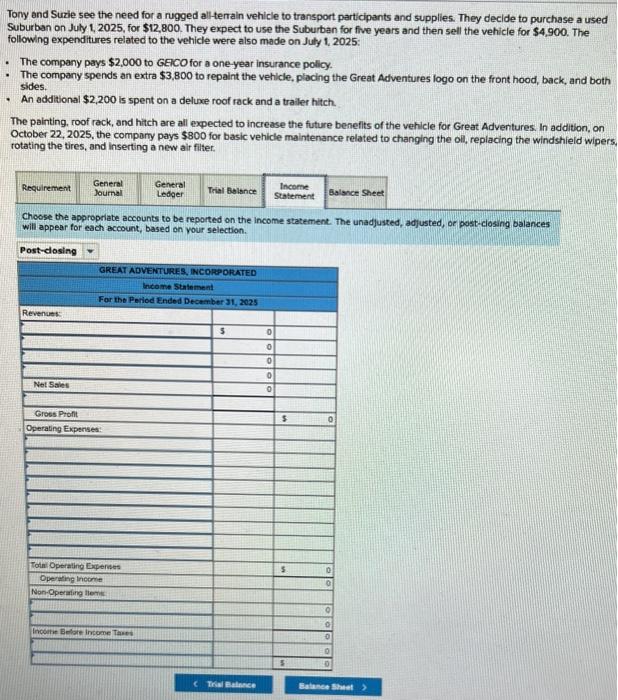

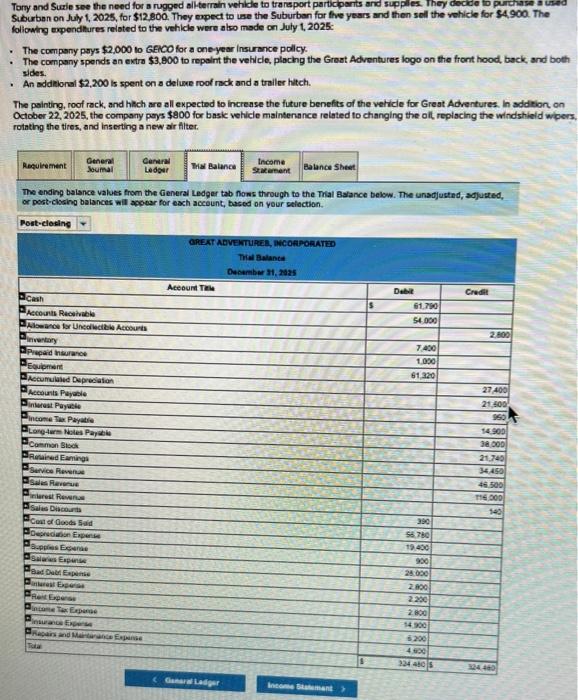

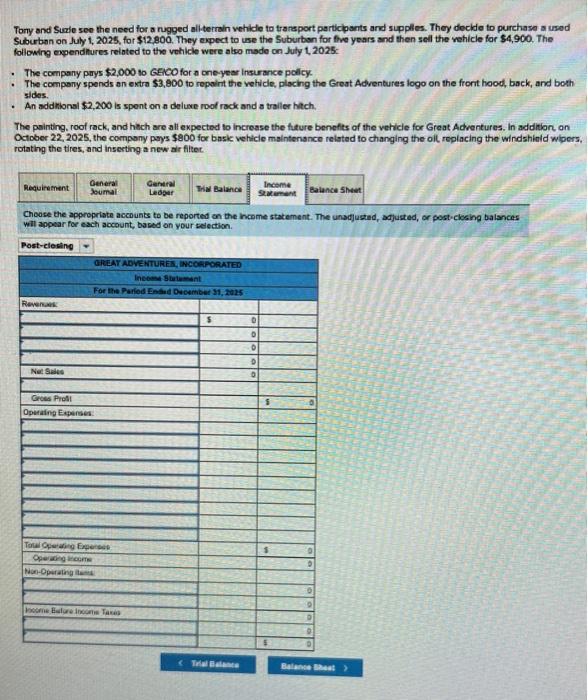

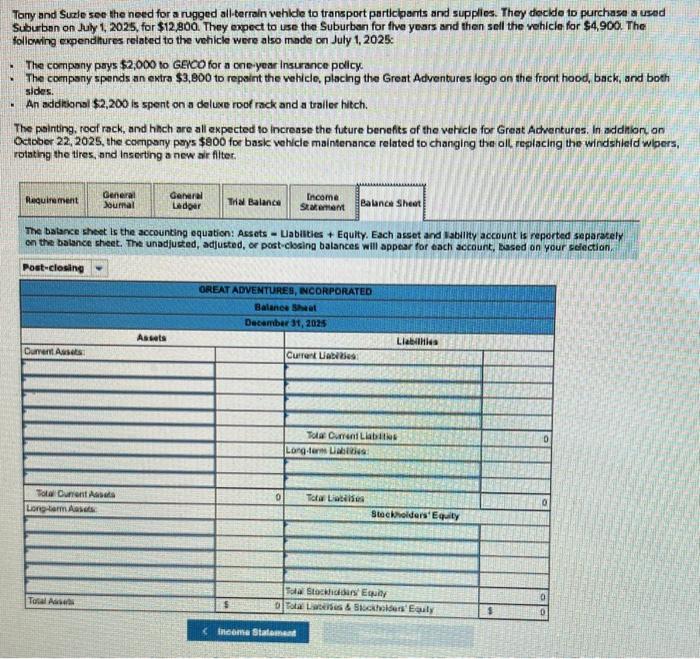

Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $12,800. They expect to use the Suburban for five years and then sell the vehicle for $4,900. The following expenditures related to the vehicle were also made on July 1, 2025: - The company pays $2,000 to GECO for a one-year insurance policy. - The company spends an extra $3,800 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,200 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22,2025 , the compory pays $800 for basic vehicle maintenance related to changing the oll, replacing the windshleld wipers rotating the tires, and inserting a new air filter. Choose the approprlate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Tory and Suzie see the need for a rugged aliterrain vehicle to traisport participants and supplies. They docide to purthase a used Suburben on July 1, 2025, for $12800. They expect to use the Suburban for flive years and then soll the vehicle for $4,900. The following expenditures reloted to the vehicle were atso mode on July 1, 2025: - The company pays $2,000 to GEiCo for a oneyear insurance pollcy. - The company spends an extra $3,800 to repaint the vehicle, plachn the Groet Adventures logo on the front hood, back, and both sides. - An additional $2,200is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hilch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2025, the company pays $800 for basic vehicle maintenance related to changing the oll, replocing the windshield wipers rotathy the tires, and inserting a new air fliter. The ending balance values from the General Ledger tab nows through to the Tilal Balance below. The unadjustad, adjusted, or post-clocing balances will acoeer for each account, based on your selection. Tony and Suale see the need for a rugged aliterrain vehide to transport participonts and supplies. They docide to purchase a used Suburban on July 1, 2025, for \$12,800. They expect to use the Suburben for fwe years and then sell the vehicle for \$4,900. The following expendhures related to the vehicle were atso made on July 1,2025: - The company pays $2,000 to Geico for a cneyear insurance policy. - The company spends an extra $3,800 to ropaint the vehicle, plocing the Great Adventures logo on the front hood, back, and both sides. - An addilional $2,200 is spent on a deluve roof rack and a tralier hitch, The pointing, roof rack, and hich are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, an October 22, 2025, the compony pays $800 for basic vehicle maintensnce related to changing the oll ropiacing the windshinid wipers. rotathg the tires, and inserting a new air fleet. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-cloaing balances will appear for each accosunt, based on your selection. Tory and Suxle see the need for a rugged all-terrain vehide to transport participants and supplics. They decido to purchasa a used Suburben on July 1, 2025, for $12,800. They expect to use the Suburban for fhe years and then sell the vehicle for $4,900. The following expenditures reiated to the vehicle were also made on July 1,2025: - The compony pays $2,000 to GEiCo for a cne-year insurance policy - The company spends an extra $3,800 to repaint the vehiclo, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,200 is spent on a deluxe roof rack and a trailer hitch. The pointing, roof rack, and hich are all expected to increase the future benefits of the vehicle for Great Achentures. In addition, on October 22, 2025, the company psys $800 for basik vehicle maintenance related to changing the oll repiacing the windshileid wipers, rotating the tires, and inserting a new ai flitec. The batance sheet is the accounting equation: Assets - Labilities + Equity. Each asset and Isbility account is reported separately on the balance sheet. The unadjusted, adjusted, or post-clocing balances will appear for each account, based on your selection. Tony and Suzie see the need for a rugged all-terrain vehicle to transport participants and supplies. They decide to purchase a used Suburban on July 1, 2025, for $12,800. They expect to use the Suburban for five years and then sell the vehicle for $4,900. The following expenditures related to the vehicle were also made on July 1, 2025: - The company pays $2,000 to GECO for a one-year insurance policy. - The company spends an extra $3,800 to repaint the vehicle, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,200 is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hitch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22,2025 , the compory pays $800 for basic vehicle maintenance related to changing the oll, replacing the windshleld wipers rotating the tires, and inserting a new air filter. Choose the approprlate accounts to be reported on the income statement. The unadjusted, adjusted, or post-closing balances will appear for each account, based on your selection. Tory and Suzie see the need for a rugged aliterrain vehicle to traisport participants and supplies. They docide to purthase a used Suburben on July 1, 2025, for $12800. They expect to use the Suburban for flive years and then soll the vehicle for $4,900. The following expenditures reloted to the vehicle were atso mode on July 1, 2025: - The company pays $2,000 to GEiCo for a oneyear insurance pollcy. - The company spends an extra $3,800 to repaint the vehicle, plachn the Groet Adventures logo on the front hood, back, and both sides. - An additional $2,200is spent on a deluxe roof rack and a trailer hitch. The painting, roof rack, and hilch are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, on October 22, 2025, the company pays $800 for basic vehicle maintenance related to changing the oll, replocing the windshield wipers rotathy the tires, and inserting a new air fliter. The ending balance values from the General Ledger tab nows through to the Tilal Balance below. The unadjustad, adjusted, or post-clocing balances will acoeer for each account, based on your selection. Tony and Suale see the need for a rugged aliterrain vehide to transport participonts and supplies. They docide to purchase a used Suburban on July 1, 2025, for \$12,800. They expect to use the Suburben for fwe years and then sell the vehicle for \$4,900. The following expendhures related to the vehicle were atso made on July 1,2025: - The company pays $2,000 to Geico for a cneyear insurance policy. - The company spends an extra $3,800 to ropaint the vehicle, plocing the Great Adventures logo on the front hood, back, and both sides. - An addilional $2,200 is spent on a deluve roof rack and a tralier hitch, The pointing, roof rack, and hich are all expected to increase the future benefits of the vehicle for Great Adventures. In addition, an October 22, 2025, the compony pays $800 for basic vehicle maintensnce related to changing the oll ropiacing the windshinid wipers. rotathg the tires, and inserting a new air fleet. Choose the appropriate accounts to be reported on the income statement. The unadjusted, adjusted, or post-cloaing balances will appear for each accosunt, based on your selection. Tory and Suxle see the need for a rugged all-terrain vehide to transport participants and supplics. They decido to purchasa a used Suburben on July 1, 2025, for $12,800. They expect to use the Suburban for fhe years and then sell the vehicle for $4,900. The following expenditures reiated to the vehicle were also made on July 1,2025: - The compony pays $2,000 to GEiCo for a cne-year insurance policy - The company spends an extra $3,800 to repaint the vehiclo, placing the Great Adventures logo on the front hood, back, and both sides. - An additional $2,200 is spent on a deluxe roof rack and a trailer hitch. The pointing, roof rack, and hich are all expected to increase the future benefits of the vehicle for Great Achentures. In addition, on October 22, 2025, the company psys $800 for basik vehicle maintenance related to changing the oll repiacing the windshileid wipers, rotating the tires, and inserting a new ai flitec. The batance sheet is the accounting equation: Assets - Labilities + Equity. Each asset and Isbility account is reported separately on the balance sheet. The unadjusted, adjusted, or post-clocing balances will appear for each account, based on your selection