Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2022, for $15,800. They expect to use the Suburban for five years and then sell the vehicle for $6,400. The following expenditures related to the vehicle were also made on July 1, 2022: (please answer 1-6 with the information above and below, i need journal entries aka debiting and crediting)

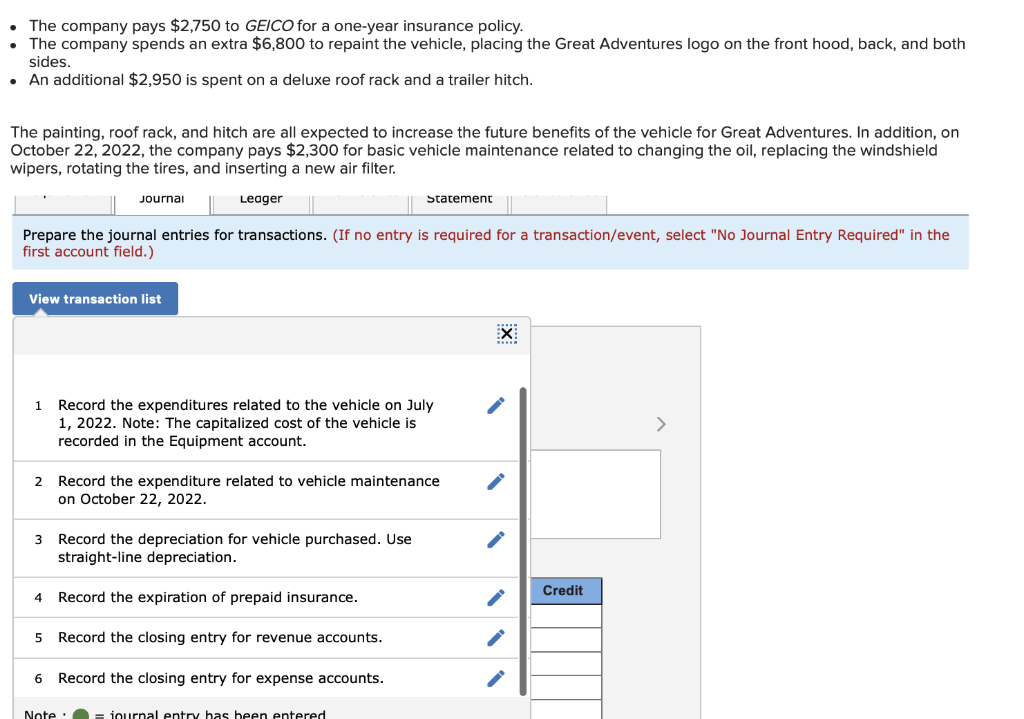

The company pays $2,750 to GEICO for a one-year insurance policy. The company spends an extra $6,800 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. An additional $2,950 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2022, the company pays $2,300 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Journal Leager Statement Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list 1 Record the expenditures related to the vehicle on July 1, 2022. Note: The capitalized cost of the vehicle is recorded in the Equipment account. 2 Record the expenditure related to vehicle maintenance on October 22, 2022. 3 Record the depreciation for vehicle purchased. Use straight-line depreciation. Credit 4 Record the expiration of prepaid insurance. 5 Record the closing entry for revenue accounts. 6 Record the closing entry for expense accounts. Note . = iournal entry has been entered The company pays $2,750 to GEICO for a one-year insurance policy. The company spends an extra $6,800 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. An additional $2,950 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2022, the company pays $2,300 for basic vehicle maintenance related to changing the oil, replacing the windshield wipers, rotating the tires, and inserting a new air filter. Journal Leager Statement Prepare the journal entries for transactions. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list 1 Record the expenditures related to the vehicle on July 1, 2022. Note: The capitalized cost of the vehicle is recorded in the Equipment account. 2 Record the expenditure related to vehicle maintenance on October 22, 2022. 3 Record the depreciation for vehicle purchased. Use straight-line depreciation. Credit 4 Record the expiration of prepaid insurance. 5 Record the closing entry for revenue accounts. 6 Record the closing entry for expense accounts. Note . = iournal entry has been entered