Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tom is the owner of an excavation and trucking firm. Harold owns a garden supply business. When Harold is very busy in the spring of

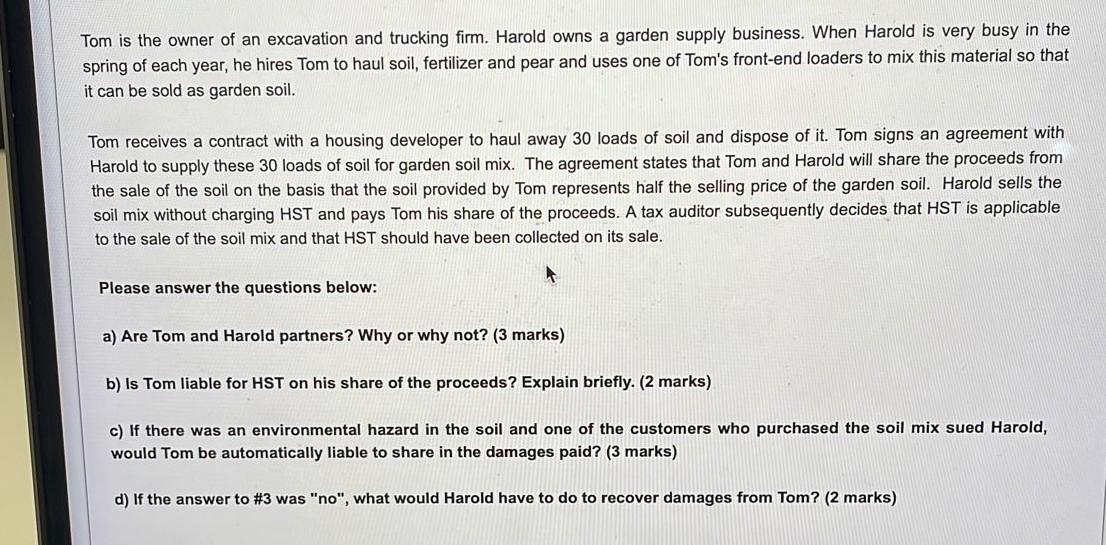

Tom is the owner of an excavation and trucking firm. Harold owns a garden supply business. When Harold is very busy in the spring of each year, he hires Tom to haul soil, fertilizer and pear and uses one of Tom's front-end loaders to mix this material so that it can be sold as garden soil. Tom receives a contract with a housing developer to haul away 30 loads of soil and dispose of it. Tom signs an agreement with Harold to supply these 30 loads of soil for garden soil mix. The agreement states that Tom and Harold will share the proceeds from the sale of the soil on the basis that the soil provided by Tom represents half the selling price of the garden soil. Harold sells the soil mix without charging HST and pays Tom his share of the proceeds. A tax auditor subsequently decides that HST is applicable to the sale of the soil mix and that HST should have been collected on its sale. Please answer the questions below: a) Are Tom and Harold partners? Why or why not? (3 marks) b) Is Tom liable for HST on his share of the proceeds? Explain briefly. ( 2 marks) c) If there was an environmental hazard in the soil and one of the customers who purchased the soil mix sued Harold, would Tom be automatically liable to share in the damages paid? ( 3 marks) d) If the answer to \#3 was "no", what would Harold have to do to recover damages from Tom? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started