Question

Tom Davis was born and raised in San Francisco and served as a Navy lieutenant in Vietnam. After his discharge he used the GI Bill

Tom Davis was born and raised in San Francisco and served as a Navy lieutenant in Vietnam. After his discharge he used the GI Bill to attend NYU, where he received his degree in finance and held a part?time job at Steel, Robbins, Hernandez, and Associates, a regional brokerage firm headquartered in New York City. After graduation he was offered a permanent position with Steel, which he gladly accepted. While at the firm, Tom became friends with Gene Michaels, a Stanford MBA who had been working as a financial analyst with the company for just over a year. Although Tom enjoyed his work, his ultimate goal was to open a financial consulting firm in his hometown. After five years, Tom managed to save enough commissions to realize his goal. He convinced Gene to become his partner and to move to San Francisco to open their own financial consulting firm, Davis, Michaels, and Company.

Davis, Michaels, and Company provides financial planning services to upper-middle-class professionals. Basically, the firm provides consulting services in the areas of income tax planning, investment planning, insurance planning, estate planning, and employee benefits planning for small, family-owned businesses. The firm is heavily involved in the Chinese community where Tom has close ties. Also, both he and Gene speak fluent Chinese. The firm does not have a tax lawyer or CPA on its staff, so Tom and Gene hire outside experts when a problem arises which they cannot handle, but this is rare.

Business has been good, perhaps too good. Tom and Gene have been working overtime to handle the load, and no end is in sight. In fact, Tom recently turned away several potential customers because he didnt think that the firm could offer them the high degree of personal service that it usually gives its customers. As a permanent solution, he is talking to career resource center personnel at several universities.

He hopes to hire a finance major who can start work immediately after graduation, but that is still several months away.

In the meantime, Tom believes that Janet Ho, the firms top secretary, can handle various financial analysis duties after turning over some of her clerical duties to someone else. Janet has been taking night courses in business at a community college, and she is convinced that she can handle increased responsibilities. Tom has a great deal of faith in Janetshe has been with the firm from the very beginning, and her great personality and sound work ethic have contributed substantially to the firms success. Still, Tom knows that there is little room for error in this business. Customers must be confident that their financial plans are soundly conceived and properly implemented. Any mistakes create instant mistrust, and the word spreads quickly.

To make sure that Janet has the skills to do the job, Tom plans to give her a short test. As far as Tom is concerned, the single most important concept in financial planning, whether it be personal or corporate, is discounted cash flow (DCF) analysis. He believes that if Janet has solid skills in this area, then she will be able to succeed in her expanded role with minimal supervision. The basis for the test is an actual analysis that Tom is currently working on for one of his clients. The client has $10,000 to invest with a goal of accumulating enough money in 5 years to pay for his daughters first year of college at a prestigious Ivy League school. He has directed Tom to evaluate only fixed interest securities (bonds, bank certificates of deposit, and the like) since he does not want to put his daughters future at risk.

One alternative is to invest the $10,000 in a bank certificate of deposit (CD) currently paying about 10 percent interest. CDs are available in maturities from 6 months to 10 years, and interest can be handled in one of two waysthe buyer can receive interest payments every 6 months or reinvest the interest in the CD. In the latter case, the buyer receives no interest during the life of the CD, but receives the accumulated interest plus principal amount at maturity. Since the goal is to accumulate funds over 5 years, all interest earned would be reinvested.

However, Tom must also evaluate some other alternatives. His client is considering spending $8,000 on home improvements this year, and hence he would have only $2,000 to invest. In this situation, Toms client plans to invest an additional $2,000 at the end of each year for the following 4 years, for a total of 5 payments of $2,000 each. A final possibility is that the client might spend the entire $10,000 on home improvements and then borrow funds for his daughters first year of college.

To check your skills at DCF analysis, place yourself in Janets shoes and take the following test.

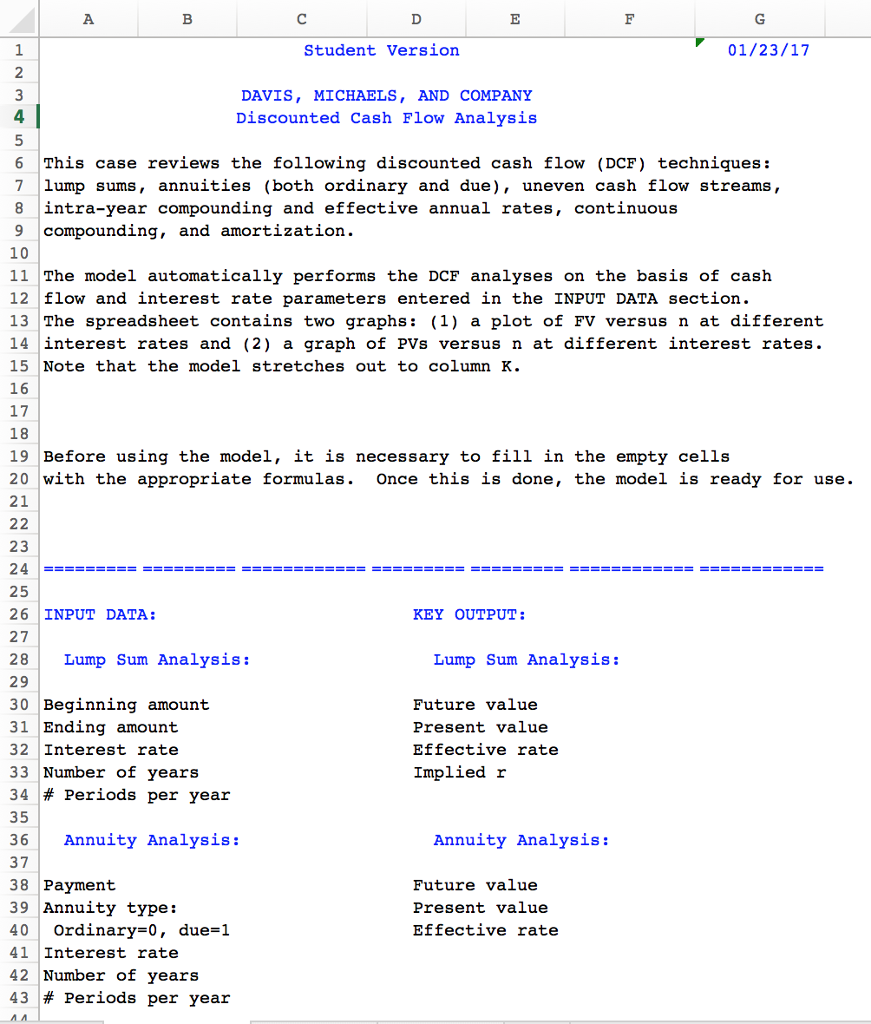

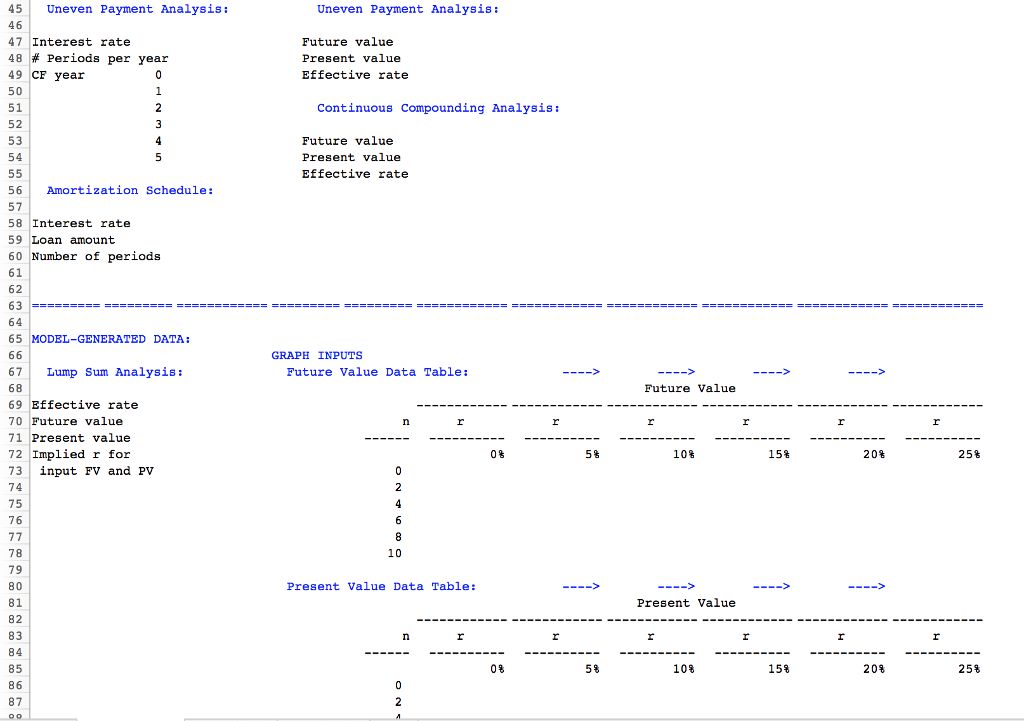

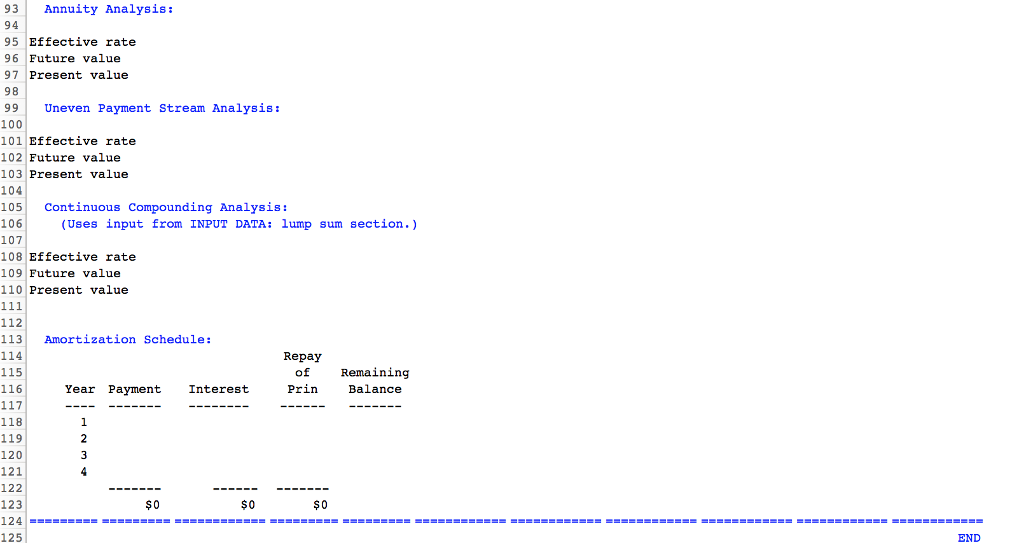

Student version 01/23/17 DAVIS, MICHAELS AND COMPANY Discounted Cash Flow Analysis 6 This case reviews the following discounted cash flow (DCF) techniques 7 lump sums annuities (both ordinary and due), uneven cash flow streams 8 intra-year compounding and effective annual rates continuous 9 compounding, and amortization. 10 11 The model automatically performs the DCF analyses on the basis of cash 12 flow and interest rate parameters entered in the INPUT DATA section. 13 The spreadsheet contains two graphs: (1) a plot of FV versus n at different 14 interest rates and (2) a graph of PVs versus n at different interest rates 15 Note that the model stretches out to Column K. 16 17 18 19 Before using the model it is necessary to fill in the empty cells 20 with the appropriate formulas Once this is done, the model is ready for use 21 22 23 24 25 KEY OUTPUT: 26 INPUT DATA: 27 28 Lump Sum Analysis Lump Sum Analysis 29 30 Beginning amount Future value 31 Ending amount Present value Effective rate 32 Interest rate Implied r 33 Number of years 34 Periods per year 35 36 Annuity Analysis Annuity Analysis 37 Future value 38 Payment 39 Annuity type: Present value 40 Ordinary 0, due 1 Effective rate 41 Interest rate 42 Number of years 43 Periods per yearStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started