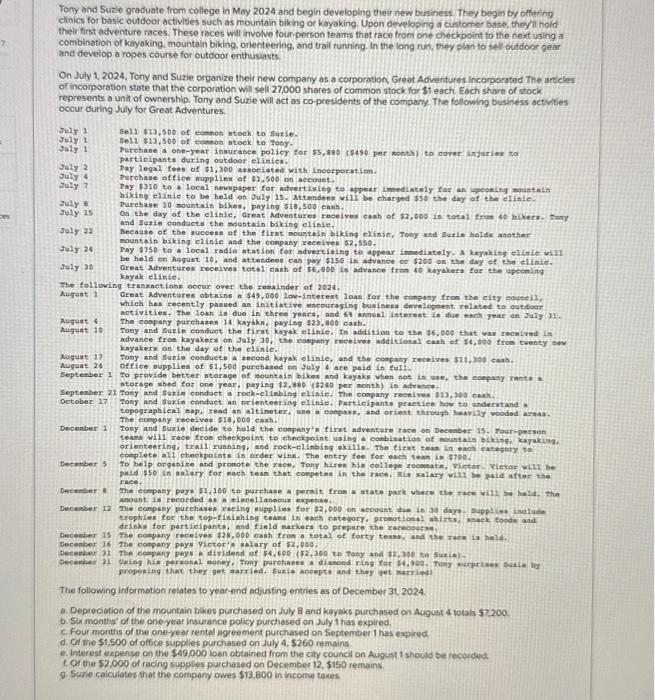

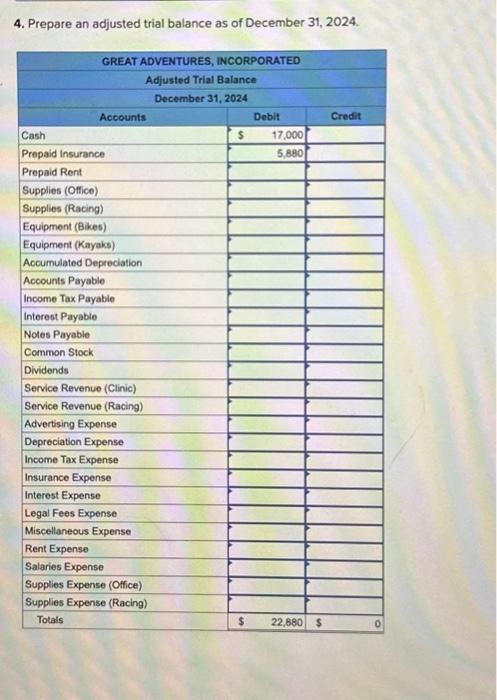

Tony and Suzie graduate from college in May 2024 and begin developing their new business. They begin by offering clinics for basic outdoor activities such as mountain biking or kayaking. Upon developing a cistomer bise, theyil hold their first adventure races. These races will involve four-person teams that race froen one checkpoint to the next using an combinstion of kayaking, mountain biking, orienteering, and trail funning. In the lang nun, they plan to sell outdoor gear and develop a ropes course for outdoor enthusiasts. On July 1, 2024, Tony and Suzie organize their new company as a corporation, Great Adventures incorporated The articles of incorporation state that the corporation will sell 27,000 shares of common stock for 31 each. Each share of stock represents a unit of ownership. Tony and Suzie will act as co-presidents of the compary. The following business activities occur during July for Great Adventures. July1July18011$13,500ofcoenonntooktoSorie.Sel1$13,500ofcomenstocktoFosy. Joly 1 Perehase a ose-year insurance policy for 55,800 (5490 per nohth) to oover infuries to July 2 Partioipante during ontdoor elinies. Pay legal tees of 51,300 assoeisted with inoorporation. Joly 4 Purohase office mupplies of $1,500 on accoust. July Pay $310 to a local nevipaper for advertirisg to afpear amedincely loz an upeeaing noastain Joly 9 biking elinie to be held of July 15. Mctendeen will be chatged sso whe day of the elinle. Tuly 15 Purchase 10 mountain bikes, paying 518,500 eaxb. Outy is Oo the disy of the clinie, Great Adventures foceives cash of 62, bce in cotal fron 4t bikerm. Tony July 22 Because of the succese of the firot mountain biking elinse, Tocy and Burle solda another Jaly 24 moustain biking clinie asd the conpasy receives 52 , sso. 2eiy 26 Pay $750 to a local radio ntation for sdvertining to appear imediately. A-kaykikg elinic wall foly 30 be held on hagust 10, and at teadeon cas pey 1150 is atvanee or 1200 on the day ef the elinic. Krayak elirie. receiven totel canh of 56,000 is advanee fron so kayakera for the upecoing The folloving trasactions oocur oyer the zanainder of 2024. Auquet 1 Creat Adventures obtaine a $49,000 low-interent loan foe the canpany fron the eity eouneil, which bas zecently passed an initiat.ive encouragiog businesa develogoent related to outdoor augast ictivities. The losn is due in three yenra, and Av annuel istereat in die each year on daly 31 . Touy and Sugie conduet the first keyak elinfe. In addition to the 16, 000 that wam received in advance from kayakers of Jaly 30 , tbe coepeny receiver additiosal eauh of 54 , 00s from twency sew kayakers on the day of the elinie. Mugast 17 Tooy and surie conducte a focond kayak elinie, and the conpany receives \$11,309 cak?. Auguat 24 office dupplies of 51,500 purchaned on July 4 are paid in fall. September 1 To provide better storage of mountain biken and knyoks when net in wit, the ounpeay rants a ntorege whed for one year, paying $2,080 (\$240 per month) in ndratce. Septenber 21 Tosy and seaie conduct a rook-climbing elinie. the conpany recelves 113,300 cant. Ootober 17 Tony and Surie condoet an orienteeribg elinie. Participants practiea hov to anderatand a topograplieal =ap, fend an altineter, we a eoepas, and orient through heivily wooded ainas. The company rocelven sie, 000 eanh. Decenber 1 Tony and suxie decide to kold the conpany's first didentere race on Decenter 15. Toar-person teand wil1 race frop eleekpoint to chockpoint using a pombinatios of nouatain biking. kayaking. orienteering, trail running, and roek-olinhing wkills. The tirat tean in wach eatedgety to coeplete inll checkpoints in order vinis. the ebtry fee for each than in 5760 . Secember 5 to help orgenize and promote the race, Fony hiren bin oollepe rocemate, victor- Vietor vili be padd $50 in anlary for nach tean that conpeten in the race, min malazy wili be paid aftar the race. fecenber \& The composy pays 51,100 to parchase a perait from a weate park where che rack will be hald. the pecenter 12 moubt is recorded as A hincellaneous nxpence. Deconber 12 The conpeny purchasen rueing eupplien for 52,000 on wcooust dee in 30 days. Duppline inotude dritks for participants, and field matkers to prepare the racecoetan. becenber is the eompany receiven 52i,090 gash trom a total of forty tense, ond the race in hald. necenber i4 the cotpany peys victor'a melery of 52,000 . gecember 31 the corpany paye a dividend of 54, 600 (\$2,300 to fefy and $2,300 to surie)gropesing that they get maraied- surie mocepts and they get marrindl The following information relates to year-nnd adjusting entries as of December 31,2024. a. Depteciation of the mourtain bikes purchased on July 8 and kayaks purchased on August 4 totais 57,200 . b. Six months' of the one-year insurance policy purchased on July 1 has expired. c. Four months of the one-year rental agreement purchased on September 1 has expired. d. Of the 51,500 of office supplies purchased on July 4,$260 remains. e. Interest expense on the $49,000 loan obtained from the city council on August 1 thould be recorchad. f. Of the $2,000 of racing supplies purchased on December 12, 5150 remains. 9. Surie calculates that the company owes $13,800 in income taxes. 4. Prepare an adjusted trial balance as of December 31, 2024