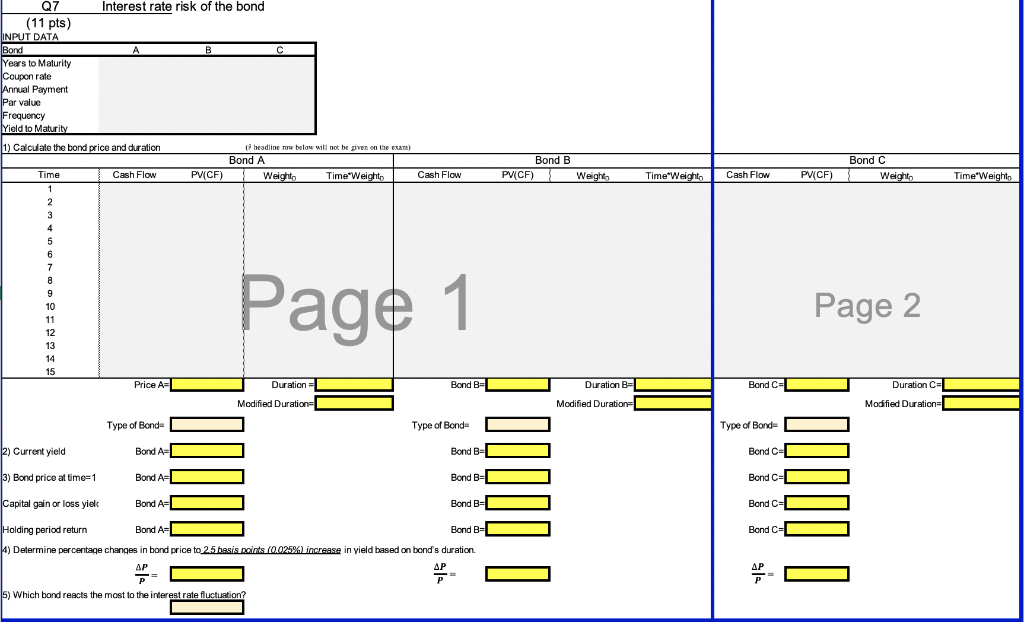

Tom is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds. Bond A 7% 15 112 Bond B 10% 15 Coupon rate Maturity (Yrs) Payment frequency Face value Yield to maturity Bond C 12% 15 1 $1,000 10% 1 $1,000 10% $1,000 10% 1) (3 points) Calculate the price, Macaulay duration, and modified duration of each of the three bonds, and determine the type of each bond (use the drop-down list). 2) (2 points) Calculate the current yield for each bonds. 3) (2 points) If the yield to maturity stays 10%, what will be the price of each bond one year from now? What is the expected capital gains/loss yield for each bond? What is the expected holding period return over one year for each bond? Page 23 MGF405 F21 Advanced Corporate Finance Instructor: Dr. Szu-yin (Jennifer) Wu 4) (2 points) Determine the percentage changes in the bond price to a 2.5 basis-point (0.025%) increase in the yield based on only duration. 5) (2 points) Based on results from (4), which bond reacts the most to the interest rate fluctuation (use the drop-down list)? Verify this result with Property (V) of interest rate risk on slide page 31. Bond B PV(CF) Weight Cash Flow Bond C Weight Time Weight Cash Flow PV(CF) Time Weight Q7 Interest rate risk of the bond (11 pts) INPUT DATA Bond A B Years to Maturity Coupon rate Annual Payment Par value Frequency Yield to Maturity 1) Calculate the bond price and duration beadline row below will not be given on the exam) Bond A Time Cash Flow PV(CF) Weight- Time Weight 1 2 3 4 5 6 7 7 8 9 9 10 11 12 13 14 15 Price A Duration Modified Duration 1 Page 2 Bond B- Bond C= Duration C=L Duration B- Modified Duration Modified Duration Type of Bonda Type of Bond- Type of Bond- 2) Current yield Bond A- Bond Bu Bond C 3) Bond price at time=1 Bond A Bond BE Bond C= 1 DOOD! Capital gain or loss yiek Bond A Bond BV 00 00000 I boll! Bond C- Bond C= Holding period return Bond A Bond BV 4) Determine percentage changes in bond price to 2.5 basis points (0.025%) increase in yield based on bond's duration AP AP ) ? 5) Which bond reacts the most to the interest rate fluctuation? AP Tom is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds. Bond A 7% 15 112 Bond B 10% 15 Coupon rate Maturity (Yrs) Payment frequency Face value Yield to maturity Bond C 12% 15 1 $1,000 10% 1 $1,000 10% $1,000 10% 1) (3 points) Calculate the price, Macaulay duration, and modified duration of each of the three bonds, and determine the type of each bond (use the drop-down list). 2) (2 points) Calculate the current yield for each bonds. 3) (2 points) If the yield to maturity stays 10%, what will be the price of each bond one year from now? What is the expected capital gains/loss yield for each bond? What is the expected holding period return over one year for each bond? Page 23 MGF405 F21 Advanced Corporate Finance Instructor: Dr. Szu-yin (Jennifer) Wu 4) (2 points) Determine the percentage changes in the bond price to a 2.5 basis-point (0.025%) increase in the yield based on only duration. 5) (2 points) Based on results from (4), which bond reacts the most to the interest rate fluctuation (use the drop-down list)? Verify this result with Property (V) of interest rate risk on slide page 31. Bond B PV(CF) Weight Cash Flow Bond C Weight Time Weight Cash Flow PV(CF) Time Weight Q7 Interest rate risk of the bond (11 pts) INPUT DATA Bond A B Years to Maturity Coupon rate Annual Payment Par value Frequency Yield to Maturity 1) Calculate the bond price and duration beadline row below will not be given on the exam) Bond A Time Cash Flow PV(CF) Weight- Time Weight 1 2 3 4 5 6 7 7 8 9 9 10 11 12 13 14 15 Price A Duration Modified Duration 1 Page 2 Bond B- Bond C= Duration C=L Duration B- Modified Duration Modified Duration Type of Bonda Type of Bond- Type of Bond- 2) Current yield Bond A- Bond Bu Bond C 3) Bond price at time=1 Bond A Bond BE Bond C= 1 DOOD! Capital gain or loss yiek Bond A Bond BV 00 00000 I boll! Bond C- Bond C= Holding period return Bond A Bond BV 4) Determine percentage changes in bond price to 2.5 basis points (0.025%) increase in yield based on bond's duration AP AP ) ? 5) Which bond reacts the most to the interest rate fluctuation? AP