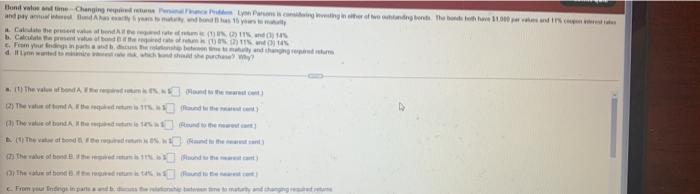

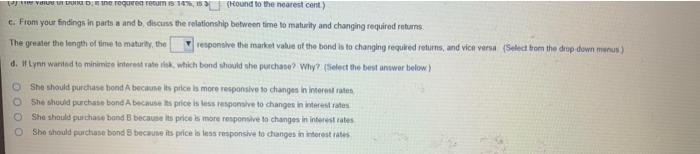

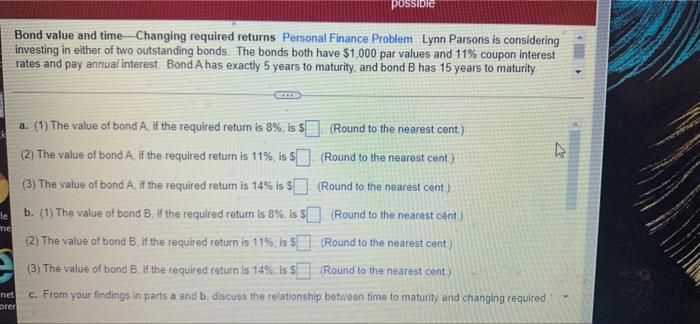

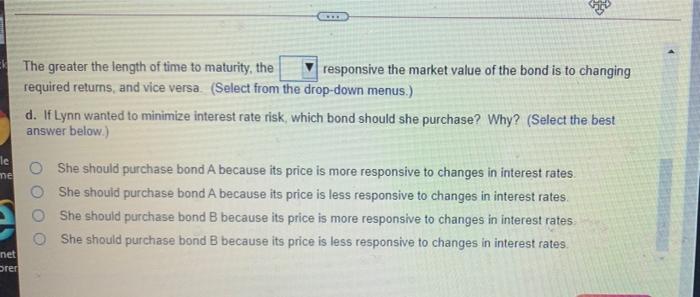

tone and one Chanoine de chegar a entende onts. I 1.00 din and Ayam 16 years Cathered 1. Calculate pretend the on the From your own Why The value fondant the marc The valente que se con The value abondante The word om te weet The author of the From noge in partes VUUDrequires recums 10. Round to the nearest cent) c. From your findings in parts and b, discuss the relationship between time to maturity and changing required returns The greater the length of time to maturity, the responsive the market value of the bond is to changing required retums, and vice versaSed from the drop down menu 4. Ily wanted to minimize interest rate blok, which bond should che purchase? Why? (Select the best answer below) She should purchase trond A because its price is more responsive to changes in interest rates She should purchase bond A becauses price is less responsive to changes in interest rates She should purchase and because its price is more responsive to changes in interest rates She should purchase bond because its priceless response to changes in interest possible Bond value and time-Changing required returns Personal Finance Problem Lynn Parsons is considering Investing in either of two outstanding bonds. The bonds both have $1.000 par values and 11% coupon interest rates and pay annual interest. Bond A has exactly 5 years to maturity, and bond B has 15 years to maturity a. (1) The value of bond A. If the required return is 8%, is $ (Round to the nearest cent) (2) The value of bond A, if the required return is 11%, is $ (Round to the nearest cent) (3) The value of bond A. If the required return is 14% is 5 (Round to the nearest cent) b. (1) The value of bond B the required return is 8%, is 5 (Round to the nearest cent) (2) The value of bond B if the required return is 11%, is $| (Round to the nearest cent) (3) The value of bond B. if the required return is 14%, is 5 (Round to the nearest cent) c. From your findings in parts a and b. discuss the relationship between time to maturity and changing required le ne Tiet pret The greater the length of time to maturity, the responsive the market value of the bond is to changing required returns, and vice versa. (Select from the drop-down menus.) d. If Lynn wanted to minimize interest rate risk, which bond should she purchase? Why? (Select the best answer below.) le ne She should purchase bond A because its price is more responsive to changes in interest rates She should purchase bond A because its price is less responsive to changes in interest rates She should purchase bond B because its price is more responsive to changes in interest rates She should purchase bond B because its price is less responsive to changes in interest rates net Srer