $5,500

i. Sold an additional $10,000 of common stock in the business

j. Incurred and paid salaries of $2,500

k. Sold design supplies that originally cost $175 to an interior design student for $480 cash.

l. Paid dividends of $800 to the stockholders of Interiors by Tom, Inc.

m. Accrued the utilities of $400 for the month of April because the invoice will not arrive until the middle of May.

n. Ending office supplies balance was $200. Record the adjusting entry.

Additional Information: It was determined that 60% of salaries expense was cost of services and 40% of salaries was administrative expenses.

Requirements

1. Enter the remaining transactions for the month of April into the expanded accounting equation, calculating new balances for each account. Make sure the accounting equation balances.

2. Prepare a single-step income statement for Interiors by Tom, Inc., for the month ended April 30, 2xxx

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started