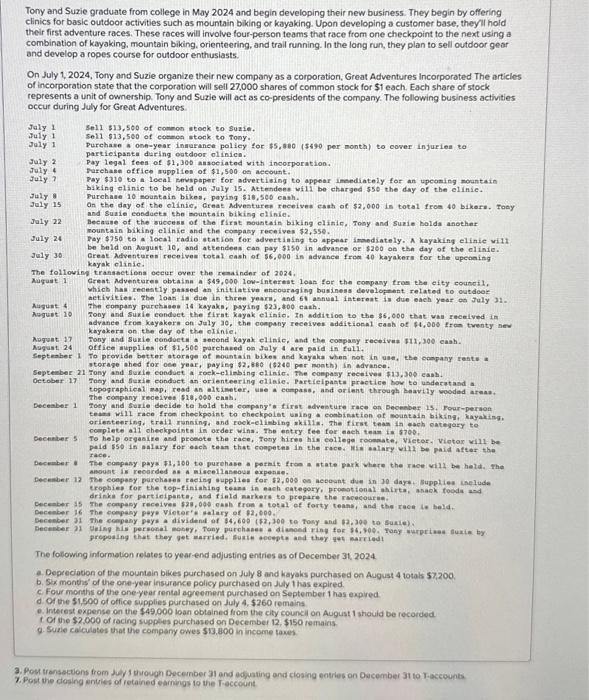

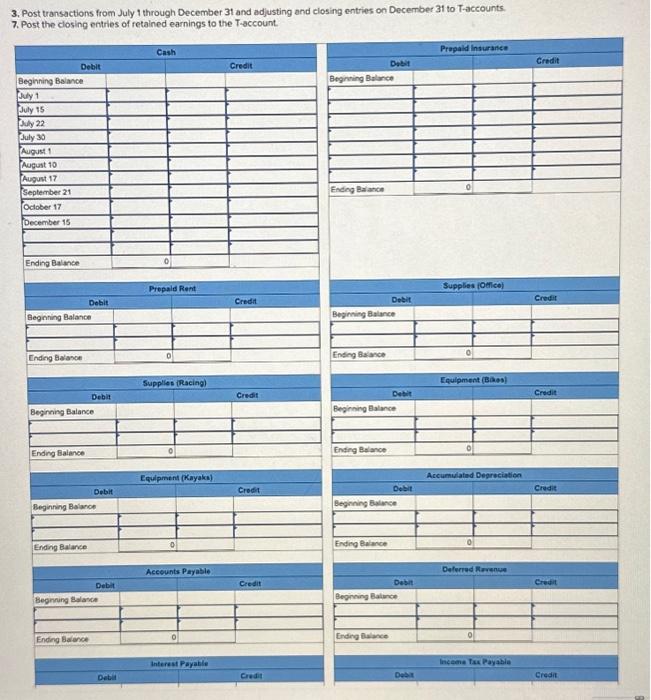

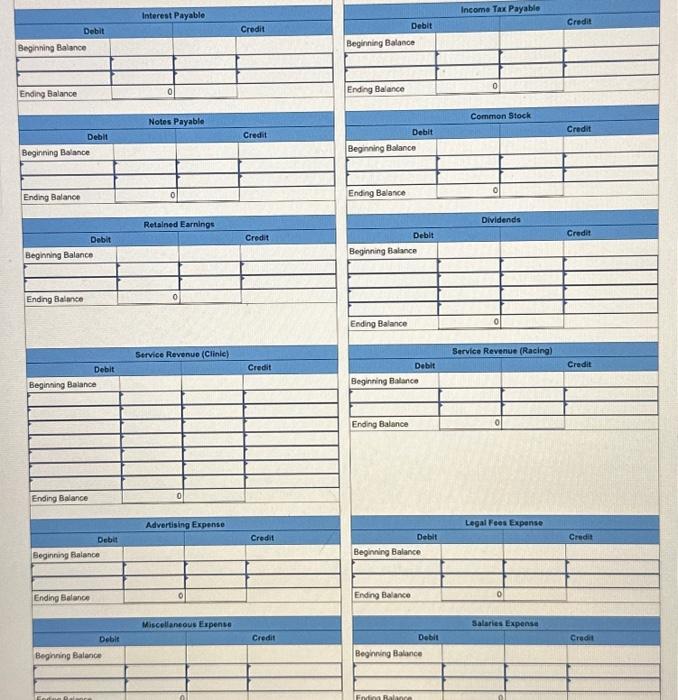

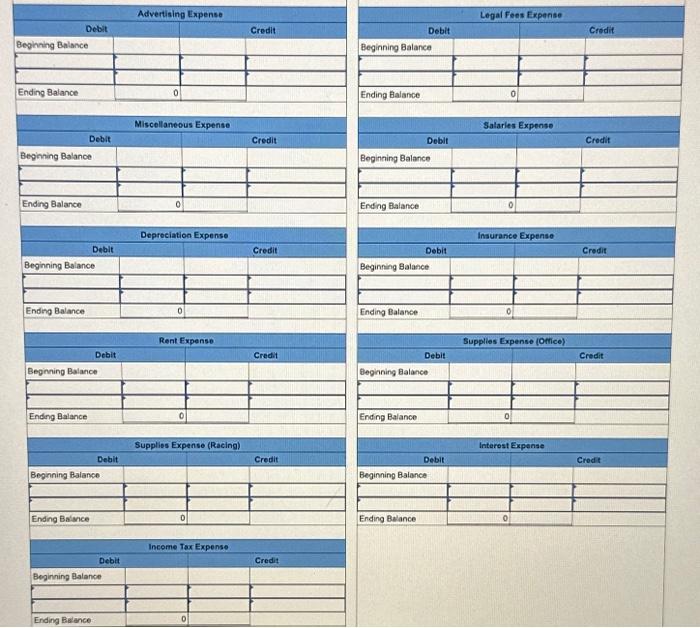

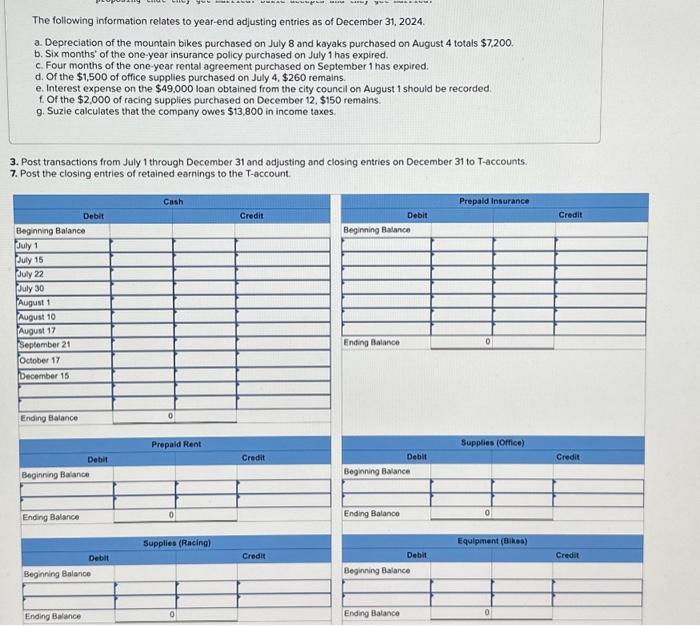

Tony and Suzie graduate from college in May 2024 and begin developing their new business. They begin by offering clinics for basic outdoor activities such as mountain biking or kayaking. Upon developing a customer base, theyli hold their first adventure races. These races will involve four-person teams that race from one checkpoint to the next using a combination of kayaking, mountain biking, orienteering, and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts. On July 1,2024, Tony and Suzie organize their new company as a corporation, Great Adventures incorporated The articies of incorporation state that the corporation will sell 27,000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzie will act as co-presidents of the company. The following business activities occur during duly for Greot Adventures Jaly 1 Sel1 513,500 of comen atock to suzie. Iuly 1 Soll 513,500 of eomen stock to Tony. July 1 Purchase a onn-year inmurance policy for $5,900 (\$490 per month) to cover injurien to July 2 Partieipanta during outdoor olinica. Pay lees of $1,300 ansoeiated with incorporation. July 4 Tarehase office supplien of $1,500 of aecount. July? Pay $310 to a loeal mewspoper for advertibing to appeor imeediately for an upeoming mountain biking elinie to be beld on July 15. Attendeen will be charged 550 the day of the elinie. July B Purchae 10 nountain bikes, poying 516,560 ensh. Joly is On the day of the olinie, CreaL Advestures receives eash of $2,000 in total from 40 bikera. Toey Jaly 22 Becasae of the success of the firat nountain biking olinic, Tony and surie bolda another July 24 mountain biking elinie and the compasy receives $2,550. Pay $750 to a loesl radio atation for advertiaing to appear imodiately. A kayaking elinie vil1 July 30- be beld on Awqurt 10, and attendees can pay 5150 in advance or $200 on chn day of the elinie. Great Adventuren receiven total eash of 56,000 in advance from 40 kayaker tor the upeoning kayak elinie. The following transhetiona oecur over the remainder of 2024 . Mugat 1 Creat. Adventureo obtaina a $49,000. low-intertat loan for the conpany tron ebe eity council. which ham renestly passed an initiative necouraging business developent related to outdook Auggunt actirieies. The loan is due in three yeare, and 61 annual iatereat in due each year on tuly 31. perchuse 14 kayaks, paying $23, tod cakh. roby and Surie condoet the firat kayak eliaio. In addition to the $6,000 that vau received in adyance froe kayakere on July 30 , the oomphny receives additional cash of $4, 00s from trenty nes kayaker an the day of the orinie. Aoguat 17 fony and surie candoeth a socond kayak elinic, and the cospasy receiven m11,300 eash. Aspuat.24 oftice mupplies of $1,500 parchased on Jaly 4 are paid in full. Sopteaber 1 To providn better atornge of nountain bikes and kayaka when not in uae, the oonpany rests a storage ohed for oee year, paying $2,860 (\$240 per month) in advanee. September 21 Tony and fisile coeduet a roek-climbing elinic. The conpasy feceivea \$13,300 easl. oetober 17 Fony and fierie conduct an orienteering ollaie. Partieipasta practice bor to underatand a topographiesi map, resd an eltineter, wie a cempass, and oriknt through bavily voodad areas. The conpany receiven 513,060chah. Deceaber 1 toey and Stuxie deelde te hold the company's first sdvesture race on Decenber 1s, Four-pernon teata will race from eheckpoint to checkpolot using * conbination of mountain bikingl, kayaking. oriksteering, erail ranning, and roek-elimbing akilis, The first tean in woeh eategory to complete ali oheokjoints in order wina. The entry tee for each team in s7ed. beckiter 5 To help orgaoire asd promote tha race, Tony hires his college roonate, Victor, viotor vill be. peild 550 in adary for each tann that coppetes in the race. Hik oalary will be paid after the race. December \& The eonpasy pays 71, 100 to purehase a permit troe a state park vhere the race vil1 be held. the Decenfer i2 anouat is reourded as a miscellaneoua expenae. The conpesy purehases racieg aupplies for s2,00s on aeoosht due in 30 daye supplies iaelude tropbies tor the top-tiniahing teans in each eategory, promotional ahirta, anaok tooda a-d drinke for particlpente, and field markers to prepare the racecouras. Decenber is the compery receives 523 , 09s eash trom a total of forty teans, and the race is beld. Decenber 16 the company paye Vieter's selary of 72 , 000 . Becenber 31 the company pays a dividend of 74,600 (\$2,300 to fony and 13,300 to suate). gropeatng thet ther get merried. Suain apeepts and ther qut martidd The following information relates to year-end adjusting entries as of December 31, 2024. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 wotals 57,200 . b. Six months' of the one-year insurance policy purchased on July thas expired. c. Four months of the one-year rental agreement purchased on September 1 has expired d. Ot the $1,590 of office supplies purchased on duly 4. $260 remaind e. Interest expense on the $49,000 loan obtained from the city council on August 1 should be recorded. t Ci the $2,000 of racing supples purchased on December 12, $150 remains. 9. Susie caiculates that the company ewes 513,800 in income taves 3. Pok transetens from dyy 1 shrough December 31 and adjuating and ciosing entries on Dvcember 31 to Jaccounts 7. Post the dosing entules of retained earnings to the T-eccount 3. Post transactions from July 1 through December 31 and adjusting and closing entries on December 31 to T-accounts. 7. Post the closing entries of retained earnings to the T-account. Required information [The following information applies to the questions displayed below.] Tony and Suzie graduate from college in May 2024 and begin developing their new business. They begin by offering clinics for basic outdoor activities such as mountain biking or kayaking. Upon developing a customer base, they'll hold their first adventure races. These races will involve four-person teams that race from one checkpoint to the next using a combination of kayaking, mountain biking, orienteering, and trail running. In the long run, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts. On July 1, 2024, Tony and Suzie organize their new company as a corporation. Great Adventures Incorporated The articles of incorporation state that the corporation will sell 27,000 shares of common stock for $1 each. Each share of stock represents a unit of ownership. Tony and Suzie will act as co-presidents of the company. The following business activities occur during July for Great Adventures. The following information relates to year-end adjusting entries as of December 31, 2024. a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $7,200. b. Six month's' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired: d. Of the $1,500 of office supplies purchased on July 4,$260 remains. e. Interest expense on the $49,000 loan obtained from the city counci on August 1 should be recorded. f. Of the $2,000 of racing supplies purchased on December 12,$150 remains. 9. Suzie calculates that the company owes $13,800 in income taxes. . Post transactions from July 1 through December 31 and odjusting and closing entries on December 31 to T-accounts. Post the closing entries of retained earnings to the T-account