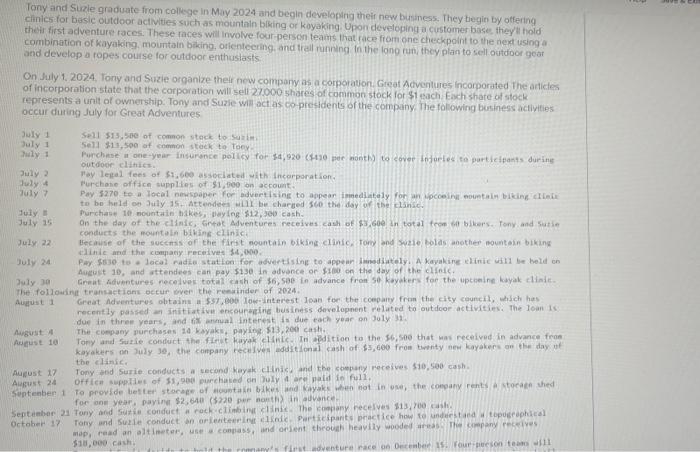

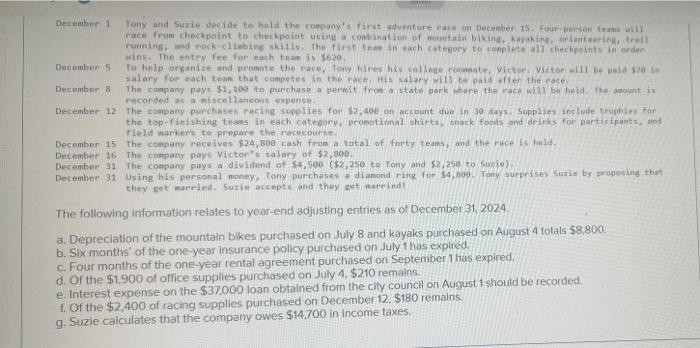

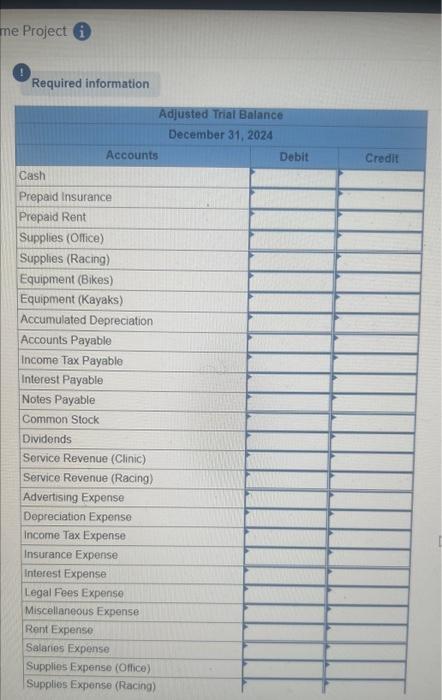

Tony and Surie graduate from college in May 2024 and begin developing their new business. They tegin by offering. Cilinics for basic outdoor acivities such as mountain biking or koyaking. Upon developing a curtomer bose, theyll hold their first adventure races. These faces will involve fourperson teams that face from one checkpoint to the next using a. combination of kayaking. mountain biking, ostenteering, and trall running th the long run, they plan to sell outdoor goar and develop a ropes course for outdoor enthustasts. On Suly 1. 2024, Tony and Suzie organize their now compary as a corporawon. Great Adventures incorporated The acticies of incorporation state that the corporation will sell 27.000 shares of common stock for $1 each Each share of stock represents a unit of ownership. Tony and Suzle wil act as copresidents of the company The folowing bosiness activities occur during July for Great Adventures 3uly 2 Fay legel fees of $1,600 associated with Incarporation? Tiely 4 Purchote office supplies of $1, 400 on account; Tuly. to bo held oo July 15. Actendees will be charged 500 the doy of the clinsic. July conducts the fountalin biking Clinici July 22. Hecause of the gucenas of the first nountain biking clinic, tond and puzle bolds abother aountoin biking July 24 Pay 5830 to o local radie station for advertlsing to appear iamediately. A hayaking elinic uill he beld en Aagust 10, and attendees can pay 5130 in advance or 8100 on the day of the clinich. July. 30 Geneat Aduentures necelvek total cash of 96 , sae in advance fron 50 koyakers for the uptiolne koyak cliniethe following transactidns octur oven the reminder of 2024 . August 1 Great Adventures obtains a 537 , e00 Jos-interest Ioan foe the coepary fron the city ceuncil, shich has necently passed an initiat ive encougeging tiusiness developent reluted to outdoor activities. The loan is: due in thee years, and tix anmual interest is due each year on july 31 . Augost 4 The conpany purchases 20 kayaks, paying 513,200 cash. tbe elinic. August i7 Tony and Surie conducts a second kayak clinis, and the company receives 510,590 cash. August, 2a office supplies of 51,900 purchased ch loly a are nald in full, for one year, payine $2,640 ( $720 per nanth) in auvance. Septimber 21 Tany and suzie confuct a rockictinbine clinic. The Eongany recelves $13,700 rash. map, read an olt ineter, use a conpass, ind orjent throual heaviliy woodes areas: Iling cinpeny recetyes 518,000 cash. Decemberi 1 Tony and Sunie decide to hold the coogany's first adventure raco ber Decenber 15. Four person teani inill. race from checkpoint to kheckpoint using a conbination of nocmtain biking, knyaking, ior Ianteuringi, trall runindg, and rock-climbing ski1ls. The Firit. tran in pach cotegory to conplete all checkpoints in ordul wins. The entry fee for each toan is 1620 . salary tor each teain that competes in the pace, His salary intl be pais ofter the cace. December 8 The rompary pays $2,160 to purchase a permit from a state park there the race wil1 be heid. The ancunt is meconded is a mitceltaneous expense. December 12 The comparty purcheses racing sopolies for $2,400 gn account due in 30 days. Supplies inelunfe troghiles far the top-finishang teans in each categony, promotional shirts, snack foods pnd drinis, for participants, and fleld markern to prepare the racecourset December 15 . The company receives $24, Bae cash from a tatal af forty teams, and the ripce is hild. December 16 . The rompany pays-victor" salary of 52,800. December 31 the coapany pays a dividend of: 54,500,($2,250 to Tany and $2,250,50.5 unio). December 31 Using his personal money. Tony purchases a dianond ring for 34 , Bap. Fony surprises Suzio by propesing that they get married. Surie accepts. and they, ast, mareind? The following information relates to year-end adjusting entries as of December 31,2024. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $8,800. b. Six monthis of the one-year insurance policy purchased on July 1 has explied. C. Four months of the one-year rental agreement purchased on September 1 has expired, d. Of the $1.900 of office supplies purchased on July 4.$210 remains. e. Interest expense on the $37,000 loan obtained from the city council on August 1 should be recorded. f. Of the $2,400 of racing supplies purchased on December 12,$180 remains.: 9. Suzie calculates that the company owes $14,700 in income taxes. Project Required information \begin{tabular}{|l|l|} \hline & Adjusted Trial Balance \\ \hline Cash & December 31,2024 \\ \hline Prepaid insurance & \\ \hline Prepaid Rent & \\ \hline Supplies (Ofice) & \\ \hline Supplies (Racing) & \\ \hline Equipment (Bikes) & \\ \hline Equipment (Kayaks) & \\ \hline Accumulated Depreciation & \\ \hline Accounts Payable & \\ \hline Income Tax Payable & \\ \hline Interest Payable & \\ \hline Notes Payable & \\ \hline Common Stock & \\ \hline Dividends & \\ \hline Service Revenue (Clinic) & \\ \hline Service Revenue (Racing) \\ \hline Advertising Expense & \\ \hline Depreciation Expense & \\ \hline Income Tax Expense & \\ \hline Insurance Expense & \\ \hline Legal Fees Expense & \\ \hline Miscellaneous Expense & \\ \hline Rent Expense & \\ \hline Salaries Expense & \\ \hline Supplies Expense (Ofice) \\ \hline Supplies Expense (Racing) \\ \hline \end{tabular}