Answered step by step

Verified Expert Solution

Question

1 Approved Answer

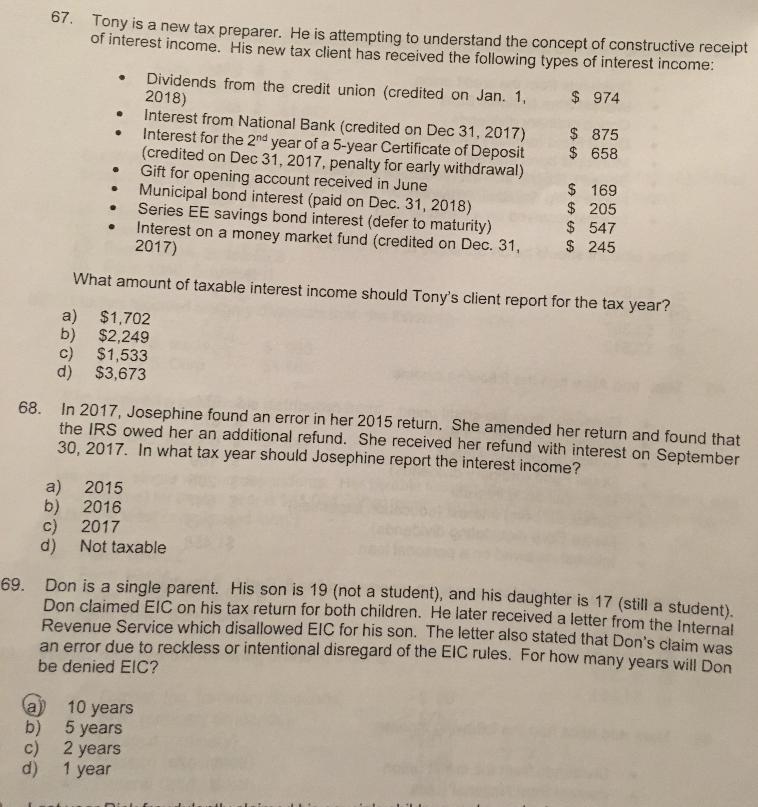

67. Tony is a new tax preparer. He is attempting to understand the concept of constructive receipt of interest income. His new tax client

67. Tony is a new tax preparer. He is attempting to understand the concept of constructive receipt of interest income. His new tax client has received the following types of interest income: Dividends from the credit union (credited on Jan. 1, 2018) Interest from National Bank (credited on Dec 31, 2017) Interest for the 2nd year of a 5-year Certificate of Deposit (credited on Dec 31, 2017, penalty for early withdrawal) Gift for opening account received in June Municipal bond interest (paid on Dec. 31, 2018) Series EE savings bond interest (defer to maturity) Interest on a money market fund (credited on Dec. 31, 2017) $ 974 $ 875 $ 658 $ 169 $ 205 $ 547 $ 245 What amount of taxable interest income should Tony's client report for the tax year? a) $1,702 b) $2,249 c) $1,533 d) $3,673 68. In 2017, Josephine found an error in her 2015 return. She amended her return and found that the IRS owed her an additional refund. She received her refund with interest on September 30, 2017. In what tax year should Josephine report the interest income? 2015 a) b) 2016 c) 2017 d) Not taxable 69. Don is a single parent. His son is 19 (not a student), and his daughter is 17 (still a student) Don claimed EIC on his tax return for both children. He later received a letter from the Internal Revenue Service which disallowed EIC for his son. The letter also stated that Don's claim was an error due to reckless or intentional disregard of the EIC rules. For how many years will Don be denied EIC? a) b) 5 years c) 2 years 1 year 10 years d)

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

67 Tony is a new tax prepare he is attempting to understand the concept of constructive receipt of interest income his new client has received the fol...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started