Answered step by step

Verified Expert Solution

Question

1 Approved Answer

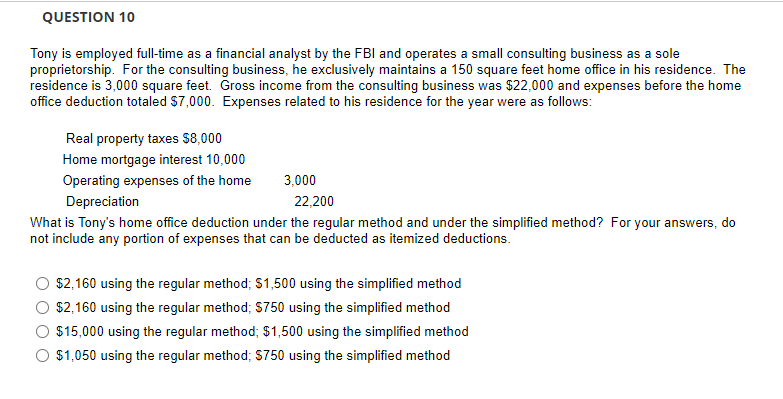

Tony is employed full-time as a financial analyst by the FBI and operates a small consulting business as a sole proprietorship. For the consulting business,

Tony is employed full-time as a financial analyst by the FBI and operates a small consulting business as a sole proprietorship. For the consulting business, he exclusively maintains a 150 square feet home office in his residence. The residence is 3,000 square feet. Gross income from the consulting business was $22,000 and expenses before the home office deduction totaled $7,000. Expenses related to his residence for the year were as follows: What is Tony's home office deduction under the regular method and under the simplified method? For your answers, do not include any portion of expenses that can be deducted as itemized deductions. $2,160 using the regular method; $1,500 using the simplified method $2,160 using the regular method; $750 using the simplified method $15,000 using the regular method; $1,500 using the simplified method $1,050 using the regular method; $750 using the simplified method

Tony is employed full-time as a financial analyst by the FBI and operates a small consulting business as a sole proprietorship. For the consulting business, he exclusively maintains a 150 square feet home office in his residence. The residence is 3,000 square feet. Gross income from the consulting business was $22,000 and expenses before the home office deduction totaled $7,000. Expenses related to his residence for the year were as follows: What is Tony's home office deduction under the regular method and under the simplified method? For your answers, do not include any portion of expenses that can be deducted as itemized deductions. $2,160 using the regular method; $1,500 using the simplified method $2,160 using the regular method; $750 using the simplified method $15,000 using the regular method; $1,500 using the simplified method $1,050 using the regular method; $750 using the simplified method Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started